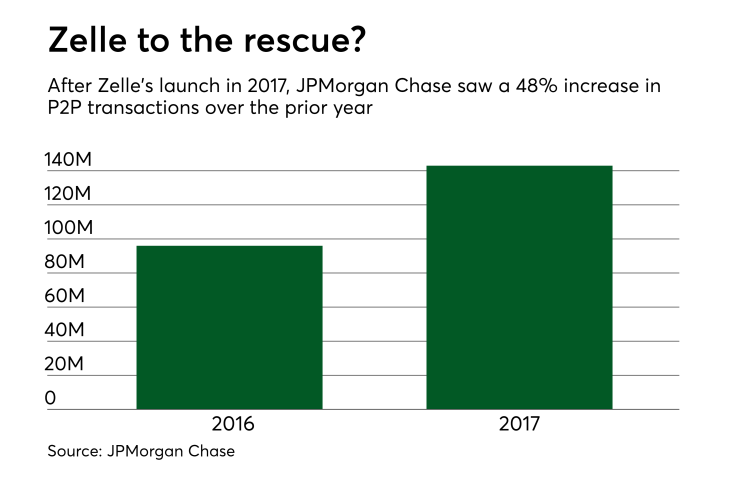

Zelle presents the most recent opportunity for banks and credit unions to offer an innovative new digital service, person-to-person payments.

Zelle holds risk, but fraud should be low and manageable. The benefits and coolness of real-time will be a real thing.

Consumers, as long as they are diligent, will be well protected. Whether it is Zelle or Venmo or traditional bank-centric P2P, the feature is useful and the bankers need to understand the risks, overcome their fears and get Zelle P2P implemented ASAP. Time is ticking on the window of opportunity to be early to market with a compelling P2P strategy.

Zelle does comes with some risk. The money is moved in real time. For any banker out there who understands payments and repudiation rules, that is one very scary thing. Wires are real time. Zelle and a few other P2P solutions offer the ability to transfer money in real time. Zelle uses ACH to actually move the money, but regardless, the money is credited in real time.

The fintech industry often looks at a new feature, failing to capture the end-user perspective. The consumer. Given the fact that the risk is actually shifted to the end user or consumer, this perspective can be enlightening. So how does the consumer look at Zelle and the associated risk?

Where does the risk sit with Zelle? When you transfer money in real time, does it actually leave the account and get credited in real time? Does it matter that ACH and EFT networks are used? Do those rules apply? Lastly, isn’t the consumer really the one who holds the risk? One way or another, in the end consumers will pay for the fraud, if and when it rears its head.

Risk abounds with a transfer that happens in real time. The good news is that the risk is being managed properly; Zelle can be implemented safely. There are lots of layers technology risk-mitigation features, and network-level mitigation is provided as well. It is also worth noting that P2P solutions in the market today, those that do not have real-time capability, do not experience large amounts of fraud. There is a lot of technology to deploy, such as out-of-band authentication and behavioral monitoring; the risk is very manageable when technology is deployed.