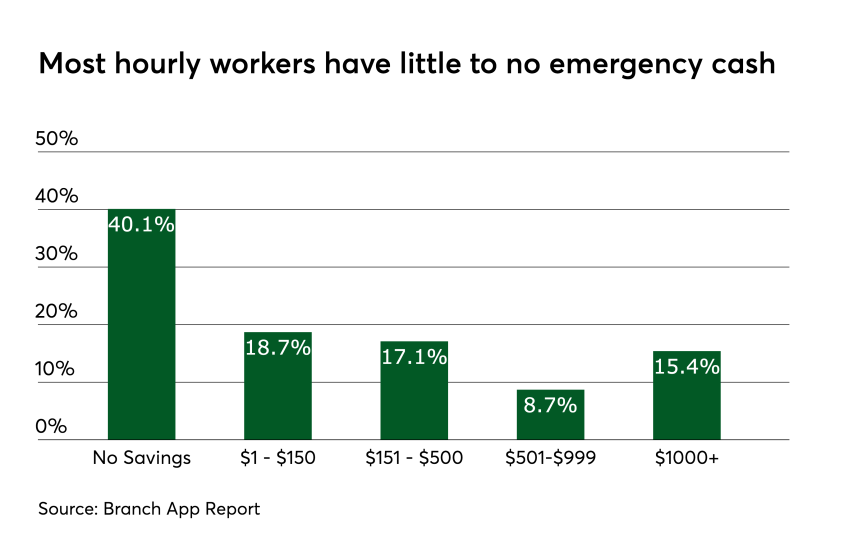

Often overlooked as prospects by financial services institutions who have increasingly focused on the wealthy, hourly workers represent a massive pool of underserved consumers with distinct financial needs.

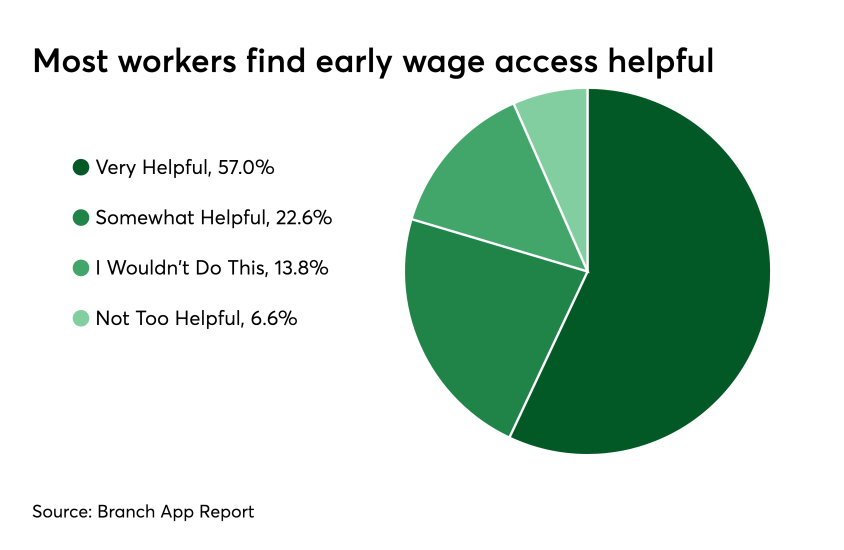

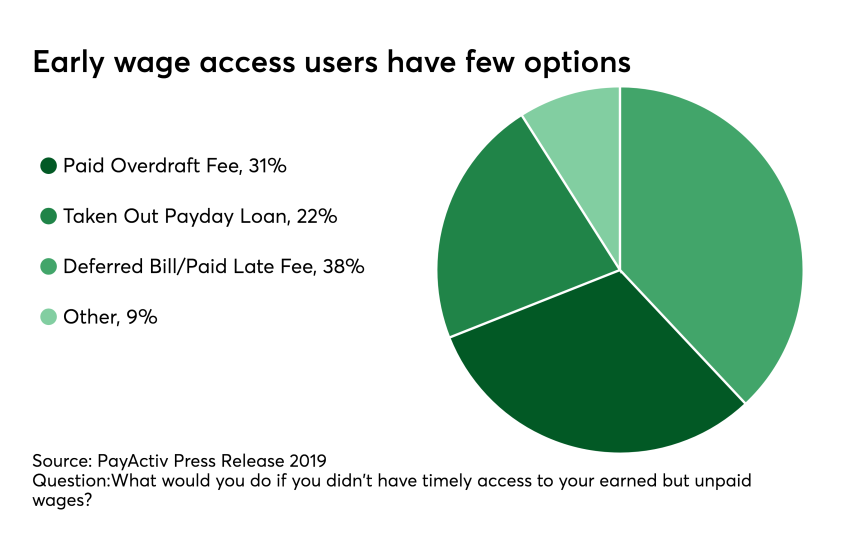

Early access to earned wages is just one financial product that has recently come to the market and seen dramatic success, as it is a significantly less expensive alternative to payday loans for consumers struggling to make ends meet.

According to the