The financial services industry ships over 3 billion new cards each year, according to ABI research.

That's enough plastic, laid end to end, to wrap around the planet more than six times. And issuers replace these cards every three to five years — leaving the old ones to sit in landfills for hundreds of years before they fully decompose, if they ever do.

Plastic leakage into the environment will almost double, to 44 million tons, in 2060, according to the

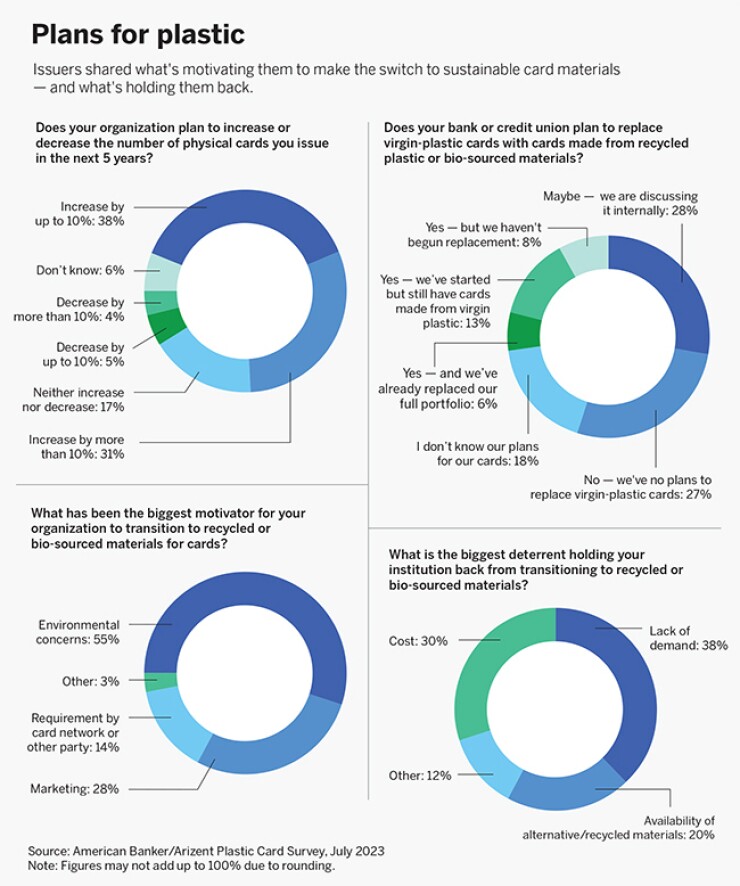

Despite these risks, most banks and credit unions plan to push out more plastic in the next five years, according to a July survey of 109 card issuers conducted by American Banker's parent company, Arizent, for this story. Thirty-eight percent of respondents said they plan to increase the number of physical cards they issue by up to 10%, and 31% said they plan an increase of more than 10%.

Even if digital alternatives such as mobile wallets eventually replace physical cards, the planet and its inhabitants still suffer each year that new plastic enters circulation.

"I never knew that it takes 400 years for a debit card to degrade. When you hear that, it's shocking," said Eric Carter, digital solutions and innovations officer at Bank of New Hampshire.

The $2.4 billion-asset bank began issuing a biodegradable debit card last August. It's one of several players in the financial services industry taking notice of this issue —

'I'm part of the problem'

Carter, who has worked in the banking industry for 36 years and has held his current responsibilities for the past 18 years, was researching options for debit card materials when he discovered the possibility of issuing biodegradable cards, and how much better they were for the environment than cards made of first-use plastic.

And then it hit him.

"I've been doing this for 18 years and I'm part of the problem," Carter said.

As Carter was doing his research, he was also struck by how much his own daughters cared about sustainability. They would talk about the materials going into Pringles cans or plastic sandwich bags; they worried about the coral in the ocean. His oldest, Marissa, is a 20-year-old marine biology major at the University of New England in Biddeford, Maine. Her sister, Eliza, is 18 and wants to preserve old buildings; her senior project was a dress made from recycled materials. She starts at Wentworth Institute of Technology in Boston this fall.

But would the type of plastic in their debit cards really matter to his daughters and their friends? When Carter asked, he got an emphatic yes. This was all the encouragement he needed to present the idea to his team.

Bank of New Hampshire chose polylactic acid, or PLA, for its biodegradable debit card. PLA is made from corn or similar bio-sourced material, and has the benefit of being compostable under the right conditions.

There are a variety of other sustainable choices, depending on what the bank's key environmental concern is — and how much it wants to spend to solve the problem.

Recycled polyvinyl chloride, or rPVC, and recycled polyethylene terephthalate, or rPET, cards are made primarily using plastic waste; a key difference between the materials is that rPET, mostly used in bottles and other food packaging, doesn't emit the same toxic chemicals as PVC when incinerated. Both of these plastics are typically less expensive than other sustainable materials.

A more premium (and thus more expensive) option is ocean plastic. These cards are made primarily using plastic collected from coastal areas to prevent that trash from drifting out to sea.

In all cases, the nonplastic components, such as the EMV chip, contactless antenna and magnetic stripe, are the same as those in cards made of first-use plastic.

"Though my daughter is a marine biology major and I like the idea of reclaimed plastic, it's still plastic. It's good that it's out of the ocean, but I don't want to put it in my back yard either," Carter said.

Carter's bank is based in Laconia, New Hampshire, but it gets its cards from Thales, a global card manufacturer based in France. And while many other banks around the world have the same access to sustainable materials for their cards, Bank of New Hampshire is still very much an early adopter in the U.S.

Ultimately, many banks may not have a choice about adopting more sustainable options. Mastercard will require all banks to

ABI predicts that the number of rPVC payment cards issued will "surge" to 638 million in 2026 — but making the cards out of recycled plastic or compostable materials solves only half the problem.

Those cards will also be discarded one day, and many will still take up space in landfills or as litter. To this end, some banks have begun putting bins in their branches to collect expired cards, shred them on the spot, and then ship the pieces off to a recycling partner once the bin is full. Others are collecting expired cards at ATMs, which already have the ability to capture cards.

Global problem, regional solutions

Mastercard's deadline is meant, in part, to get everyone on the same page. Different regions may share a goal of being more environmentally friendly, but they each have their own reasons.

"Europe has always been hot on this and therefore the EU has really been driving it," said Paul Trueman, executive vice president of cyber and intelligence at Mastercard. Building on a cultural imperative to be more sustainable, regulators in the European Union expect corporations to have

Other parts of the world have their own motivations. In the Asia-Pacific region, rising sea levels are a major concern; in Brazil, it's deforestation, Trueman said. But the environmental impact of plastic cards can be addressed only if the supply of recycled or bio-sourced material is available to the card issuers who care to procure it.

In 2018, Mastercard launched a partnership with three European card manufacturers — IDEMIA (France), Giesecke+Devrient (Germany) and Gemalto (a Dutch unit of Thales) — that serve a global audience, with a goal of reducing the amount of first-use plastics each of these companies use. In 2020, Mastercard created a sustainable materials directory to allow issuers to more easily find options for eco-friendly cards; the Mastercard Card Eco-Certification scheme followed in 2021, enabling issuers to display a badge on their cards to demonstrate their sustainability.

Today, Mastercard endorses 23 alternatives to first-use plastic, and issuers worldwide have produced 235 million Mastercard-branded cards using those approved materials since 2018. There are 3.2 billion active Mastercard and Maestro-branded cards worldwide, according to the company's second-quarter earnings report for this year.

Past efforts to fundamentally change payment cards, such as the addition of the EMV chip for security, have involved some degree of coordination among the major global card networks. For Mastercard's sustainability goal, that level of coordination isn't necessary.

"We work directly with the vendors. And the reason for that is those vendors serve us, but they also serve Visa, Amex, Discover and all the rest of them ... the vendor then supplies the product directly to the bank," Trueman said. "A card is just a piece of plastic, no matter which brand's on it."

At Giesecke+Devrient, for example, 60% of its orders are already for eco-friendly materials, according to Ashwini Pandey, director of product management at G+D, which ships about 500 million cards a year and plans to stop using virgin plastic in its payment cards by 2030.

G+D has been working on offering recycled cards for over 10 years, and the technology behind these cards has advanced substantially in that time.

"The market was not there ... and also from the technological perspective, from the material plastic perspective, it was not that refined or innovated the way it is today," Pandey said.

By 2020, enough of the necessary pieces were in place for G+D to move ahead more aggressively with eco-friendly cards. Its suppliers had an ample amount of recycled plastic to work with, and the quality of the finished product was now good enough to meet the same standards that the card networks applied to cards made of first-use plastics, Pandey said.

Although Mastercard is spearheading this particular initiative with G+D and other vendors, the other card networks have their own projects underway.

Visa offers

American Express has offered cards made from

Individual banks have also made their own commitments to sustainable payment cards.

"There is a big consciousness now, from a consumer angle, of wanting to be more green, as well as a big-business focus on recognizing the role we play in driving towards net zero and beyond," said Jeni Mundy, global head of merchant sales and acquiring for Visa.

But ultimately, the banks and card networks don't need to be aligned on this as long as the vendors do their part, according to Mastercard's Trueman.

"Even if you don't want to do it, there's no physical benefit in having a first-use PVC card versus a recycled card," Trueman said.

Any price difference between first-use PVC and recycled PVC should flatten out over time due to competitive pressures, he said. Ultimately, the experience of buying virgin-plastic cards will be like buying leaded fuel at the gas pump — it will be almost impossible to find, and anyone who sells it will charge a steep premium because there will be so little demand, Trueman said.

"The whole petrochemical process switched over, [and] all the engines became better," he said. "Everybody can handle unleaded fuel, so unleaded fuel is the new norm."

Closing the loop

The credit card industry has long advised its customers to cut up their expired cards and discard them in household trash for security purposes, and if this habit doesn't change, recycled-plastic cards will take up just as much space in landfills as first-use plastic cards do.

The payments industry is still figuring out how to best address this issue, and it has yet to come up with a universal solution.

Bank of New Hampshire chose PLA cards — the kind made from corn — because they are biodegradable under the right conditions, but considered sturdy enough for everyday use.

To properly decompose, "it's got to be in an industrial compost pile, with heat and moisture, and it's got to be in for six months," Carter said. But just "being in your car or your wallet, or you went swimming, that's fine."

Consumers who do their own composting could dispose of their cards at home, and if these cards do end up in landfills they are still nontoxic, allowing them to break down safely over time, Carter said.

Other banks are instituting programs that allow them to collect plastic cards to be recycled, regardless of what kind of plastic they're made from.

In June, HSBC began piloting a system at some of its U.K. branches to allow people to bring in cards to be shredded on-site and then shipped off for recycling once the bin is full. The bin is collected by TerraCycle, which separates the shredded plastic from the card's metal components (which are also shredded), allowing the plastic to be reused.

Although the bins are being deployed by HSBC in partnership with Mastercard, they can accept any card for recycling.

Santander has a similar in-branch recycling program in the U.K., but in Spain it takes a different approach — it works with G+D to collect expired cards through its ATMs.

"We are using the existing infrastructure," Pandey said. "There's no physical change needed in the ATM," which is already designed to capture cards when, for example, a user mistypes their PIN multiple times.

Consumers aren't likely to bring an expired card to the ATM unless they know it's expected of them, so the ATM starts to inform the user about this process about three months ahead of the card's expiration date. G+D collects 60,000 to 70,000 cards a month this way. The plastic from these cards is then recycled to be made into benches, Pandey said.

A third option is to mail the card to the bank or its recycling partner.

Each of these processes has its pros and cons. ATM capture "throws another supply chain headache into it," according to Trueman, because ATMs can't shred cards on their own. The bins that banks use in the U.K. provide peace of mind to consumers by shredding the cards im- mediately, but this works only for banks that have branches, he said. A fully digital bank would have to accept cards by mail or at a partner location.

Most of these projects also don't solve for the growing number of metal payment cards being issued.

"Metal cards have a different positioning in the market; they're more like a lifestyle card," Pandey said. These cards are already made with some amount of recycled metal, he noted.

ROI

All of these steps — from replacing first-use plastic to accepting cards for recycling when they expire — add to the issuer's costs.

Whether the issuer gets a meaningful return on its investment is the elephant in the room — or in the case of Bank of New Hampshire, the moose.

When the bank began issuing biodegradable debit cards a year ago, it offered a series of new designs that its customers could choose from. Its most popular new design is the Old Man of the Mountain, a famous New Hampshire rock formation that collapsed two decades ago; before that, customers' favorite design was a picture of a moose.

"Everybody loves the moose card," Carter said.

Bank of New Hampshire is a mutual bank, meaning it is owned by its depositors instead of traditional shareholders. This structure enabled it to downplay the issue of cost when choosing the materials for its new cards.

"[Cost] wasn't a factor for us; it was really the social aspect of it," Carter said. Bank of New Hampshire pays about 30 cents more per card than it did before switching away from first-use plastic.

The choice of a biodegradable "corn card" has its own built-in marketing perks, Carter added.

"Every time you talk to a customer about a biodegradable card made out of nonedible corn, it always gets people talking," he said. People asked whether it would melt in their pockets (it won't) or whether the card could be eaten (it can't). Once they got their answers, those customers started using the cards a lot more.

Although the bank can't prove a direct correlation between card materials and spending, it has been tracking a number of metrics that showed an increase in usage — and, by extension, an increase in revenue.

Bank of New Hampshire has about 28,000 active card users; its processor defines an active user as one who transacts at least once a month. This number has risen about 3% year-over-year, but the big leap is in the number of "super power users," who make over 40 transactions a month. That number jumped by 7%, to 7,000, from a year earlier.

In June of this year, the bank opened 35% more new accounts than it did a year earlier. Its debit card transactions rose 2.6%, to 20,115 transactions, from June 2022. Its total amount spent rose 2%, to $757,004. "More transactions means more interchange income," Carter said.

For another bank, the cost of issuing recycled or sustainable cards still hasn't added up.

This is a point of frustration for

It checks vendor pricing regularly, and most recently ran the numbers in December. A "run of the mill" card costs it $2 to $3, with a typical minimum order of 1,000 cards. It has 2,300 account holders today, many of whom have already been issued cards.

Of the options Climate First considered, Cucci said the cheapest sustainable card was just under double its current cost. Climate First would prefer to issue cards made from ocean plastic, which would cost $7 a card, though this is a "prohibitive" amount, Cucci said.

Climate First isn't the only card issuer struggling with this problem. Of the participants in American Banker/Arizent's July survey, only 6% had replaced their full portfolio with cards made from recycled plastic or bio-sourced materials. Another 13% have started replacing their cards but still issue virgin plastic, and 8% have a plan in place but haven't started. Twenty-eight percent are discussing replacing first-use plastic but haven't made a decision yet; the remaining 45% either have no plans or don't know their company's plans.

Of those that are replacing first-use plastic cards, the biggest motivator is the environment, at 55%. Marketing was the second-biggest motivator, at 28%, and mandates from a card network or other party was the driving force for 14% of respondents.

Of those that are not replacing their cards, the biggest deterrent was lack of demand, at 38%, followed by cost, at 30%.

Climate First's customers sometimes inquire about the materials used to make its cards, and Cucci said the bank tries to be transparent about the process it's going through. "We haven't lost a customer over it, but I would say that it's something that our customers ... do ask about, and they'll be really excited when we have a solution," he said.

The persistence of plastic

Most of Climate First's customers use digital wallets like Apple Pay or Android Pay, but that doesn't eliminate the need for a plastic card, Cucci said.

"They still require you to issue a physical card to be able to turn those services on," he said.

While this isn't true for all cards — the iPhone's built-in Apple Card, for example, mails a physical card only to users who request one — there are many factors that

A full shift away from plastic "requires that everybody does have a smartphone capable of handling [mobile payments], that they have the capability to pay through that card and that they have a choice — that they want to pay through that physical card," Mastercard's Trueman said.

An industrywide shift fully to digital payments "assumes a lot [about] the equity across the countries" in their access to technology and desire to change habits, he said. The plastic card endures because of the simplicity and the security it provides, Trueman said. He likened plastic cards to pencils, which people still use long after the invention of the pen.

"There's something about a pencil. It does one job incredibly well. If you get fed up with [what you're writing], you can just kind of rub it out and start again," he said.

At Bank of New Hampshire, Carter hopes its sustainable debit card sets an example that other banks will want to follow. But he knows it won't be that simple. Bank of New Hampshire was also an early adopter of contactless cards in the U.S.; it offered contactless debit cards in 2009. It took nearly a decade — and the combined impact of EMV-chip cards, Apple Pay and a global pandemic — before most other banks made the same shift.

To Carter, this is cause to be patient about the momentum behind sustainable payment cards.

"It might take a little bit for it to take hold, but hopefully in the long run it's going to take hold and we'll be one of the first to have made that leap," he said.

A finer pointBanks aren't just in the business of mailing out plastic cards. They also distribute a huge number of pens to their branches. Some go a step further and offer them to customers as promotional materials. TD Bank, the U.S. unit of Toronto-Dominion, hands out 12 million to 15 million plastic pens a year. It's a branding initiative that began when it was a New Jersey-based company called Commerce Bank, which the Canadian TD purchased in 2008. Despite rebranding as TD, the bank didn't want to stop handing out pens, but it had two major environmental concerns to contend with: Its pens were made of first-use plastic, and they were all shipped from China (burning a lot of fuel in transit). To address both of these issues, TD embarked on a three-year project to convert to rPET materials and to source its pens locally. In the end, it chose to work with Pen Company of America in Garwood, New Jersey. "Bringing the pen from China back to the U.S., we actually saved money," said Lena Forrest, head of branded experiences at TD Bank. As a safety feature, the pen isn't refillable; the bank didn't want small children to be able to dismantle the pen and choke on its parts. To make sure the pen lasts, TD requested to use a large ink cartridge. As a result, TD's pens can write for about 2,730 feet before running out of ink — the equivalent of seven and a half football fields, or twice the height of the Empire State Building, according to Forrest. "In my 15 years [at TD Bank], I've not come across a pen that has run out of ink," Forrest said. TD expanded its promotional pen program to Canada in July, shipping 250 pens to each of its 1,300 branches in the country. Until this point, Canadian branches had been using ordinary unbranded pens sold by office supply stores. The bank isn't focused only on pens. A few years ago, TD embarked on a plan to remove all single-use plastic within the bank. This included plastic cups and cutlery in its office kitchens, as well as the packaging it uses to ship promotional materials. "Even the tape that we use on our boxes is a water-based tape," Forrest said. "We take the environment very seriously at the bank." |