Some key questions were raised —

- What happens to top of wallet models in an "on file" world?

- Do traditional payment players effectively become a "dumb pipe" for third party technology providers?

- Will the dynamics of consumer trust in on file payments diminish or grow in a post-Equifax world?

Numerous data sources provide insight on the growth of this new paradigm in payments and some indication of how consumers can be motivated to prefer a specific payment instrument over others.

Considering that this shift in sentiment took place during the U.S. EMV migration — when companies such as Netflix complained of the "

In a Q1 2017 study conducted by 451 Research with Discover, the companies surveyed 500 payments decision-makers at e-commerce merchants headquartered in the U.S. to learn that 57% of merchants already have card on file payments set up on their sites, with 29% planning to add this functionality within the next 12 months and a further 9% planning to add card on file payments within 24 months.

With near ubiquitous merchant integration within the next couple of years and increasing consumer comfort with setting and forgetting their digital payment preferences, “on file” transactions are clearly set for continued growth.

According to research from Deloitte, 41% of “on file” transactions are made directly from consumer bank accounts. This is understandable given that this category also encompasses household bill payments such as mortgages, utility bills and automotive loans. Smaller ticket transactions such as digital content and ride sharing services tend to be more typically connected to credit or debit cards, which collectively make up 52% of “on file” transactions.

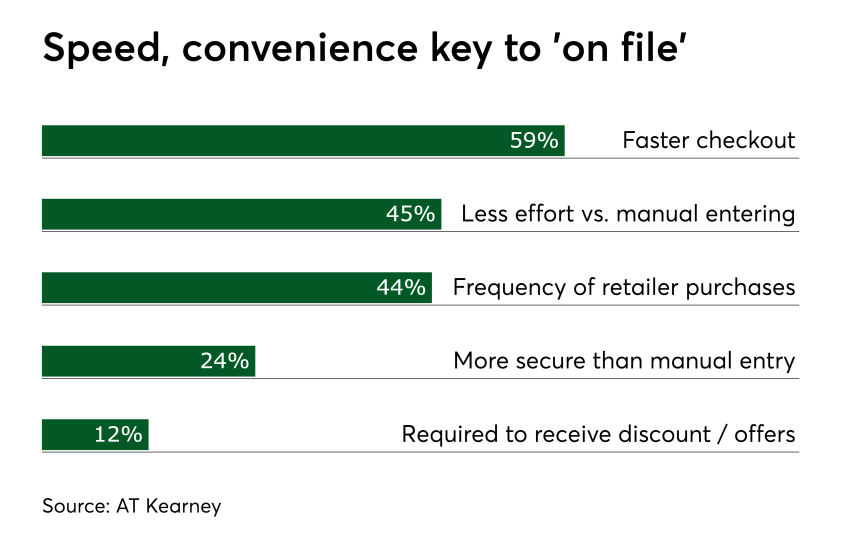

Fifty-nine percent of consumers in the recent AT Kearney study stated that faster checkout times were among the main reasons for setting up “on file” payments. Connected to this, 45% stated that reduced effort compared to manual entering was a motivating factor for setting up “on file” payments, and 44% stated that the frequency of transactions with a specific merchant was a motivator.

A quarter of consumers were motivated by the security of having credentials stored with a merchant or third party rather than manual entry each time. And in a post-Equifax environment, this may be a specific area of growth for “on file” payments, particularly when stored with trusted third party digital wallets such as Visa Checkout and Masterpass.

Finally, 12% of consumers were motivated to set up "on file" transactions because this was a requirement to receive discounts or offers with a specific merchant.

It would seem that in the new "top of wallet" environment of digital payments, rewards will be key to sculpting consumer transaction behavior and shifts in default payments.

In the recent Deloitte survey, nearly a quarter of participants who had removed “on file” capabilities from third parties and retailers did so due to their distrust of the merchant or platform that was storing their payment information.

The fear of data theft is shown to be more of a barrier than the amount of actual fraud occurring — just 15% of consumers removed their cards because they had experienced fraud paying with the card, compared to 23% who removed the card due to a sense of distrust.

The impact of the Equifax data breach could be catalytic in driving consumers to adopt digital wallets where their credentials are never exposed with a specific merchant. However, given that the Equifax data breach was not at a merchant level, it remains to be seen whether consumers decide to change already well entrenched digital payment behaviors.