As people return to flying, installment lenders are rushing to provide financing for a purchase category that is deeply important to credit card issuers.

Affirm recently added American Airlines to its expanding roster of travel partnerships that support its buy now/pay later product. Though Affirm and its peers are far from displacing credit cards, they may gain a first-mover advantage as card issuers decide how to bring their own installment options to the forefront of this spending category.

"Travel is an area where we have made substantial investments ... and it's more important than ever for merchants to offer flexibility at checkout," said Geoff Kott, chief revenue officer at the buy now/pay later company Affirm.

Affirm will be the exclusive buy now/pay later option for travelers booking trips on American Airlines' website, aa.com. That provides competition to options such as American Airlines'

"We can help people pay for seats on a schedule that works with their budget without charging deferred fees," said Kott, noting that Affirm has existing partnerships with Expedia, Priceline, Vrbo and other travel companies. "We show consumers exactly what they owe upfront and never change that amount."

Affirm will appear as an additional option at checkout, allowing consumers to split the total cost of flights over $50 into monthly payments, with terms depending on the specific transaction. If there is interest, it appears as a dollar amount at the point of sale.

American Airlines did not provide comment by deadline. In an email, Citigroup's press office said AAdvantage cards have built-in digital installment options that enable cardmembers to earn rewards and airline status, which are not perks of other BNPL plans. The installment plans, Flex Pay and Flex Loan, have no application, no credit inquiries and "no incremental fees," according to Citi.

These perks make a difference to travelers, said Daniel Keyes, an analyst in the payments practice at Javelin Strategy & Research.

"Card issuers still have the upper hand with travelers. They have decadeslong relationships with airlines, and if they can work with consumers on installment plans with points or other travel deals, they could do better than fintechs," Keyes said.

The American Airlines-Affirm deal is part of a

In October, Klarna agreed to acquire Inspirock, a Palo Alto, California-based online travel planner. Inspirock has more than 25 million users who will be able to plan, shop and pay for their trips inside Klarna's app. Klarna would not provide comment for this story.

Online travel site Booking.com recently launched a fintech unit to build on its payments technology. The company's payment platform is the foundation for its "connected trip" strategy, or a vision of booking accommodations, flight, ground transportation, attractions and dining through a single experience, Daniel Marovitz, Booking.com's senior vice president of payments product strategy, said in an email.

One of the new products at Booking.com is a BNPL service that will allow a traveler to pay for a trip in installments starting months in advance, while the lodging service or airline gets paid upfront.

The additional financing options could help airlines attract

By the end of the first half of 2021, air travel in the U.S. had passed 2 million daily passengers, according to

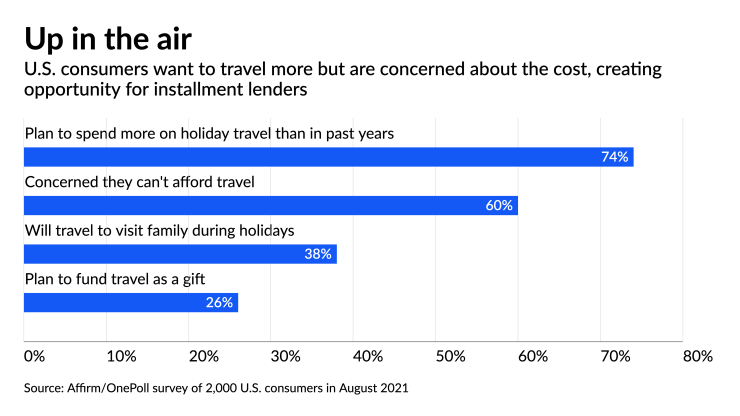

Affirm is also relying on a boost in travel spending and contends it's finding demand. Affirm cited its recent

Among the card companies,

In an email, Shikha Narula, vice president of U.S. consumer lending at American Express, said Plan It is built into virtually every U.S. American Express consumer card. "Plan It can be used wherever Card Members shop, online or in-store, and use isn’t limited to only certain online retailers like some other BNPL solutions can be," Narula said.

Sezzle, a Discover BNPL partner, also offers travel BNPL through a product called

At American Express, travel and entertainment spending is expected to reach 80% of 2019 levels during the fourth quarter.

"The travel and entertainment spending will eventually fully recover, but at varying paces across customer types and geographies. And we remain focused on maintaining our leadership position in offering differentiated travel and lifestyle benefits to our consumer and commercial customers as they return to travel," Jeff Campbell, chief financial officer at American Express, said during the company's earnings call.

At Visa, cross-border travel-related spending, excluding intra-Europe, was 40% higher in April 2021 than April 2019, 50% higher in June and 61% higher in September.

U.S.-to-Mexico travel spending was 60% above 2019 levels in the most recent quarter, according to Visa.

"As we have seen consistently during the pandemic, there is pent-up demand for travel as bookings accelerate when a border is opened. Latin America remains by far the strongest destination, well over 2019 levels," Vasant Prabhu, Visa's vice chairman and CFO, said during the company's earnings call. On the same earnings call, Visa Chairman and

During Mastercard's earnings call, CEO Michael Miebach reported cross-border travel improved 48% over 2019 in the second quarter of 2021 and 72% in the third quarter of 2021, and said there is "substantial upside potential" still remaining. Against this backdrop, Miebach said Mastercard is investing in technology to provide faster and easier access to products and services, and is leveraging Mastercard's multirail capabilities to offer choice across payment applications. One of those products, Mastercard Installments, can deliver BNPL with "little or no" integration for merchants, Miebach said.

The card brands can use their scale to embed BNPL into existing travel products and marketing incentives to deliver a broad menu of financial services, according to Javelin's Keyes.

"BNPL and points would be complimentary for the card networks," Keyes said. "That could stave off the threat from fintech companies."