Digital remittance provider WorldRemit has agreed to acquire Sendwave, a mobile app-based remittance company focused on servicing the African money transfer corridors.

The purchase of Sendwave will be a cash and stock transaction and is expected to close in the fourth quarter of 2020, subject to pending regulatory approvals. While the company did not disclose the purchase price,

“Both WorldRemit and Sendwave share a common purpose: allowing customers to easily and cost effectively send financial support to families, friends and businesses in other countries,” said Breon Corcoran, CEO of WorldRemit, in a press release. “WorldRemit has one of the broadest and most accessible networks for money transfers globally. Combining it with Sendwave, which offers instant, no/low-fee and fully digital payments from North America and Europe to Ghana, Nigeria, Senegal and East Africa, addresses customer needs for fast and secure digital payments — especially given today’s travel restrictions and economic turmoil.”

In the 12 months ending June 30, 2020, WorldRemit and Sendwave sent a combined $7.5 billion in money transfers generating approximately $280 million in revenue, representing a 50% year-over-year growth in combined revenues. The combined entity will have over 100 send money transfer send licenses, including one for every U.S. state that requires one. The Sendwave acquisition will bolster WorldRemit’s network to total more than 50 countries as send markets and over 150 receive markets.

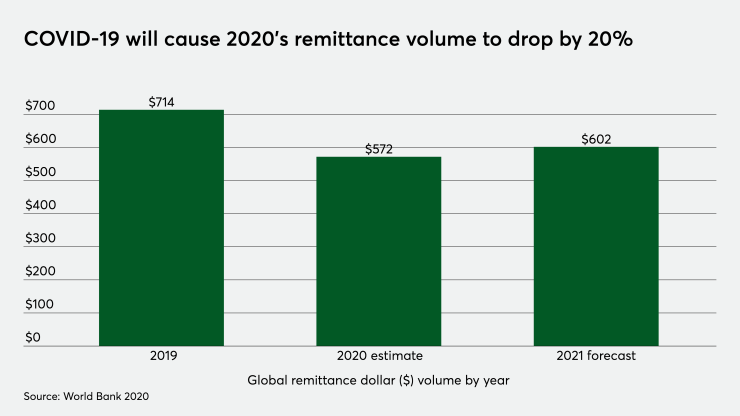

WorldRemit estimated that the addressable market for the combined entity is approximately $175 billion, and is growing at a 10% annual growth rate. On a global level, the

Last year

At a time when the COVID-19 pandemic is sending shockwaves across the global economy, one trend in the remittance market is quickly gaining traction —

As such, investors are finding digital remittance fintechs particularly desirable as investments. Digital remittance company