Numerous predictive and hyper-personalized experiences have led to a significant shift in consumer expectations.

Fitbit tells us how many stairs we must climb to lose 10 pounds by the holidays. Kayak clairvoyantly advises us when to buy that pricey plane ticket to get the best deal. The artificial intelligence-enabled Nest thermostat automatically adjusts our home’s temperature to make sure every family member is comfortable.

Provided largely by young, digital firms, these everyday insights help us improve our lives in hundreds of tiny, yet hugely appreciated, ways. And the fact is, experiences like those delivered by Fitbit, Kayak, Nest and others are changing the way bank customers and credit union members expect to interact with their financial institutions.

Actually, they are reframing the way consumers expect to be treated by all of the organizations invited into their circles. Openly sharing our valuable (and vulnerable) personal information with these firms adds to the expectation they will use that data to enhance our lives.

Legacy financial institutions are beginning to feel the competitive pressures of this ramped-up expectation for predictive, hyper-personalized interactions. When surveyed recently by CO-OP Financial Services, nearly half of credit union executives said they believed they are in an inferior position to the digital brands consumers love. This includes emerging financial brands like SoFi, Lending Tree and Rocket Mortgage.

Flipping that inferior position on its head is a key motivator behind the digital transformation trend. Traditional firms across industries are committing to an intentional evolution of their processes, skills and even business models to better leverage digital technologies for enhanced end-user experiences. Smartly leveraging data for actionable insights is a huge part of this evolution. It’s why we say digital and data are two sides of the same coin.

Armed with consumer intelligence, financial institutions will better understand the needs and preferences of their customers. They will also have the insights to surprise and delight them with innovations they didn’t even know they needed.

To create exceptional banking experiences, financial institutions have to get out ahead of the banking consumer. Predictive and prescriptive analytics applied to the data from digital banking solutions makes this possible.

Take payments, for example. This is an area with lots of opportunities to become more personalized and more predictive. To transform annoying daily transactions full of friction into something easy, perhaps even enjoyable, banks and credit unions have to know what’s around the corner for their customer or member. They have to know the bills to be paid, the purchases to be made and the money to be moved. Predictive and prescriptive models applied to user (and nonuser) data deliver those insights — and much more. With these insights, a legacy financial institution can think more like a fintech startup. Rather than focusing on the functionality of moving money from point A to point B, they seek to fulfill the emotional and/or psychological needs of the people using their products.

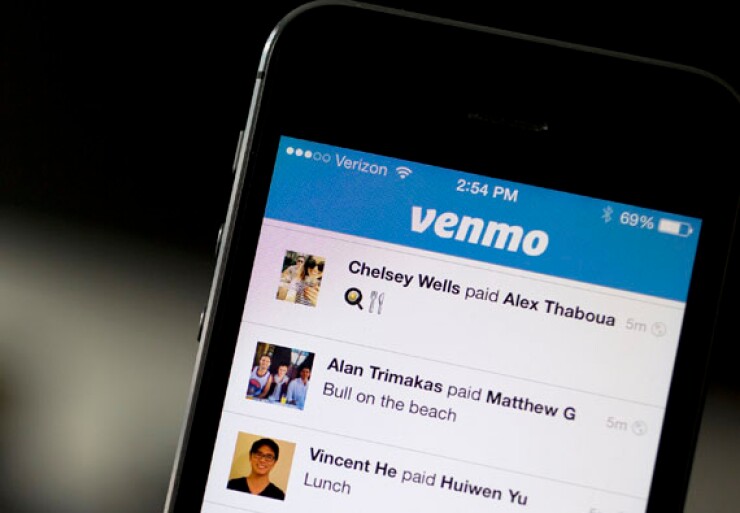

This is how digital payment brands like Venmo are achieving scale so quickly. They have recognized no one wakes up thinking, “I need to make a transaction today.” What they are really thinking is, “I need to pay for those concert tickets or my friends will think I’m a deadbeat.”

Providing predictive, hyper-personalized offers is possible with AI-powered financial technologies. Although technology that can learn on its own has been around for decades, it’s now more readily available — and more affordable. We’re seeing it everywhere, from voice assistants to fitness trackers.

Much of the AI use cases we are seeing in the financial space center around making interaction with financial institutions more seamless and more natural. That’s why we have seen something of a groundswell in chatbots powered by AI. These experiences are expected to grow exponentially over the next few years. In fact, Gartner predicts that by 2020, the average person will have more conversations with bots than with their spouse.

Predictive and prescriptive analytics and AI are fascinating, game-changing technologies. But they won’t amount to a hill of beans if they aren’t used to solve a real problem. Part of achieving digital transformation is knowing the pains and joys of the end-user and deploying the right technologies in a way that is customized to the optimal user experience.

Legacy financial institutions should aim to use both sides of the digital transformation coin to learn how customers and members are going about their financial tasks in clunky or encumbered ways.

Consider a credit union member with a newly empty nest. She wants to send money to her son on a regular basis. Perhaps she’s calling the branch to request a similar funds transfer each week. Data analytics can not only identify that behavior, it can predict how that behavior will either continue or evolve in the future. The credit union can use that information to make her life easier.

Perhaps they can introduce the member to a P-to-P solution that would help her get those funds to her son in real time. Maybe that, in turn, introduces her son to the credit union. In this imagined scenario, the insights derived from the data not only helped the member automate a task, it gave the cooperative a direct line to a potential new member.

Consumers are being conditioned to expect you, whether you are a retailer, financial institution, a car dealer or doctor — to know exactly how they feel at any given moment and to respond. Very soon, if they don’t already, these same consumers will expect you to predict how they will feel tomorrow and put a stop to any bad experiences waiting around the corner. Transforming to meet these expectations is critical to securing your relationships with the people who are, as we speak, exploring predictive, hyper-personalized ways to improve their lives.