Visa Makes Peace with PayPal

Mastercard Bets Big on Vocalink

Visa Reunites with Visa Europe

Mastercard's Master Plan for Asia

Visa's Olympic Event

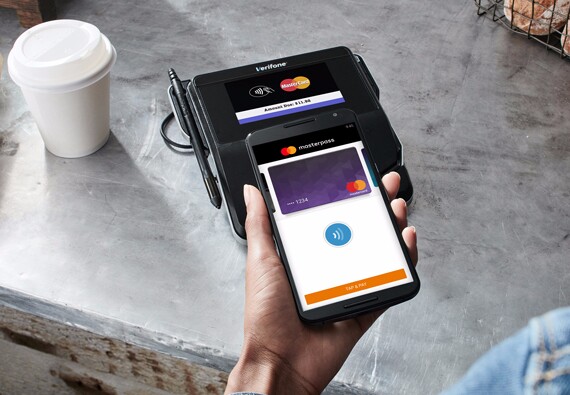

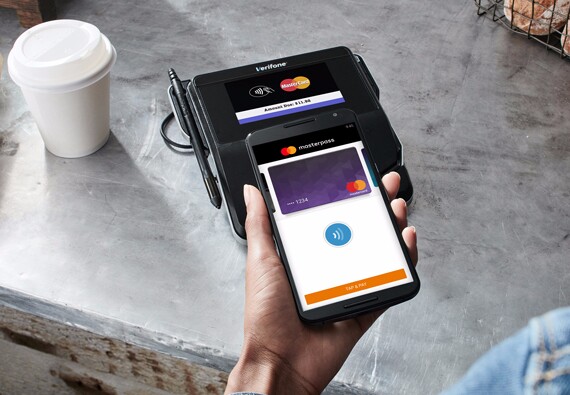

Masterpass Makeover

Redefining EMV

The Department of Justice told a court that the bureau cannot legally request funding from the Federal Reserve System, arguing that the Fed has not turned a profit since 2022 and thus cannot fund the CFPB.

Tougher contracts and more transparency are two of the improvements that have come about since the banking-as-a-service middleware provider's bankruptcy, practitioners say.

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

The Boston-based custody bank has acquired PriceStats, a private economic researcher. The move comes at a time when federal data agencies are weathering budget cuts, political attacks and a government shutdown.

Barwick Banking Co. will have the wherewithal to accelerate its expansion in Georgia and Florida after a $50 million investment from a new venture capital platform.

The fintech SpringFour has partnered with financial institutions to connect individuals to community resources in a record-long U.S. government shutdown.