New Zealand

Visa acquired Pismo in 2024. Auckland, New Zealand-based Dosh was founded in 2021 and is working toward becoming a registered bank. The partnership with Pismo will lay the groundwork to offer spend, save and borrow banking solutions.

"Working with Visa and Pismo allows us to move faster and scale with confidence," said Dosh CEO Shane Marsh in a statement. "As we step into this exciting next chapter, our focus is on offering New Zealanders a modern banking experience that's smart, simple, and puts value back in their pockets. This collaboration is a key step in that journey."

Dosh will migrate its 40,000-plus accounts to the Pismo platform by May 2026, the company said.

Tether invests in stablecoin tech for African businesses

Tether has invested in Shiga Digital, an Abu Dhabi-based blockchain technology firm, and entered a collaboration agreement to scale stablecoins in Africa. The two firms will build tools to improve cross-border transactions, stablecoin payments and other digital asset products.

"Africa is on the cusp of a financial transformation, and at Tether, we believe in being more than just observers; we are active enablers," said Paolo Ardoino, CEO of Tether, in a release. "Our strategic alliance with Shiga Digital is rooted in a shared belief that access to stable, secure, and scalable financial tools should not be a privilege, but a right."

Shiga Digital partners with licensed financial transmitters to manage compliance, and to build strategies that are relevant to the needs of the local markets.

Tether issues USDT, the world's largest stablecoin by market capitalization.

In a recent interview,

"The banks and others will go after the 'Western World,' but that leaves a huge market for us to go after," Ardoino said in the interview. "Emerging markets are considered a niche but it's not really a niche." —ohn Adams

Hong Kong makes its pitch as a stablecoin hub

The

The HKMA stablecoin rules went live August 1. No firm has

"In future, the public may refer to the register of licensed stablecoin issuers as shown on the HKMA's website. Members of the public are advised to stay vigilant to any persons who claim to be regulated or licensed stablecoin issuers in Hong Kong, and those who claim to be applying for a license. Members of the public who hold unlicensed stablecoins are at their own risk," the HKMA said in a release.

Among Asian financial hubs, Hong Kong trails Singapore as a base for regional stablecoin activity. Singapore has had

Brazil's Pix tries to plug a recurring payment hole

Pix, Brazil's fast growing

This is designed to address a challenge among merchants that require periodic payments, such as subscription platforms and utilities. Pix recently launched Pix Automatico, which processes recurring payments that are static, including the same amount on the same date each month. DLocal, a payment company that specializes in

Merchants use SmartPix to store customers' Pix credentials, similar to a stored card-on-file, and initiate charges in real time, even when the amounts vary.

"This product eliminates the need for users to approve every payment, allowing merchants to offer the kind of seamless, secure experience that modern consumers expect," Gabriel Falk, product manager at dLocal, said in a release. —John Adams

Irish payments and FX fintech buys Sainsbury Travel Money business

Ireland-based payments and foreign exchange fintech Fexco has agreed to buy Travel Money, the foreign exchange and prepaid travel card business of

Fexco will take over operations of Travel Money's digital platforms and more than 220 retail locations. Financial terms for the transaction were not disclosed, and Travel Money will continue to operate under the Sainsbury banner.

The deal will increase Fexco's footprint in the United Kingdom to over 460 retail locations and provide access to more than 18 million Nectar members. Nectar is a loyalty card scheme owned by Sainsbury.

The move is the latest in Sainsbury's divestiture of its financial services businesses. It sold its core retail banking book for Sainsbury Bank to NatWest in 2024. –Joey Pizzolato

Latvian biometrics startup secures seed funding for U.S. expansion

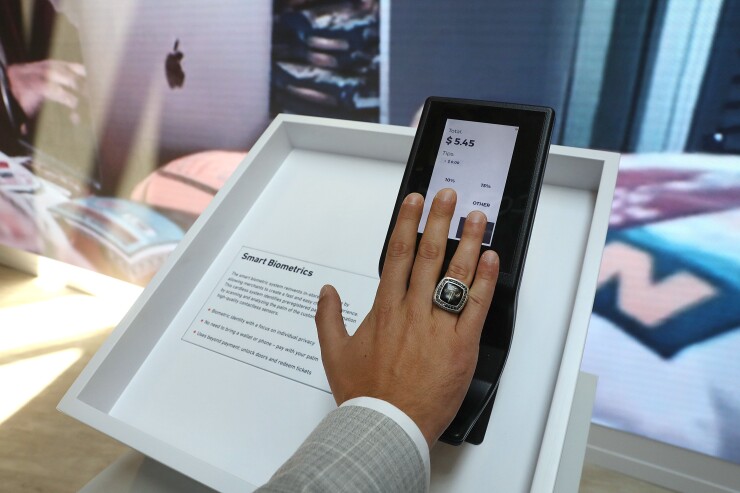

Handwave, a Latvia-based

The startup will use the funding to further develop the product, kick off pilot programs with and secure necessary regulatory licenses. The round was led by Practica Capital, a Baltic venture capital firm focusing on investments in the Baltic and Baltic-origin ventures in Europe.

Handwave links palm-based biometrics to a digital wallet that allows users to authorize payments and hold identity credentials and loyalty cards.

Payment companies have been increasing their investment in biometric payment hardware, recently.

Canadian debit network Interac names new tech head

Canada-based payments network Interac has named Anuj Dhall as group head, technology and operations, effective Aug. 5.

Dhall joins

In his new role, Dhall will be responsible for the modernization of the company's technology infrastructure, overseeing architecture, engineering and tech operations of Interac's core services such as debit, e-transfer and verification. He is also responsible for the company's partnership with Payments Canada as the fraud services provider and primary technical operator of its

Dhall "brings vast experience modernizing systems at scale and he joins us at a moment of great momentum as we build the future of payments and digital infrastructure in Canada," said Jeremy Wilmot, president and CEO of Interac, in a statement. –Joey Pizzolato

American Express taps Toast to boost restaurant products

American Express and restaurant payment firm

Amex/Toast developed products are scheduled to start deployment in early 2026.

"Restaurants today deliver exceptional experiences with leaner teams and tighter margins, making intelligent, connected tools more essential than ever," said Pablo Rivero, senior vice president of American Express global dining and CEO of Resy and Tock, in a release. –John Adams

JPMorgan names new global co-head of blockchain division

JPMorganChase has appointed a new global co-head of its blockchain division Kinexys.

Based in Edinburgh, Kara Kennedy will lead Kinexys alongside Naveen Mallela, according to a JPMorgan spokesperson.

Kennedy will oversee Kinexys Digital Assets, which focuses on asset tokenization, and Kinexys Labs, which helps clients prototype blockchain projects. Mallela, who is based in Singapore, will continue to run the payments divisions, including Kinexys Digital Payments and Kinexys Liink.

Kennedy previously served as the executive director and head of digital asset product for JPMorgan's security services business. Her appointment comes as blockchain initiatives among global banks and multinational companies gain momentum following the passage of landmark

JPMorgan is piloting

In June, the bank executed its first transaction, transferring JPMD from its digital wallet to U.S. crypto exchange Coinbase Global. The bank plans to run the pilot for several months before expanding to other users and currency denominations, pending regulatory approval, the spokesperson said.—Emily Mason, Bloomberg News