-

Bankers spent Monday cleaning up damaged branches, wondering if their small-business clients will need more emergency aid and contemplating how the racial and economic inequalities highlighted by days of violent protests nationwide can be corrected.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

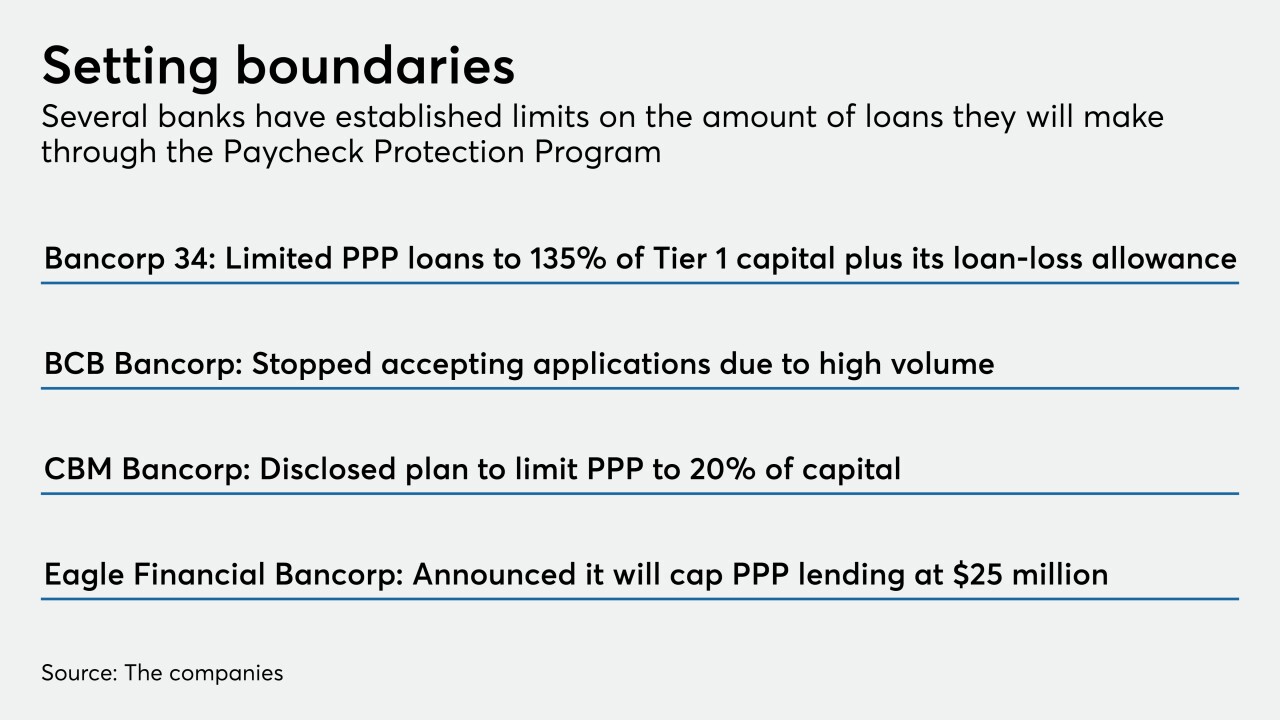

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

Starling Bank has raised £40 million (about $49 million) in its latest fundraiser as it steps up its support for small businesses, bringing its 2020 total to £100 million (about $123 million).

May 29 -

The modern mobile wallet no longer uses a card as a crutch. Instead, it sees it as an additional product that can add revenue from interchange, lending and loyalty.

May 29 -

The website, ppp.bank, will help borrowers in the Paycheck Protection Program apply for loan forgiveness.

May 28 -

The Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.

May 28 -

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

May 28 -

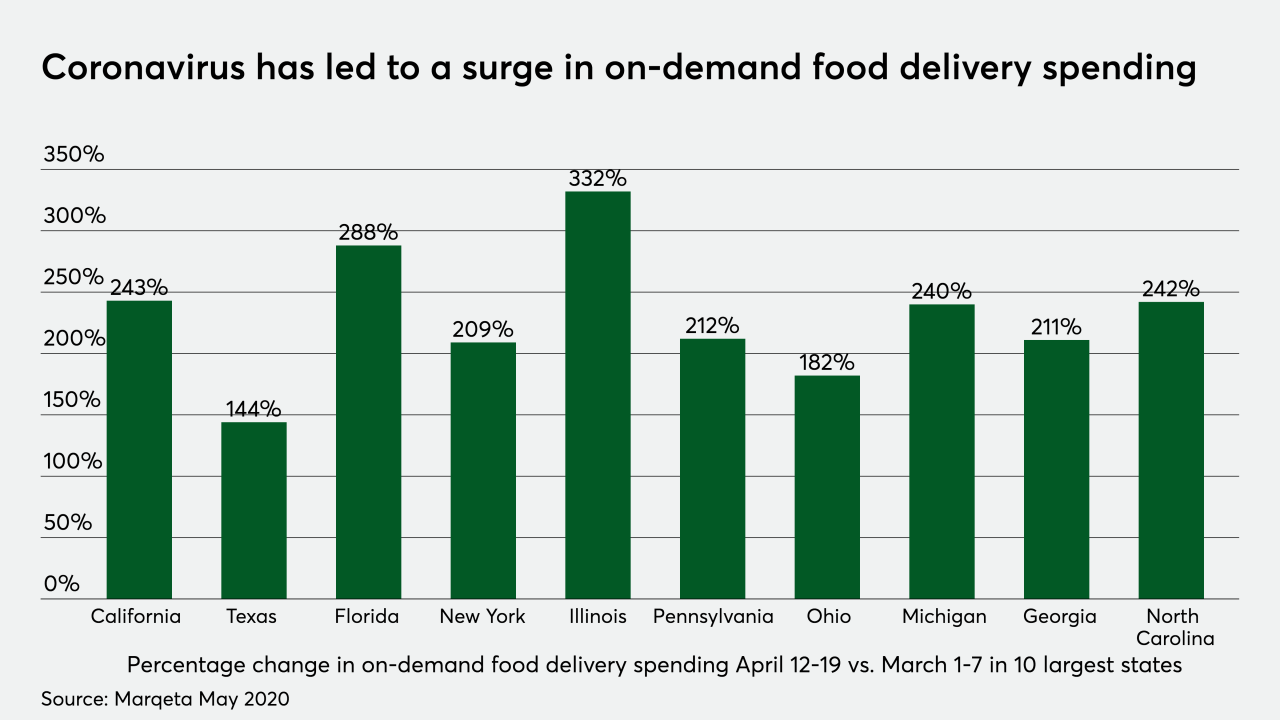

People who order groceries for delivery may be using digital payments or a plastic card to pay for their food, but the person picking up the groceries may be making a separate payment at the point of pickup — and in the process, influencing the global shift toward contactless payments.

May 28