The pandemic-driven move to electronic payments isn't slowing down, and card issuers are finding an eager group of innovators promising a speedy migration to digital card production.

Companies like Backbase, i2c, Marqeta, Ondot or Q2 concentrate on the digital-first programs that banks increasingly desire. They also help banks from being overshadowed by the likes of

Even major bank technology vendors like Fiserv and FIS establish partnerships with the digital card issuing technology providers to assure they can keep up with demand and their customers have access to digital cards to complement mobile wallets and plastic cards.

Merchant acquirers and independent sales organizations are also seeing the need to stay abreast of the digital card-issuing trend and develop new revenue channels in the process. Whether it's a digital-first or digital-only issuing platform or a traditional plastic card with digital enhancements attached, the appeal is growing. Many are also seeing digital card capabilities as a way to offset the expected loss of revenue if post-pandemic retail results in fewer orders for physical payment terminals, long a foundation of acquirers' merchant services.

"If you are looking to drive revenue on both sides of the transaction, digital card issuing is the logical next step," said Steve Vickers, director of revenue and growth at The Strawhecker Group. "If you have the ability to increase that card acceptance and can bring that to the table, there are a lot of banks and players out there willing to have a meeting with you,"

There's three main types of digital card issuing. Digital-first means a digital card or card number has been issued to conduct transactions, with a physical card coming later to complement it. Digital-only represents a full digital replacement of physical cards. The digital-plus category concentrates on digital enhancements to existing physical card programs, such as transaction messages and monitoring services to mobile phones or automatic rewards redemption.

Mostly, digital card issuing technology providers are driven by the tech giants' advancements and their threats to the traditional banking world.

"When you think about those tech giants, they have all come to the same place in saying what does a modern card look like?" said Chris Harris, senior director at Ondot Systems, which focuses on mobile card services in digital-first programs with major payment processor partners.

The answer for what the modern digital card looks like comes down to a few key factors, Harris said. "You can get those cards instantly, and you can clearly see your spending records and payments insights," he added. "You can also manage your card with digital self-service and you can engage with your card through perks, offers and rewards."

The digital card issuing game is not for everyone, Harris noted. "Not just anyone can jump in and do this because you have to be plugged into the infrastructure, which is why we partner with most of the payment processors and issuers."

Through its Card App, Ondot can help bank clients deliver card programs similar to Apple, Google and Samsung, allowing banks to keep up with the migration of financial services to smartphones.

Marqeta powers similar digital card capabilities as

The company's card-issuing platform technology has also gained steam in the U.S. through customer signings with Square, Instacart, Doordash and Affirm.

With digital card issuing as a key service, Marqeta also has the lure of offering an open API to developers to more easily build and test payment innovations. Marqeta also powers the Sezzle virtual card for a "buy now, pay later" setup

Marqeta is a little more complicated, as a processor, than Ondot, but both companies can work with any of the banks, according to David Shipper, senior research analyst in Aite Group's retail banking and payments practice. "All of these banks and credit unions are looking at digital cards, as most issuers have it on their roadmap," Shipper said. "But the big things are always budget, technology and resources, and also whether their processor supports it."

Digital card tech providers are looking to help banks add these capabilities on top of their legacy systems, Shipper added. "These providers can add functionality and help them innovate without having to add a lot of new technology (to replace legacy systems)," he said.

The COVID-19 pandemic has accelerated the need for issuing and acquiring banks to offer digital products to merchants and increasing customer demand for those products, Shipper wrote in a recent Aite report on digital cards, noting the return-on-investment is solid for issuers considering digital capabilities. The expense of implementing new functionality, features, products and processes "should be offset by reduced costs, higher revenue, and higher cardholder retention," the report said.

Digital enhancements to physical cards are also catching the attention of acquirers and ISOs who work mostly with small business owners who need cards and management tools for their business operations, Scott Goldwaithe, president of Aliaswire, said at a recent mobile payments conference.

"The market size for small businesses is vast, with more than 6 million small businesses in the U.S., and those owners spend more than $750 billion on credit cards annually," Goldwaithe said, adding the majority of that spend comes from the top tier of small businesses, while the "vast majority of small businesses are completely overlooked by the card issuers, and they are the ones hardest hit by the pandemic shutdown," Goldwaithe added.

Aliaswire developed the PayVus card program specifically designed for ISOs and acquirers working with small businesses, giving them the ability to issue a Mastercard World Elite credit card to their merchants with a revolving line of credit.

A physical PayVus card may be in play, but every other aspect of the process is automated from underwriting, to card production and cardholder support. In many ways it takes a payment facilitator approach on the merchant acquiring side and applies it to the issuing side of the payments ecosystem.

Aliaswire split-settles a portion of the processing receivables and returns it to the payment card, while the remainder goes into the merchant bank account. In addition, the company participates in a revenue-sharing plan with ISOs and acquirers on all settled funds as a way to help those organizations lower merchant services fees or improve their margins, Goldwaithe noted.

"Those processes allow us to evaluate merchant risk in real-time, and our ISOs and acquirers get a significant revenue stream and increased loyalty," he added. "Issuing is saving acquiring because our resellers are showing more revenue on the issuing side than they do on the merchant services side."

It adds to the consternation many banks are feeling now, Ondot's Harris said.

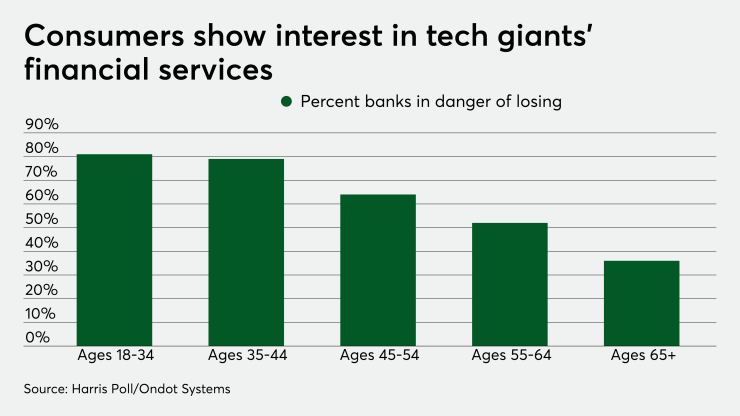

In a Harris poll it conducted last spring of more than 2,000 consumers, Ondot discovered 60% of consumers said they would purchase financial products from Amazon, Apple, Google or Facebook.

Banks' potential loss of consumers by age group was striking in that 81% of those ages 18 to 34 expressed interest in the tech companies, while that number was at 79% in the 35 to 44 group. The advancement of technology is not lost on Baby Boomers either, as 36% of those 65 and older were interested in financial services through tech companies.

"This is an existential crisis for banks," Harris said. "If they want to attract the next generation of customers, they have to have a strategy in place for digital processes."