For some years now, we have discussed the transformational potential of digitization, whether in the way we live, work or interact.

The rise of digital payments is an important example of this. New national instant payment schemes and the growth of mobile wallets are both driving, and driven by, the explosion of digital business models and e-commerce.

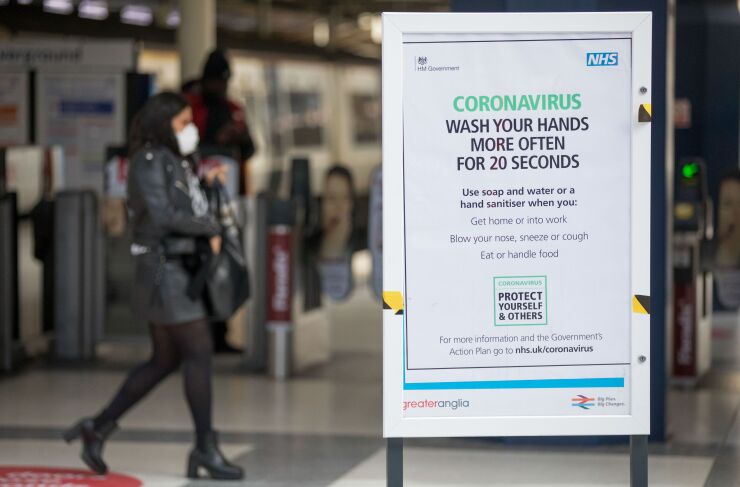

The pandemic has further accelerated payments digitization, but also created new use cases. Governments quickly switched from cash and checks to digital payments to support vulnerable individuals and businesses. Consumer spending moved online as lockdowns took hold. Businesses rapidly moved from manual processes and payments to ensure continuity of the business in a home working environment.

These experiences create valuable lessons as companies look ahead, and in particular, how they define and execute their growth strategies in a new world.

The pandemic has created a rapid reassessment of corporate priorities, with long-term resilience, stability and flexibility superseding short-term growth ambitions. International expansion is a key element of building a company’s immune system to future crises by diversifying risk, and creating new sourcing and sales markets. According to a recent study by Standard Chartered, 55% of internationally active companies with a turnover above $500 million saw Asia Pacific as a priority growth market, and 32% sought expansion opportunities in the Middle East. Seventeen percent expected Africa to be in their top three growth destinations, a figure that is likely to increase as companies recognize the evolving opportunities.

To achieve these diversification, risk and growth objectives through international growth, however, senior executives need to understand, and have the tools to address, the constraints and opportunities in each market. Today, lack of understanding of the regulatory environment is the biggest obstacle to international growth, highlighted by 35% of U.S. CFOs and treasurers who participated in the study cited earlier. At the same time, however, only 12% of U.S. respondents indicated that understanding regional payment methods and infrastructure was one of their top three international growth challenges. In reality, understanding how to pay, and get paid, is a key element to operating successfully in a new market. This involves a keen understanding of the regulatory environment, as well as what will delight customers and suppliers.

Many companies have implemented sophisticated payment and collection systems supported with web-based, host-to-host, or in some emerging cases, application programming interface (API)-based bank connectivity.

As a result, it is perhaps unsurprising that managing payments in new markets is not considered a significant challenge. However, understanding and embracing the payments landscape in each new growth destination requires not just technology, but also a deep understanding and appreciation of payments regulation, trends and consumer behavior.

Furthermore, while companies may already have technology in place that supports efficient payments and collections in their home region, treasurers and finance managers need to reflect the diverse and evolving payment and collection demands of customers and suppliers in each market, without compromising the efficiency, security and transparency of their internal operations.