- Key insights: The D.C. Court of Appeals upheld a May 2025 ruling that dismissed most of D.C. Attorney General's claims against EarnIn.

- What's at stake: The decision marks a major win for earned wage access providers, who have faced lawsuits brought by state attorneys general as other states enact more legislation favorable to the industry.

- Forward look: More states are expected to enact laws governing EWA this year. A federal bill has also been floated.

The D.C. Court of Appeals has decided to uphold the lower court's ruling that dismissed a lawsuit against earned wage access provider EarnIn in a major win for the industry.

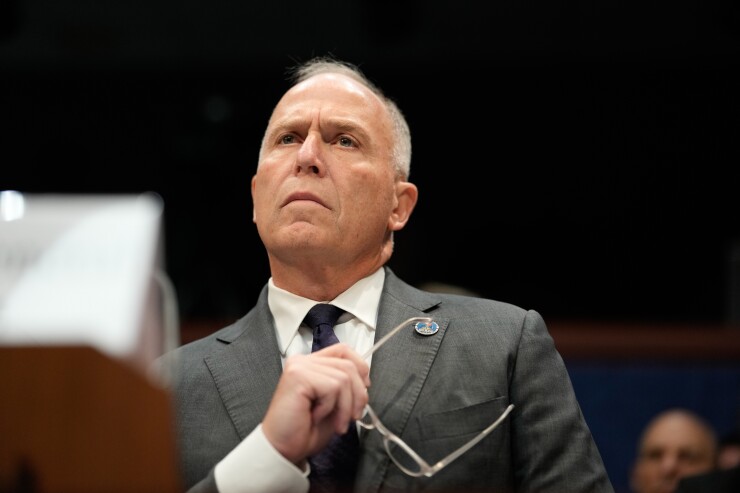

D.C. Attorney General Brian Schwalb first

"What the DC Court of Appeals, relying on primary jurisdiction precedent, determined was that a DC agency charged with understanding financial products, charged with knowing what to do to protect consumers, is the best vehicle to set up rules of the road where we have these new fintech products," Karl Racine, co-head of the Hogan Lovells State AG practice, told American Banker. Hogan Lovells represented EarnIn.

"This decision encourages the legislative and regulatory process, which is better suited for this novel area, instead of rough litigation," Racine said.

Schwalb's office didn't respond to a request for comment by publication time.

Whether EWA should be considered a loan is central to the debate being hashed out across the country by consumer advocacy groups, lawmakers and industry groups.

Already this year, New York State has introduced a bill that would

AG Schwalb's lawsuit against EarnIn came as the district's financial regulator, Department of Investment and Securities Bureau, was in the process of reviewing EWA to decide whether they should be considered a loan.

The appellate court's decision is one of the first to end pending litigation against an EWA provider, and sets a key precedent that Racine hopes other courts will follow. New York State Attorney General Lettitia James has also

"What we would urge those states and other bodies to do is, where you have your legislators or regulators who are looking at the policy implications of these new products, allow them to legislate and regulate before filing suit," Racine said.

The decision also reinforces what industry groups have been lobbying for over the last couple of years: namely that earned wage access is not a loan, Ian P. Moloney, chief policy officer at the American Fintech Council, told American Banker.

"Efforts to regulate it through enforcement litigation or by forcing it into ill-fitting regulatory frameworks are misguided," Moloney said.

The D.C. Court of Appeal's decision also aligns with two other civil court cases that are playing out in the Ninth District Court of Appeals, Moloney said. Those cases,

"Federal courts should not disrupt the ongoing, nationwide EWA policymaking process by applying ill-fitting laws designed for credit to EWA products," according to a joint statement from the two industry groups.