How much do Germans like cash? Consider the following common German phrase: "Geld stinkt nicht," which roughly translated means, "money doesn’t stink."

While most countries, ranging from the

It's a tough market for an online payment company such as Sweden's Klarna to approach, and as such Klarna has turned to local players for an assist. It's not unusual for a foreign company to face regulatory or cultural hurdles in a new market, and Klarna's betting a familiar brand will smooth things over in Germany.

"There's no silver bullet. You want to be where the consumers want to shop," said Brian Billingsley, CEO of Klarna North America. "Where people are going online, it has to be a seamless experience and it has to be familiar, easy and local for that market."

Klarna just acquired

Beyond local regulatory differences, which are generally more easily addressed than consumer preference, the acquisitions give Klarna access to a German and Central European audience that is accustomed to these companies.

"It doesn't feel like some other party is coming in to push a new product," Billingsley said of working through local players. These companies are also part of Germany's early migration toward digital payments. Germany is obviously not an emerging economy, but a very technological country that has a huge potential as the largest addressable market for e-commerce in Europe.

Klarna's core product is a platform for online retail installment payments. BillPay offers a similar model that "breaks up" e-commerce payments over time. It also gives Klarna access to nearly 30 million consumers in Germany who have used the product.

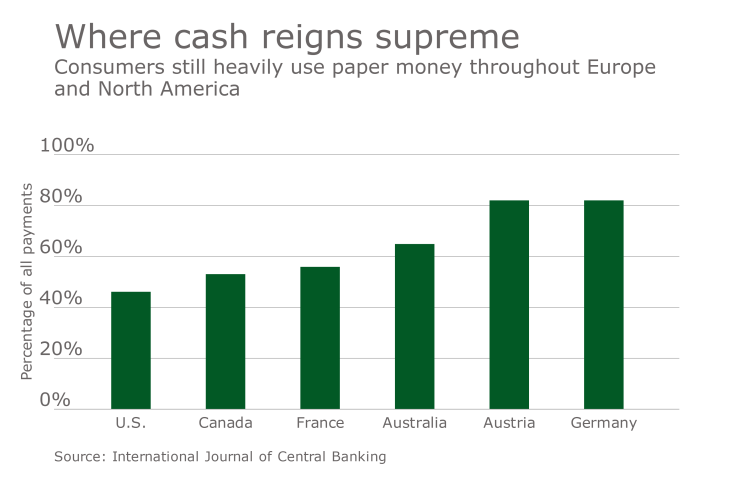

"It's still a cash-based economy, so there's lots of room for growth," Billingsley said. "And we're starting to see people adopt e-commerce."

BillPay's model should encourage more digital payments, given the clarity of its closed-end installment payment plan instead of a more open-ended credit card style model. "People know what they bought and they know what they want to spend," Billingsley said.

Klarna's also taken a local approach in the U.S., where it is collaborating with Provenir, a Parsippany, N.J.-based software company, to speed risk profiling for consumers. Provenir analyzes the data Klarna produces from sources such as email, address, transaction history, fraud and credit bureau reports and other factors to produce a risk profile in about a second. This risk profile then informs the generation of terms for installment payments.

Klarna faces ample competition in most of its markets, particularly from cloud-based companies that offer application programming interfaces, software development kits and tools aid e-commerce development. Even with the growth of that technology, there's still room for local expertise, according to Andy Schmidt, an executive advisor at CEB.

"There's always going to be variations on how merchants work, and where those differences can be major you need an added layer of expertise," Schmidt said, noting the different approach to credit and cash that exists in Germany.