Sometimes it just doesn't pay to go it alone.

"We are all competitors but the idea is to develop tools that are beneficial for the users, instead of having tools that not everyone can understand or use," said Christophe Dolique, CEO of Lyf Pay.

The app's stakeholders hope Lyf Pay will boost the adoption and use of mobile payment apps in general, considering that adoption figures still hover in the single digits in most markets. Retailer Carrefour has already started rolling out Lyf Pay.

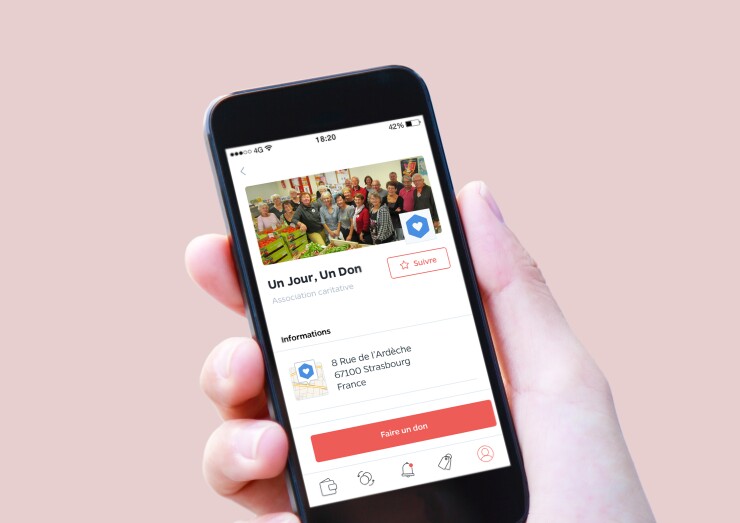

Lyf Pay offers in-store and online payments, P-to-P transfers, invoice settlement, loyalty points and coupons, with plans to expand beyond France after its launch. Lyf Pay's partners include Auchan, a retail group with a presence in 16 countries, and Mastercard. Lyf Pay has also secured commitments from French gas station chain Total, hospitality groups, non-profit charities and student organizations.

There's still work required to build a mobile payments market in France. Contactless mobile payments are not widely used in the country, though there is momentum at restaurants and fast food chains, Dolique said.

By making the wallet flexible, particularly in terms of how retailers market its use, Dolique hopes to build a user base faster than if these stakeholders were working apart. Lyf Pay integrates payment cards, loyalty cards and other marketing content; and displays merchant "news flashes" on offers and expenditures from a list that's customized based on consumer and merchant preference.

"The collaboration provides a unique user experience at checkout, and we can regularly update coupons and loyalty programs inside the app," Dolique said.

Lyf Pay signals an increasing tendency of banks and retailers to work together to offer a payment app that's agnostic to brand and technology, requires less navigation for consumers and provides more function and content, Dolique said. Another example is

"We got a lot of people around the same table and find out what the market was really looking for," Dolique said.

There's been the same migration toward collaboration in other markets.

That's a far cry from the early days of mobile payment apps, when MCX, the retailer group behind CurrentC, required at least temporary exclusivity from merchants; and the carriers behind the

"If we look at the story of mobile payments, there have been, very crudely, at least four camps — the banks, the card companies, the mobile operators and the retailers. This has changed over recent years as all sides recognize that it in order to work … everybody brings something to the table," said Gareth Lodge, a senior analyst at Celent's banking group. "It could be argued then that this was a reason why MCX never worked."

Chase Pay is a good U.S. example of a bank looking to work directly with merchants, but the trend is picking up more steam in Europe than in the U.S., according to Rick Oglesby, president of AZ Payments Group.

"Banks know a lot about their customers, and merchants know very little, which makes for an interesting opportunity for both parties to work together directly," Oglesby said.

Such collaboration in Europe is getting a regulatory boost. The PSD2 regulations in Europe pushes open banking, requiring banks to share customer information with third parties as long as the customer approves, Oglesby said.

"BBVA has an open API allowing for third parties to interface with its banking data. [Lyf Pay] is yet another example of banks working directly with retailers to provide solutions to retailer pain points," Oglesby said. "It’s [a requirement] in Europe, but the U.S. is on a diverging path so far. It may be time for U.S. banks to start thinking differently."