If you are among the fortunate few to have been away from screens last week, you missed some market fireworks. The prices of precious metals plunged and soared and plunged, and momentum stocks suffered their worst rout since the pandemic. But that drama and more was eclipsed by a spectacular crash in

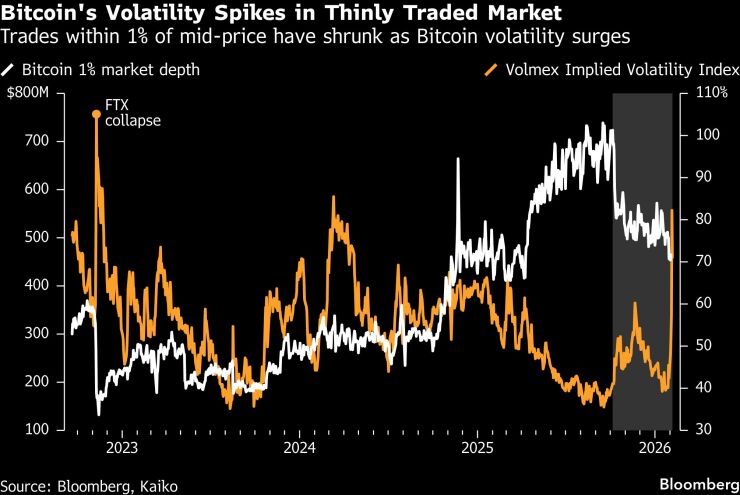

After an all-too-typical period of sideways movement, crypto prices started dropping toward the end of the previous week, continued falling into the weekend, and by last Thursday, the downward lurches had gathered enough momentum to push

We don't yet know what triggered the crash — some theories involve macro hedge funds in Asia

Rather than dive into what the market drop tells us about the evolving relationship between macro and crypto market narratives, I want to instead focus on what it reveals about stablecoins and their role as a settlement asset for the digital economy.

To set the stage: The vast majority of dollar stablecoins in circulation today are used for crypto asset trading — by

So, of course wild swings in crypto markets are going to impact demand for stablecoins.

What's more, while stablecoin plumbing is more efficient than most traditional rails, it is not completely without friction, which in turn can create price distortions.

Wait, you may ask, how can there be price distortions in an asset pegged to the dollar and backed 1:1 by dollar assets?

As with virtually all markets, it comes down to imbalances between supply and demand. I've

Occasionally, however, the oscillations break out of their usually narrow band. This tends to happen during periods of market stress as traders scramble to meet a margin call or to open a quick position.

For instance, on Wednesday of last week, the price of USDT — the ecosystem's most liquid stablecoin — momentarily fell below $0.97 on Kraken. This lasted probably all of one second, but illustrates building market stress. On Oct. 10, another dramatic day for crypto markets (when overall market cap also fell by over $800 billion between the day's high and low), USDT on Kraken briefly jumped to almost $1.03.

This is not an exchange-specific issue. Last Friday, USDT on Coinbase briefly dropped to $0.987; on Oct. 10, it blew past $1.07.

Nor are these incidents isolated to USDT. Circle's stablecoin USDC — the second largest in the ecosystem — traded as high as $1.014 on Kraken last Thursday.

There have been wilder moves: When algorithmic stablecoin issuer Terra collapsed in May 2022, USDT on Coinbase dropped to as low as $0.94. Amid market volatility in April 2021, USDC on Kraken touched $0.86.

Again, these distortions were blink-and-you-missed-it brief as bot-driven arbitrage swiftly sets things right. But they highlight that even stablecoins can be subject to market stress.

The support from the stablecoin provider follows a string of tech firm acquisitions as Anchorage Digital broadens its crypto services.

Does this matter for stablecoin payments?

Technically, no. But conceptually, here is where it gets interesting.

To start with, a stablecoin payment does not rely on exchange-traded values. Rather, it is a transfer of an agreed number of tokens from one party to another — given the solid backing of the tokens, there is no doubt that the tokens are worth the same number in dollars. If I send you 1,000 USDC, we can both confidently assume that amount is worth $1,000. In part, we can do this because we know the tokens can be redeemed at par. We also know that we will be able to sell them on an exchange, if necessary, for something close to $1 each — presumably we are not in a rush to fill margin calls or similar emergencies, so we won't be affected by brief distortions.

In sum, payments fulfil contracts based on agreed amounts, no market scrambling involved. Faith in the peg is what counts.

Essentially, it's the age-old tension between price and value.

For payments, occasional spikes in the exchange-traded value of a dollar stablecoin are not relevant. What

On secondary markets, however, what matters is the price, which is determined — as always — by supply and demand. Deviations in this are how market participants make their profit.

This unearths one of the most extraordinary features of stablecoins: They have both a market-established price, and an intrinsic value that forms the backbone of their utility as a payment token.

Usually, there is no daylight between the two. But occasionally there is. However, that doesn't need to affect either market liquidity or payment utility.

Going forward, this should assuage concerns around stablecoin de-pegs: They happen, but with faith in the backing, they correct swiftly. And they are unlikely to affect payments, where faith in the underlying value satisfies involved parties.

As an example, even in the

You'd be right in pointing out that the U.S. dollar also trades on sometimes volatile currency exchanges, yet no one questions its value when it comes to payments. But it's a base currency in which trade is denominated, not a pegged payment token that trades on active secondary markets.

Markets are about price. Payments are about value. Philosophically, we now have to grapple with the rapid growth in demand for a token that embodies both concepts.