- Key insight: Asian ride-sharing and payments fintech Grab has bought investing app Stash.

- What's at stake: Grab is continuing to expand its reach into global financial services.

- Supporting data: Grab earned $3.37 billion in revenue and $200 million in profit in 2025.

Grab Holdings is entering the U.S. market by buying a micro-investing app.

Grab, a Singaporean ride-sharing app and

The deal is expected to close in the third quarter of 2026 pending regulatory approvals, according to the company, and the payments will be made with a combination of cash and stock. Grab has committed to acquiring 100% of Stash's equity interest over the next three years, according to the company, with the initial payment covering 50.1% of the transaction and the remainder paid out over the next three years at fair market value.

Stash is a subscription-based investment advisory app with around $5 billion in assets under management from about 1 million customers, according to a company statement. The fintech, which also offers

The acquisition marks the first move that Grab has made into the U.S. market since its founding in 2015. The app offers

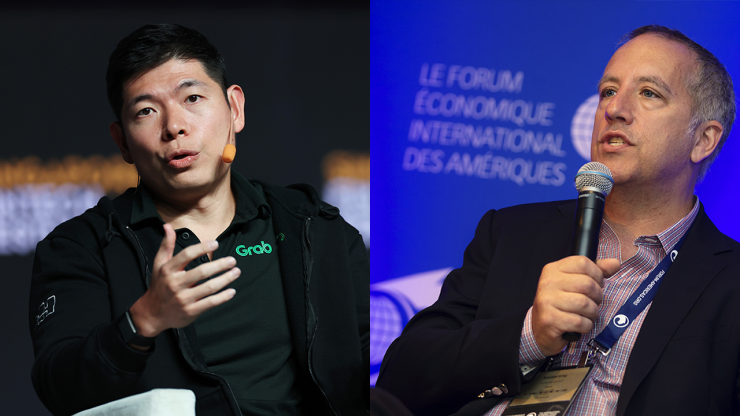

"This is a milestone in Grab's evolution as a trusted international provider of financial services," Grab CEO Anthony Tan said in a statement. "We will strengthen Grab's fintech know-how with Stash's AI-powered investing app, designed with existing U.S. regulatory requirements at its core. While we remain operationally focused on Southeast Asia and scaling our regional loanbook, this move reinforces our mission of democratizing financial services for everyone."

Grab earned $3.37 billion in revenue in 2025, according to the

A research note from Mizuho Securities maintained the firm's Outperform rating for the company and cited that Grab beat its consensus estimates by 5%.

"We believe the 3Y mid-term outlook should provide additional confidence to investors," Mizuho analyst Wei Fang wrote, "as GRAB [sic] continues to diversify its product portfolio, expand geo coverage and optimize cost to serve to further explore more opportunities in one of the youngest and most vibrant economic markets globally."

Once the deal closes, Grab plans to support Stash's continued growth in the U.S. consumer market while also introducing Stash's investing solutions, including its AI Money Coach product, in Southeast Asia. Stash will remain a standalone entity as part of Grab's business, according to the company, and the fintech's executive leadership will also remain.

"This acquisition gives us the best of both worlds: the capabilities to double down on growth in the U.S. and the resources of a technology powerhouse to accelerate our vision of personalized, AI-driven financial guidance for millions of people across all parts of their financial lives," Stash co-CEO Brandon Krieg said in a statement.

Stash is expected to generate around $60 million in earnings in the 2028 calendar year for Grab, according to the company. Fang wrote in the Mizuho report that Grab "could see steady but slower on-demand margin expansion on competition while the Stash acquisition fills in $60M EBITDA for FY28."