Though widespread use is about 12 to 18 months out, smart contracts are a perfect use case for blockchain for payments.

Smart contracts are pieces of code that sit on the blockchain. Programmed into the smart contract is an agreement between two parties or multiple parties.

The contract is created at the time you agree on terms, such as deliverables, their quantity, frequency of shipment and payment terms. Once the contract is in place, all those details live on the blockchain. Smart contracts replace the purchase order, the invoice and automate payments.

For supply chains, a smart contract can simplify transactions. Once a smart contract is executed, payments are automatically deducted from a manufacturer's digital wallet and funds are moved into the supplier's digital wallet, so payment happens seamlessly. Smart contracts are coming because they have many tangible benefits. They reduce commerce friction, accelerate payments and make business more efficient.

Smart contracts work in many different cases—simple and complex, large and small. Some countries are now replacing title insurance with smart contracts, because land deeds are one of the most old-fashioned contracts around and they’re basically pieces of paper sitting in some clerk’s office.

The nation of Georgia recently decided to modernize its titles and deeds and turn all of them into smart contracts stored on a blockchain. Each smart contract tracks the sale along with the seller and owner. This means there’s no longer a need for title insurance. The blockchain record proves ownership, plus it’s permanent and transparent to all parties. Title insurance companies are no doubt scrambling but the new system is a boon for consumers in Georgia. I wouldn’t be surprised if this type of modernization soon makes its way from Tbilisi to Atlanta and the rest of the world.

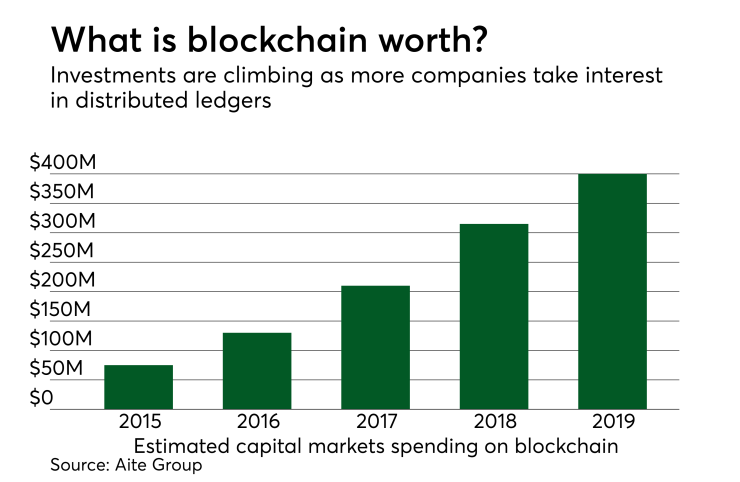

Beyond the hype, there are real benefits that come with blockchain. And that’s why it will continue to grow. The dotcom bubble wiped out lots of napkin-based valuations and lots of companies went away but the internet thrived. The same will happen with blockchain in the world of finance. After the hype fades around crypto currencies like bitcoin and ethereum and that bubble bursts, blockchain and distributed ledger will persist as the underlying technology that will enable the next wave of digital payments.