The case for real-time payments isn’t just about instant gratification, however. Truncating settlement times has enormous benefits to FIs, businesses and even governments. A 2008 analysis by Australia's Center for Economics and Business Research (CEBR) found that real-time payments in regions without a central payments infrastructure and where funds are available the following day could improve GDP by as much as 1%.

However, real-time payments technology also has the potential to cannibalize existing revenue streams such as wire transfer, and some FIs are loath to disrupt the status quo.

As an example of how consumer attitudes are shifting, a 2015 Mercator Advisory Group survey found that more than 60% of digital banking customers wanted bill payments to be instant, or within the hour, with the majority choosing instant.

With a highly competitive landscape for real-time payments developing outside the bank ecosystem from third parties such as Square, Venmo, Ripple and Circle, banks need to recognize and embrace this trend or risk being left behind. Real-time payments will increasingly be table stakes.

However, this market isn’t a top priority — the biggest priority among U.S. institutions is mobile banking (58%), followed by cybersecurity (56%) and online banking (53%), according to the survey. Further, U.S. FIs have lower priorities for investment in real-time payments compared to the rest of the world — the U.S lags behind other nations by nine percentage points. However, this attitude isn’t unique to real-time payments: The U.S. lags the rest of the world across all of the prioritization categories in the survey.

At the low end of the scale, the average real-time transaction value for Sweden is equivalent to $65. At the high end of the scale, Brazilian real-time payments average $3,841.

What is interesting here is that the transactions don’t represent the relative income levels per country — one would expect that Scandinavian transactions would be of a higher value than Latin American transactions but this isn’t the case. What it highlights is that as real-time payments gain familiarity and trust, the use cases broaden. This may cause indigestion for some FIs that see real-time payments as stepping on the toes of cash-cow revenue streams from wire transfer and ACH.

Faster payments enable a wide range of enhanced services for businesses and their staff including weekly or daily wage processing and urgent payment dispersal for dynamic inventory requirements. The main benefit, however, is likely to be from decreased cash and check handling.

In a 2016 study by the Association of Financial Professionals (AFP), 62% of finance professionals expected the impact of faster payments to be positive or extremely positive, with just 4% predicting that faster payments would have a negative impact. However, a sizeable third of financial professionals said that faster payments would have no impact.

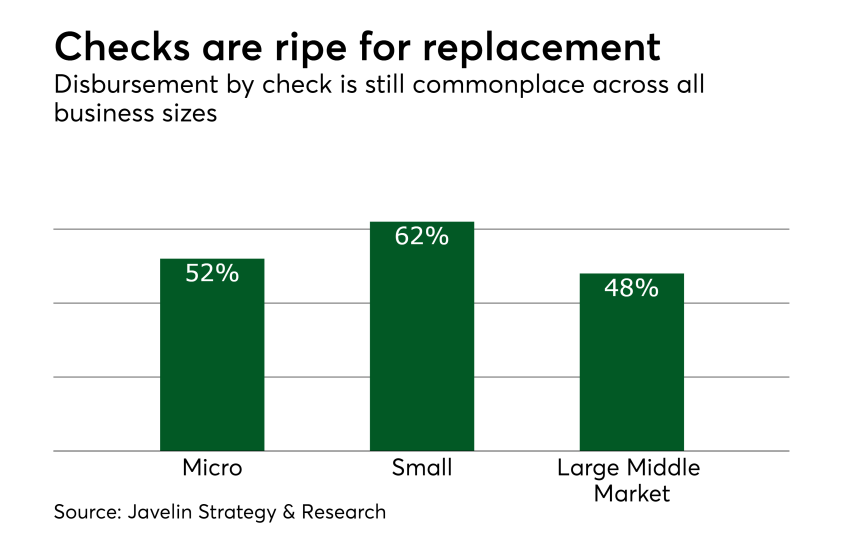

Even with recent innovations such as remote deposit capture for checks, the process remains cumbersome. Replacement of B-to-B disbursement checks presents a massive opportunity for U.S. businesses to reclaim payment velocity and to reach parity with a growing number of countries that have long ago made the transition to real-time payments.