- Key insights: The D.C. Court of Appeals declined the D.C. Attorney General's request to hear a mid-case appeal after the lower court dismissed a portion of the district's case against EarnIn.

- What's at stake: The decision marks a set-back for the Attorney General, who sought to classify EWA as a loan.

- Forward look: The appeals court did not rule on the merits of the trial court's ruling, and the AG's office could still make the claim that EarnIn's products are loans in any hypothetical appeal.

The D.C. Court of Appeals declined the D.C. Attorney General's request to hear a mid-case appeal after the lower court dismissed a portion of the state's case in a set-back in its fight to designate earned wage access as a loan.

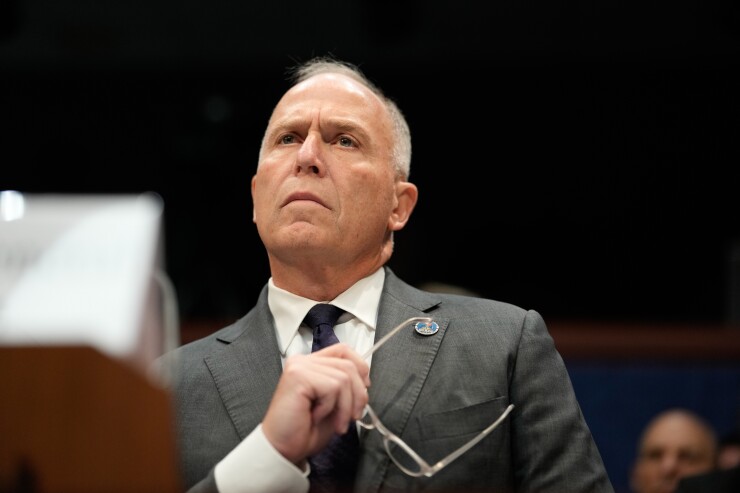

D.C. Attorney General Brian Schwalb first

The district's appellate court declined to hear the interlocutory appeal, which is a rare type of mid-case appeal that seeks a review of a specific ruling in a case before a final judgement In declining to hear the appeal, the court did not rule on the merits of the trial court's ruling or the facts of the case.

The D.C. Superior Court has allowed the AG's claims that EarnIn falsely advertises certain features of its products to move forward, and the case remains ongoing.

"What the DC Court of Appeals, relying on primary jurisdiction precedent, determined was that a DC agency charged with understanding financial products, charged with knowing what to do to protect consumers, is the best vehicle to set up rules of the road where we have these new fintech products," Karl Racine, co-head of the Hogan Lovells State AG practice, told American Banker. Hogan Lovells represents EarnIn.

"This decision encourages the legislative and regulatory process, which is better suited for this novel area, instead of rough litigation," Racine said.

Schwalb's office declined to comment.

The AG's office can still appeal the full Superior Court's ruling at the end of litigation, and could make the claim that EarnIn's products are loans in any hypothetical appeal. Courts in Pennsylvania, Maryland, and California have allowed similar claims against EarnIn to move forward.

Whether EWA should be considered a loan is central to the debate being hashed out across the country by consumer advocacy groups, lawmakers and industry groups.

Already this year, New York State has introduced a bill that would

The lower court's decision to defer to lawmakers is one that Racine hopes other courts will follow. New York State Attorney General Lettitia James has also

"What we would urge those states and other bodies to do is, where you have your legislators or regulators who are looking at the policy implications of these new products, allow them to legislate and regulate before filing suit," Racine said.

The D.C. Court of Appeals' decision to let stand the dismissal of the Attorney General's claim against EarnIn is an important development for earned wage access, Ian P. Moloney, chief policy officer at the American Fintech Council, told American Banker.

"The decision reinforces the position AFC has consistently advanced in courts, before regulators, and in Congress: earned wage access is not a loan, and efforts to regulate it through enforcement litigation or by forcing it into ill-fitting regulatory frameworks are misguided," Moloney said.

The D.C. Court of Appeal's decision also aligns with two other civil court cases that are playing out in the Ninth District Court of Appeals, Moloney said. Those cases,

"Federal courts should not disrupt the ongoing, nationwide EWA policymaking process by applying ill-fitting laws designed for credit to EWA products," according to a joint statement from the two industry groups.