Consumers happily use technology to buy and pay for everything from shoes and electronics to coffee and groceries. Businesses, however, have been slower to follow.

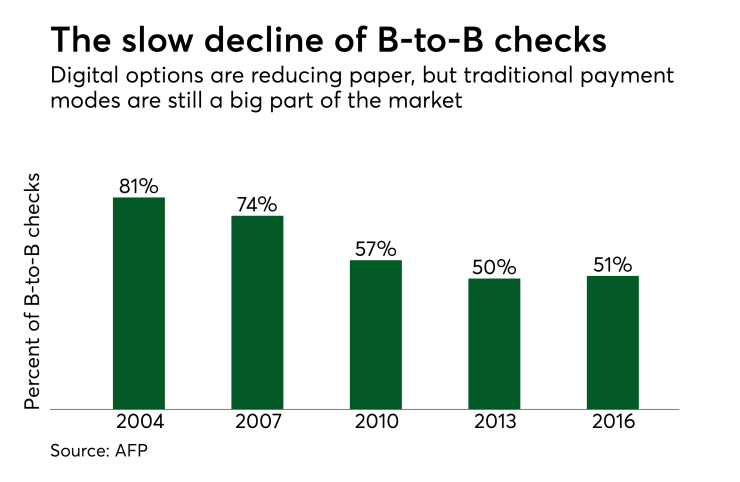

A surprising 51% of B-to-B payments are still made by paper checks, and more than 60% of payments require manual intervention, according to the 2016 AFP Electronic Payment Survey.

That means many organizations have multiple departments and employees to send, receive, organize and store checks, invoices and other paper documents. In total, organizations spend $180 billion annually on paper-based B-to-B transactions, according to PayStream. They also have higher exposure to fraud.

New technologies, including big data and cloud-based platforms, can give suppliers and buyers more insight and disrupt paper-based payments.

Seventy percent of AFP survey respondents reported that their organizations are likely to shift most payments to electronic in the next three years. Already, businesses are using fewer checks as they take advantage of electronic channels to save money and time while improving the quality and accuracy of their information.

Companies can tap into a number of technologies, including:

Cloud computing can host their accounting systems, both decreasing costs from on-site accounting system management and facilitating the integration of digital payment capabilities.

Application programming interfaces (APIs) move them away from custom file integrations to open standards, allowing them to build once and deploy many.

Electronic invoices and enhanced digital workflow capabilities allow them to track, audit and manage payables and receivables effectively and easily.

These advancements are changing the B-to-B landscape and creating opportunities for companies to reap benefits of a more efficient payments platform, including:

Internal efficiencies: Digital payments and invoices can help treasurers post payments automatically. No more taking checks to the bank.

Improved accuracy: An integrated digital payments system automatically receives and files payment, buyer and supplier information. No more errors from manual entries.

Faster settlement: Instant data transfers to the business’s bank allows the treasury team to settle payments quicker.

Reduced fraud risk: Companies can easily monitor and reconcile digital payments to ensure they check supplier invoices before paying them.

Better cash flow visibility: Using a digital platform to manage electronic invoices can provide greater visibility into the status of customer payments and the organization’s overall cash flow.

Improved working capital: A platform gives the treasury team more data on the company’s consolidated balance position, currency exposure, straight-through processing (STP) rate of payment execution and the amount of intraday credit in use.

Enhanced customer experience: Digital payments provide easier access and control to customers.

Lower banking fees: Digital payments may reduce the monthly and transaction fees of issuing paper checks.

Greater access to financing: Showing potential lenders payment data in an electronic platform might help secure working capital financing more easily.

It’s easy to extol all the benefits of electronic B-to-B payments, but then comes implementation. Some organizations have tried standard packages while others have developed their own solutions.

As technology continues to disrupt the payments space, businesses now have the option to use simple and efficient B-to-B payments platforms that will help them streamline and automate what once was a complicated, manual and expensive process.