The majority of small and medium-sized businesses in the U.S. and Europe express an interest in real-time payments, but very few are aware of the current options being tested and brought to market.

A recent ACI Worldwide study finds that 81% of businesses in the U.S. have not heard about

But this is the reality of operating a small business, a sector that tends to be "relatively underserved by the banking community, and they tend to find out about things last," said Barry Kislingbury, director of solution consulting and immediate payments at ACI Worldwide.

Smaller businesses don't have solutions designed specifically for them, as they tend to get "a cut-down version of what is given to larger businesses, or a slightly souped-up version of what retailers use," Kislingbury said. "In that regard, they sit in the middle somewhere and are under-loved."

The desire for real-time payments at the small-business level is more significant in Italy, where 90% of those businesses said they would switch providers if banks offered real-time payments, compared to 75% in France, 58% in Germany and 65% in the U.S.

"Some of these numbers are quite large and pretty significant, when talking about 90% in Italy," Kislingbury said.

Electronic payments provider ACI Worldwide, with offices in the U.S., U.K. and Singapore, commissioned YouGov to conduct a survey of 1,255 small-business decision makers in the U.S. and Europe to gauge their desire for and awareness of real-time payment schemes.

Generally, small-business owners want banks to provide the types of payments services that are favored by millennials, Kislingbury added.

"The millennials can do anything on their mobile device quickly these days, and it has become second nature," he said. "Why wouldn't you expect the same from your banking environment? They can do payments instantly in an Apple store when they pay for music, and when they go to other places, they expect the same."

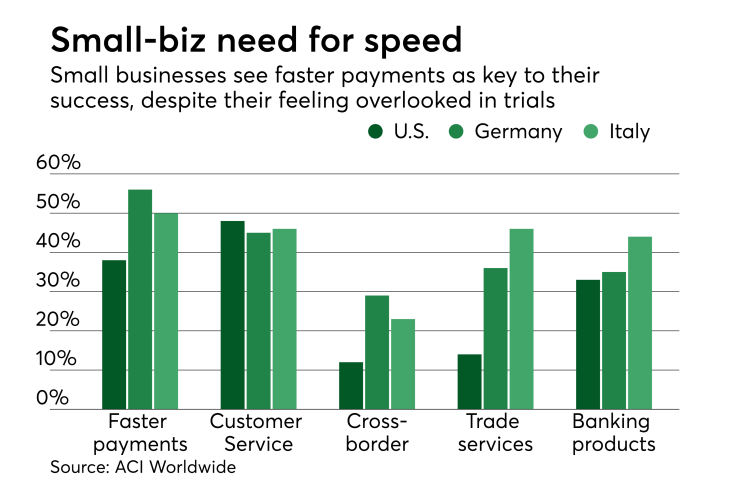

Overall, 43% of businesses acknowledged that being able to send and receive payments in real time would be essential to their success. Of those in the U.S. that want some form of faster payments, 74% favored receiving payments from customers in real-time, with 54% saying the same about paying vendors and suppliers in real-time.

Small businesses want more innovation from their banks, as 67% in Germany are using mobile or online banking and 45% have turned to PayPal for the Venmo person-to-person payment method.

"Banks have to work out how to partner with these competitors and modernize," Kislingbury said. "Ultimately, real-time payments is one of the biggest catalysts in making them look at how they are doing things."

The task at hand is to limit the frustrations that small businesses have in making payments, as 51% in the U.S. and 65% in Italy said payment delays to their own accounts or to vendors and suppliers represent the top frustration in the their businesses.

"For small and medium businesses, faster payments are likely to become a must," said Gareth Lodge, a London-based industry analyst with Celent. "Certainly in the U.K., they have become widely used amongst these businesses."

Companies can make less-expensive, automated payroll payments at one time, Lodge said. But they still need flexibility in making payroll payments to employees working non-standard hours.

The demand for faster payments, which is likely to start with larger companies, will trickle down to smaller businesses. Those that adopt it early will benefit, Lodge added.

It is not surprising that most small businesses are unaware of the faster payments schemes, because these technologies are still in testing phases, Lodge said.

"Payments are both habits and means to an end, so it has to be explained to these businesses why it's both better and how it fits with their processes," Lodge said. "After all, they care about selling and buying, not the payment itself."

It puts the onus on banks to not only upgrade their payments technology, but to educate small-business customers. The U.S., for example, does not have the benefit a faster payments scheme being a government mandate or mainstream attention.

"One of the challenges is that people look at payments and how they are done traditionally, and ask what it would really mean if they were faster," ACI's Kislingbury said. "They need to be shown what it means to the business and how much time it will save when they are not constantly checking accounts to see if money arrived on time."