Even in a pandemic, certain consumers insist on paying their bills with cash, and increasingly that includes online gambling.

PayNearMe, which developed a foothold a decade ago enabling consumers to pay bills in cash at convenience stores, is now seeing strong growth through that channel from online sports betting sites, which are proliferating in the U.S.

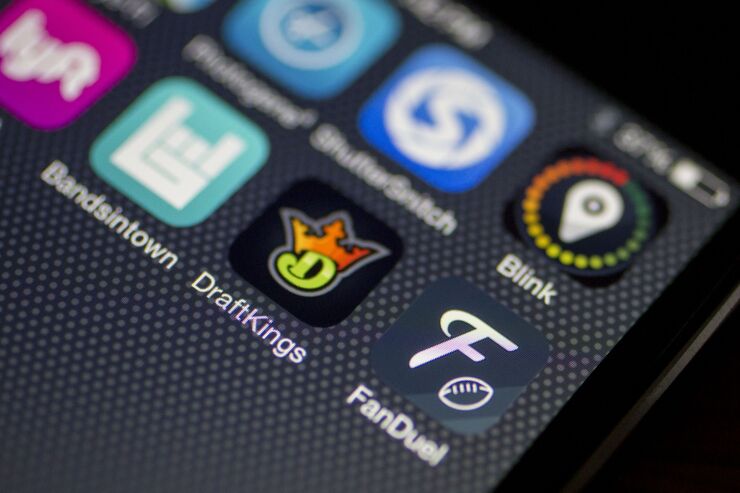

About two dozen states now host online sports betting, with many more expected to legalize it by 2022 following a 2018 Supreme Court ruling that permitted the practice in most U.S. states. But the emerging industry still contends with restrictions on gambling across state lines.

New Jersey, Pennsylvania and Delaware are seeing the strongest action in online sports betting, and more states are eyeing online sports betting to drive revenue through taxes on winnings. The potential U.S. market for online gambling could be worth up to $23 billion, according to

"We're seeing a big focus on sports betting, and for a cash-acceptance network like ours it's a big opportunity because card acceptance and usage for online bets is inconsistent," said Michael Kaplan, PayNearMe's chief revenue officer.

PayNearMe supports payments in all states where online sports betting is legal. For example, in

To accommodate this audience, PayNearMe in the last 18 months upgraded its mobile wallet to support all tender types, including cards, ACH, Apple Pay, Google Pay and cash. To pay with cash, customers present a barcode from PayNearMe's app at 7-Eleven and CVS stores, which then accept the cash payment on behalf of the biller.

The growth in payment options also enables PayNearMe to further expand rent payment collection through connections to thousands of landlords nationwide, along with providers of mortgages and auto loans, according to Kaplan.

Bills are paid in real time through PayNearMe. Revenue comes primarily from incremental collection fees PayNearMe charges billers, and sometimes from consumer fees. PayNearMe does not add expedited bill payment charges.

PayNearMe recently added new digital wallet features giving consumers richer transaction data. PayNearMe users can now turn on notifications for when bills are due or paid, and access specific bills and payment history through the digital wallet, including a full PDF of a bill from participating billers.

"We're leveraging wallet infrastructure so our customers, who routinely use a mix of payment tender types that's neither all-digital nor all-cash, have more powerful tools to keep track of their funds," Kaplan said.

Digital agility doesn’t mean more users are going all-electronic, however. Nearly all of PayNearMe’s customers use mobile devices to receive bill payment notifications from billers, but over half of the company’s users pay bills in cash, underscoring the persistence of cash even as technology’s role expands.

“There will always be a core of consumers who need to pay bills in cash, and that's why many billers need that complete solution,” Kaplan said.

PayNearMe's improved digital wallet features also enable users to keep close track of their betting deposits.

"Our decision to offer all key payment types for gaming in a single platform has removed a lot of friction from the cash deposit and withdrawal process," Kaplan said.

PayNearMe forecasts that cash will continue to be a vital part of the mix of online gambling, and the Sunnyvale, Calif.-based company has set itself up to process cash payments to 95% of online gaming and sports betting and advance-deposit wagering, to prepare for further growth.

"As new states go live with online sports betting and the market expands by adding new operators, we expect to see strong ongoing adoption," Kaplan said.