Cashless experiments by retailers and restaurants have begun to dot the map in the United States. To be clear, these are outlier activities, far from the norm in the American marketplace. And yet, for aberrational activities, these cashless experiments are promoted in curiously uniform messaging.

"They're more convenient, friction-free, safer and result in a deeper customer relationship." While many of those claims are debatable based on the results of the

"Our customers asked for cashless. Today’s consumer wants fewer choices. Privacy and the security of personally identifiable information are best served by a cashless point-of-sale." There’s a reason such talking points are left unsaid: the notion that consumers want to be limited to cashless payments, or that they’re unconcerned with security and privacy when purchasing, is not consistent with consumer behavior.

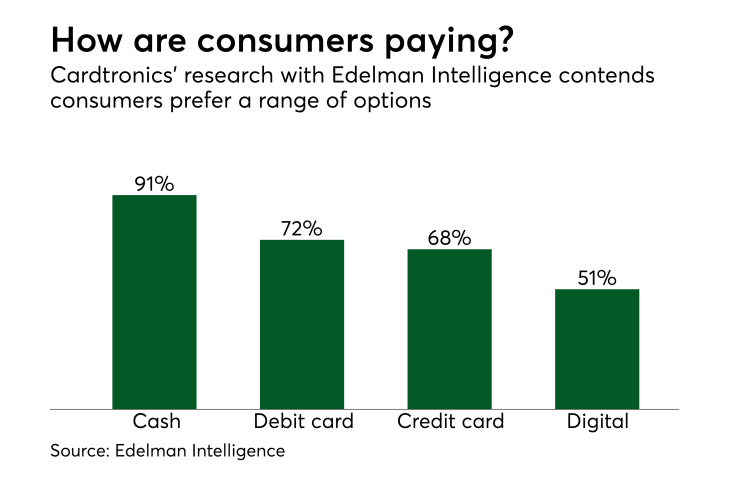

While many consumers are indeed adding smartphone-driven digital pay and mobile order and pay options into their payments toolbox, cash continues to resonate with American consumers, who show little interest in being "all in" with cashless, or having their choices limited in any way.

Contradicting an assumption that cash is fading away in the digital age, the Health of Cash Study reveals that not only do consumers continue to use cash, but in fact cash remains the most commonly used payment method by a comfortable margin, used by nine out of 10 consumers in the past six months, and by 80 percent on a monthly basis.

While the Heath of Cash Study offers in-depth analysis of the resiliency of cash in 2017, consumer feedback on payment method choice, security and privacy should strike a dissonant chord for any retailer considering making their customers the test subjects in a cashless experiment.

Choice. The idea that consumers want to be limited to cashless payments is not consistent with consumer behavior. Consider: 89% of people like having the ability to use a variety of payment methods; 90% of consumers use at least two payment methods a month; and 82 percent of people would miss cash if it went away altogether.

What’s more, and regardless of their personal payment preference, 61% of consumers admit they get upset when establishments don’t accept cash – and among millennials there’s an uptick to 68%.

Security. In the eyes of consumers when selecting a payment method, convenience is highly valued, and an attribute fairly common to cash, cards and digital/mobile. After convenience, people continue to be highly concerned about payment safety, with 84% describing themselves as worried about data security. And when the choice of ‘how to pay’ hinges on safety and privacy, cash clearly separates from the payments pack, most notably on privacy (e.g. doesn’t track purchase behavior) – a benefit that cashless cannot deliver. Cash is identified as the safest (48% of survey respondents) and most private (60 percent) way to pay.

What the Health of Cash Study makes clear is that a cashless mandate is neither the want nor the will of the vast majority of Americans, who want the choice of having multiple ways to pay, including cash, and they want to personally decide what is best for them.

Mobile and kiosk ordering offers intriguing opportunity for retailers and restaurants. But having the freedom to pay with cash is not a freedom that should go away simply because technology has advanced. Let the people choose. It’s that simple.