Most talk around bots is decidedly consumer-focused, enabling ways for people to schedule an Uber or order lunch. But PayPal, in working with the business chat client Slack, is setting a much different tone.

Slack isn't entirely out of consumer territory, since colleagues use it for P-to-P uses while they're on the clock. And PayPal's P-to-P chops definitely help establish straightforward use cases for its Slack bot.

"Whether your colleague picked up the tab at lunch or you are chipping in for a group gift for a teammate’s birthday, sending money from your PayPal account to a friend’s is as easy as typing, '/PayPal send $5 to @Dave.',” said Meron Colbeci, PayPal's senior director of core consumer products, in the payment company's Tuesday

The strategy somewhat echoes the beginnings of the hugely popular Starbucks payment app in 2009. In the Starbucks app's early days, it focused on selling to office workers picking up their morning coffee on the way to work. This meant prioritizing development for

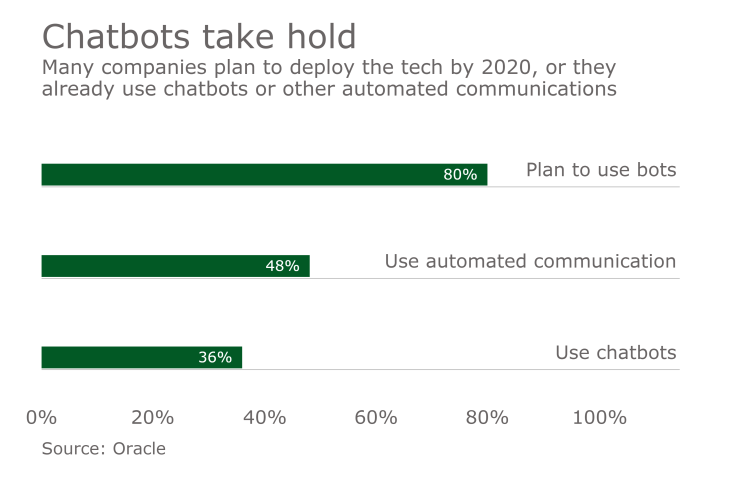

Chatbots are an older technology, but

By 2020, the average person will engage bots for conversation more than they will have direct conversations with their spouse, according to a

PayPal and Slack did not make executives available for comment. In an email, a spokesperson from PayPal's external public relations provider said P-to-P payments are one of the largest drivers of consumer acquisition and engagement at PayPal, and P-to-P increases customer engagement on PayPal by 67%. The company is making P-to-P payments more personal and contextual, and the Slack collaboration is part of that strategy, according to the email.

"Slack is the 'new Skype,'" said Andy Schmidt, an executive advisor at CEB. "It makes sense for these types of networks that connect people in a social way to enable funds to flow through them. We're working toward a time where it's not a question of if you're on Venmo or PayPal, but if you're on Facebook, Skype or Slack."

The addition of payments to the arsenal of bot development tools allows developers to introduce end to end capabilities spanning impression, conversion and service, said Jordan McKee, a senior analyst at 451 Research.

"Payment acceptance fills a blatant gap that has limited the overall effectiveness of bots as a sales tool," McKee said, adding 451 Research has found 61% of U.S. e-commerce merchants cite "improving conversion rates" as a top three challenge this year, underscoring a latent opportunity for bots to capture sales that otherwise may have been abandoned.

"While the technology for bots development remain the same, we believe payment integration can help bots evolve from simple marketing and branding mechanisms to tools that convert shoppers into buyers, driving real business outcomes," McKee said.

Bots additionally hold great potential for payments intermediaries such as gateways and processors to capture incremental revenue from sales that otherwise may have been abandoned, McKee said. "Early success will be achieved through partnerships and API accessibility," McKee said.

The most immediate use for the PayPal/Slack integration would be groups of coworkers or other acquaintances, given Slack is often used as a professional messaging platform, said Tiffani Montez, a retail banking senior analyst at Aite Group who covers issuance for prepaid, credit and debit cards. "I could see a need where you have a pooling type situation," Montez said.

The larger opportunity in bots is in financial management, Montez said. "P-to-P transfers are still very transactional, the role that bots can play is taking those transactions and providing a lot more intelligence behind it," she said. "How does this transaction impact other areas of your life as it pertains to financial wellness."