DailyPay has raised $500 million and is adding Carrick Capital Partners to its board of directors as it seeks to expand beyond earned wage access.

The capital raise was separated into two fundraising efforts. The first is a $175 million Series D equity round that was led by Carrick Capital Partners with additional participation from existing investors. The second is a $325 million credit capital facility provided by various unnamed sources. As part of the Series D round, DailyPay will be adding an unnamed representative from Carrick Capital Partners to its board.

The EWA category provides employees an option of receiving part of their earned paycheck ahead of the two-week payday. The service is typically offered through employers, though employees may incur a fee for its use.

"Since 2016, we have partnered with world-class employers to enable their employees to access or save their pay as they earn it," Jason Lee, founder and CEO of DailyPay, said in a news release. "The initial application of our first-of-its-kind technology platform was to redefine how money moves between employers and their employees. We are now expanding our platform to change the relationship between merchants and their shoppers, as well as financial institutions and their customers. This platform enables us to create a new financial system by rewriting the invisible rules of money."

Before this capital raise, DailyPay had raised $14 million in funding over six rounds since 2015, based on data from

DailyPay is one of the EWA industry’s early pioneers and has benefited from the tremendous demand, fueled in part by the pandemic's strain on employee cash flow.

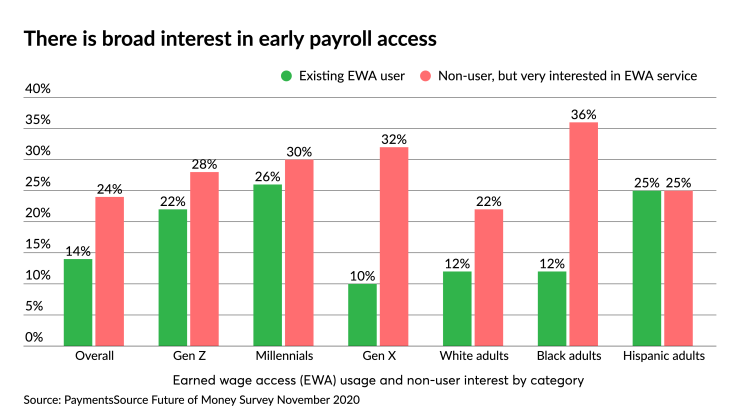

Approximately 14% of U.S. consumers are existing EWA users and an additional 24% are very interested in becoming EWA users, based on data from a

The growth of the EWA industry has not gone unnoticed by industry regulators, as the

DailyPay reported that it has reached several new milestones in the last 12 months, including increasing its revenues by 141% in 2020 as well as releasing a suite of new products that enable employers to provide off-cycle payments and remit employee reward payments. DailyPay has also launched ExtendPX, a proprietary while-label solution for payroll/human capital management firms.

"We have seen the explosion in the on-demand pay industry, and how DailyPay has been leading the category," Jim Madden, co-CEO of Carrick Capital Partners, said in the release. "We chose to invest in DailyPay now because we believe they are only just beginning to respond to the enormous opportunity they have to provide on-demand pay solutions to global enterprises."