When engaging in an increasingly competitive credit card rewards and benefits market, issuers have to make sure their programs and pitches to consumers are as simple as possible. But that's hard to do when perks range from points and rewards to the very materials used to build the cards.

More than a third of credit card customers do not understand rewards programs, according to the J.D. Power 2018 Credit Card Satisfaction Survey. This trend is also supported through Auriemma Consulting Group's second-quarter research, which indicates half of U.S. cardholders also have no idea what sort of benefits their cards offer.

Still, consumers know what they like or want as their main features on a card and 47% of credit card customers have switched to a new card in the past year because of better reward programs, according to the J.D. Power survey, which compiled responses from more than 24,000 credit card customers from September 2017 through May 2018.

Even though they may have to do a better job of communicating the perks on their cards, issuers are keenly aware that the cards have to offer something cardholders find beneficial to their spending habits and lifestyles.

"Rewards have always been important, but most recently issuers have focused on acquisition as opposed to managing the risk and losses coming out of the recession," said Jim Miller, senior director of banking practice at J.D. Power. "Credit card spend is at a record high, but there are not many ways for an issuer to grow other than trying to take business away from competitors" through better rewards.

Auriemma's research, conducted via 800 online interviews with cardholders, pinpointed cardholder wants and needs with an emphasis on the cardholders' perception of benefits available to them, rather than what they knew they had on their cards.

Nearly half of cardholders want a cash-back card, while 22% prefer a points-based rewards program, the research showed. Within those key card categories, nearly 80% cited no annual fee as the most essential benefit for their cards, while 66% cited receiving rewards that never expire.

Though it has become common for some elite cards, and some cardholders rank them highly, the metal or heavier card material was the least desired benefit, with only 29%.

"As VIP experiences and more niche benefits become more prevalent, the value proposition gets more rich, so we really wanted to see if those really play a role in how consumers are evaluating cards," said Jaclyn Holmes, director of payment insights for Auriemma.

Even though the heavier metal card was considered the least important, it does not mean that these are features consumers don't want, Holmes said. "I think cardholders want everything that we were presenting in the survey," she added.

The survey responses take into consideration that many respondents were sharing their "perceived value" of the benefits because many did not believe those features were currently being offered on their card — even though many are on most cards, Holmes said.

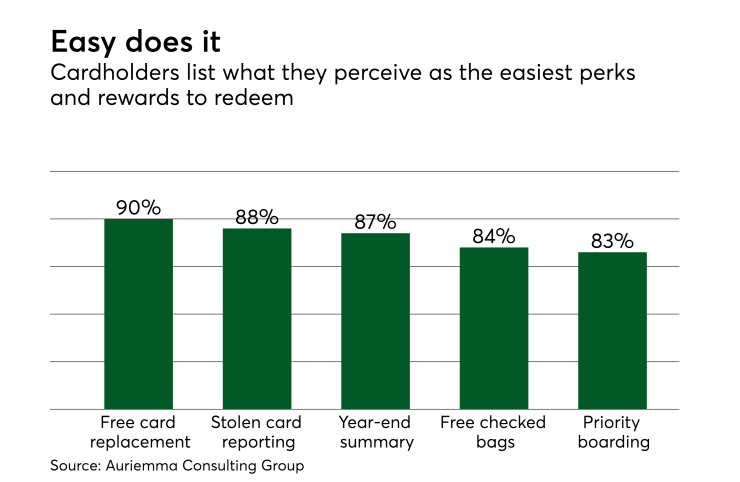

"Access to VIP experiences and free gifts and customized options are all really powerful," Holmes added. "But overall, in looking at the mass market, the long-term simple benefits are most valuable, such as zero liability, 24-hour support and free card replacement."

The J.D. Power study cited free credit scores as one of the more popular benefits to emerge in the past few years in the wake of so many data breaches, citing a satisfaction rating that is 43% higher among cardholders with that feature.

It would serve issuers well to make sure their customers fully understand the benefits on their cards, J.D. Power's Miller said. "On the benefits side, most customers don't know what the card offers," he added. "A card like Visa Signature shows the customer a long list of benefits, but they don't remember any of them."

Most customers only use about two of the card's benefits on a regular basis, so there is plenty of room for cardholder education in order for users to get the maximum benefit from their payment cards, he added.

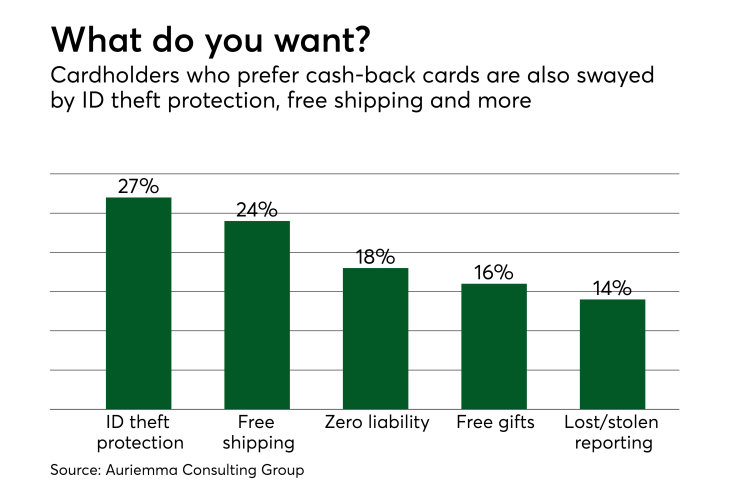

In a hypothetical scenario, Auriemma asked cardholders to select the top three benefits they would want in a new card when applying. ID theft protection (27%), free shipping (24%) and zero liability (18%) were those top three. Free gifts (16%), lost or stolen card reporting (14%) and 24/7 service and support (14%) garnered slightly less attention from respondents.

Even with various rewards and benefits being offered, cardholders still have a tendency to spend on multiple cards. Forty-three percent of respondents said they like to put specific purchases on specific cards, while 35% said they rotate cards to maximize their rewards programs.

Twenty-eight percent simply preferred to spread out their spending over multiple cards, while 17% said they liked to link different cards to different online accounts or apps.