Banks are curious, but most remain cautious about blockchain technology. But this year could be a pivot point for blockchain to move past proofs of concept to adoption, propelled by strong investor interest.

In an era of growing consumer distrust about data security, blockchain could even become the "cornerstone of trust," according to Eric Jing, CEO of Chinese fintech giant Ant Financial Services Group, which operates Alipay.

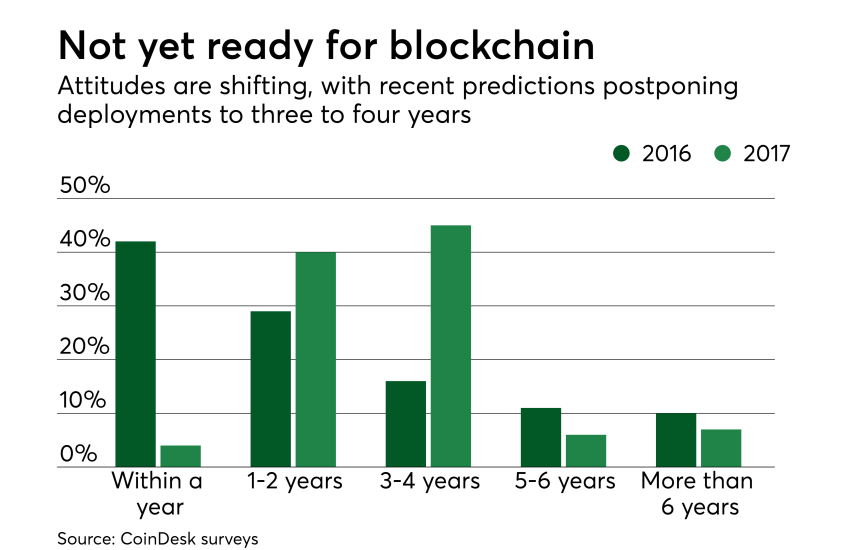

But many still see the tech as being three to four years away from going mainstream.

Charting investments and tracking loyalty and rewards are top blockchain use cases. One example is the DigitalBits Network, an open-source decentralized blockchain tokenizing loyalty points so consumers can receive them in the form of digital tokens. Those tokens would be transferable for digital assets and other goods for a network that claims to take out the middleman in the process and complete token transfers in seconds.

In a similar process, creators of Blocksquare seek to make real estate investments available to those who may not be institutional investors and would prefer to make investments through a blockchain-powered market that allows contributions to multiple properties through an internet connection.

Meanwhile, ShiftPixy Inc. is leveraging blockchain as a digital ledger for transactions that include crucial and sensitive personal information during a hiring or onboarding process. The company insists that blockchain utilizing biometrics could play a major role in the employee verification process, and goes as far as calling blockchain the most efficient tool available to protect data from cyber interference.

Basically, supporters of blockchain say the first factor pointing toward potential disruption would be any industry that relies on small vendors. Moving companies, wedding planners, dental and other health care providers all fall into this category because they are not controlled by a dominant player within their industries.

Small companies may be more inclined to accept a change in how transactions and accompanying data is recorded and stored, while also finding it easier to connect or convert from an existing system.

On a larger scale, farming and agricultural businesses are finding blockchain facilitates stock control and distribution, ownership proof and domestic transactions.

There is some action, though. American Express last month filed a patent for a new payment process involving blockchain, aiming to facilitate payments between two parties by using transaction requests as a proxy. To access the system, the patent states, parties conducting a transaction would create a digital wallet on the blockchain.

"A payment network based on peer-to-peer payments may be used to facilitate most functions of traditional card payment networks and to enable additional services and functionality," the patent said.

In short, Amex appears to be eyeing a real-time payment scheme for purchases that wouldn't be card-based nor would they use the current payment rails.

Modex touts the app store as a "smart contract marketplace" operating as a central hub for third-party applications and web platforms to plug into and deploy smart contracts with the goal of speeding up blockchain technology adoption by engaging technology developers to leverage Modex to monetize their skills and offer smart contracts and easier access to crypto currencies.

The advantages of such an approach could including driving consumer adoption, enterprise cost savings, access to developer tools, community trust, internet protocol protection and revenue opportunities for developers.

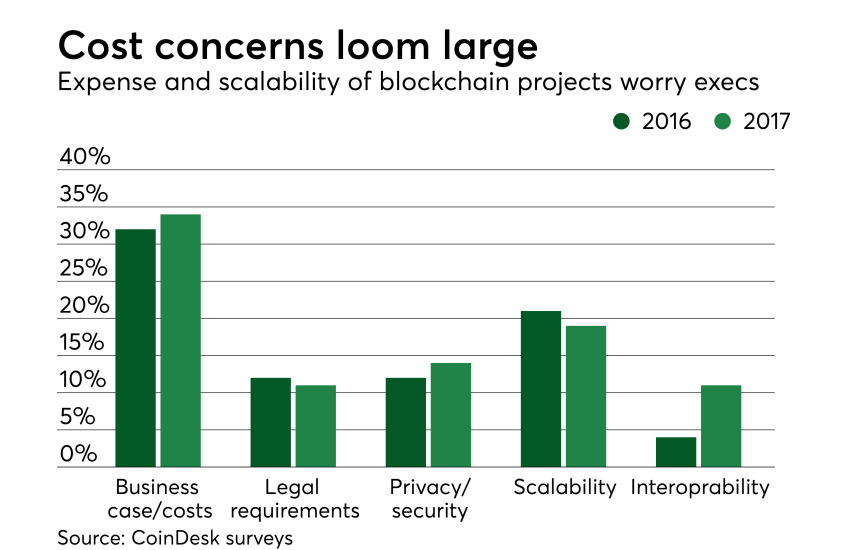

If 2018 indeed becomes a pivotal year for blockchain adoption, it will mean more executives across various industries must gain a fuller understanding of the differences between distributed ledger technology and existing architecture — internal transaction systems, middleware/messaging and clearing houses.

Existing middleware/messaging architecture represents a secure, inter-party and independent settlement process enabled through messaging, but it generally takes three to five days and typically requires an external provider. One example is messaging provider Swift, which has spent the past year on getting closer to real-time transactions.

Clearing houses currently in use represent a third-party service that has recently improved transaction speed, but some view them as fairly complex and expensive networks.

For its part, blockchain showcases distributed ledger technology with cryptographic integrity at near real-time speed.