Klarna's deal to offer its buy now/pay later service to Stripe merchants — a case of two of the most valuable fintechs combining forces — is the latest in a string of deals that could make the Swedish installment lender an even bigger force in payments.

The Stripe deal came a day after Klarna participated in a $100 million funding round in Billie, a German fintech that powers buy now/pay later for B2B payments. It's also four days after Klarna entered an agreement to acquire the online travel planner Inspirock of Palo Alto, California, to add shopping and payment technology for travel merchants.

The range of deals that Klarna has struck in a short time will allow it to compete with banks in a broader range of merchant services, according to Richard Crone, a payments consultant.

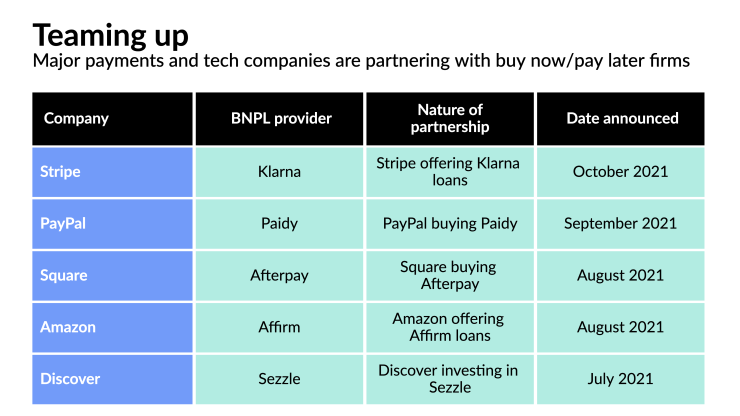

The partnership comes after rival BNPL firms such as Affirm, Afterpay and Sezzle have also teamed up with large payment technology companies for integrations. While issuers such as

"BNPL is already being offered alongside credit cards at a large and fast-growing number of merchants," said Ginger Schmeltzer, a strategic advisor for Aite-Novarica.

These fintech deals are heading off the

The threat these buy now/pay later partnerships pose to banks is different from the alternative to revolving credit narrative often pushed by the buy now/pay later firms themselves. If a brand like Klarna, which is well known among consumers, and Stripe, which is popular with merchants, can attract new users, these consumers and merchants may look beyond banks for short-term credit.

While some BNPL options allow consumers to pay off the loan on a credit card, Stripe will be Klarna's "preferred partner" for payments, meaning that after Klarna funds the original buy now/pay later purchase, Stripe will process the consumer's repayments. Klarna says this will result in about 90% of its payment volume in the U.S. and Canada running through Stripe.

"BNPL does pose a threat to banks, but more because of the lost opportunity than a challenge to revolving consumer credit, which in the U.S. market is

Most buy now/pay later purchases are between $100 and $250, according to Riley, adding the banks that are moving into buy now/pay later view it as an introductory service. The fintechs that have become well known as buy now/pay later providers are getting in the way of this bank strategy.

"Credit card-based BNPL loans can show credit experience with the lender. That can lead to more products, higher card limits and broader relationships," Riley said. Issuers, he said, "need to broaden their nets to increase their loan books."

The access to B2B technology potentially supports a payment type that is the "next phase" for BNPL and other digital payment types, according to Crone.

"B2B is hard to solve. It requires integration into the e-commerce platform and the enterprise resource platform. Klarna will have a large consumer business and will be able to offer a whole new set of BNPL for B2B. Nobody has really done that yet."

The travel partnership allows Klarna to build a specialization in a specific business line for BNPL, a key move as its service extends to more diverse payment types.

"Vertical specialization in merchant services is critical. The way you serve supermarkets is very different from restaurants or travel providers," said Zil Bareisis, head of Celent's retail banking practice. "Bringing BNPL to specialist services such as travel or B2B requires deep understanding of specific friction points in those sectors."

In an email, Stripe's PR office said "flexible payment options are important. ... Stripe users around the world have found that flexible payment options like Klarna increase conversions and order value, as well as attract new customers. The PR office said Stripe does not offer BNPL directly and has similar partnerships with Afterpay and Quadpay.

Klarna did not provide comment by deadline. As part of the deal, Klarna will make its buy now/pay later options available to internet businesses that use Stripe in the U.S. and 19 European countries. Stripe serves roughly

"Consumers and merchants have decided that BNPL is here to stay," Schmeltzer said. "Industry players need to make sure they are supporting BNPL both directly via their own products and indirectly via the major branded players like Klarna, Affirm, Afterpay, and the others that consumers and merchants have become accustomed to using for installment-based purchases."