-

A proposal to revise how the agency calculates the restrictions for less than well-capitalized banks relies on faulty methodology and ignores competition from fintechs and credit unions, according to the industry.

November 7 -

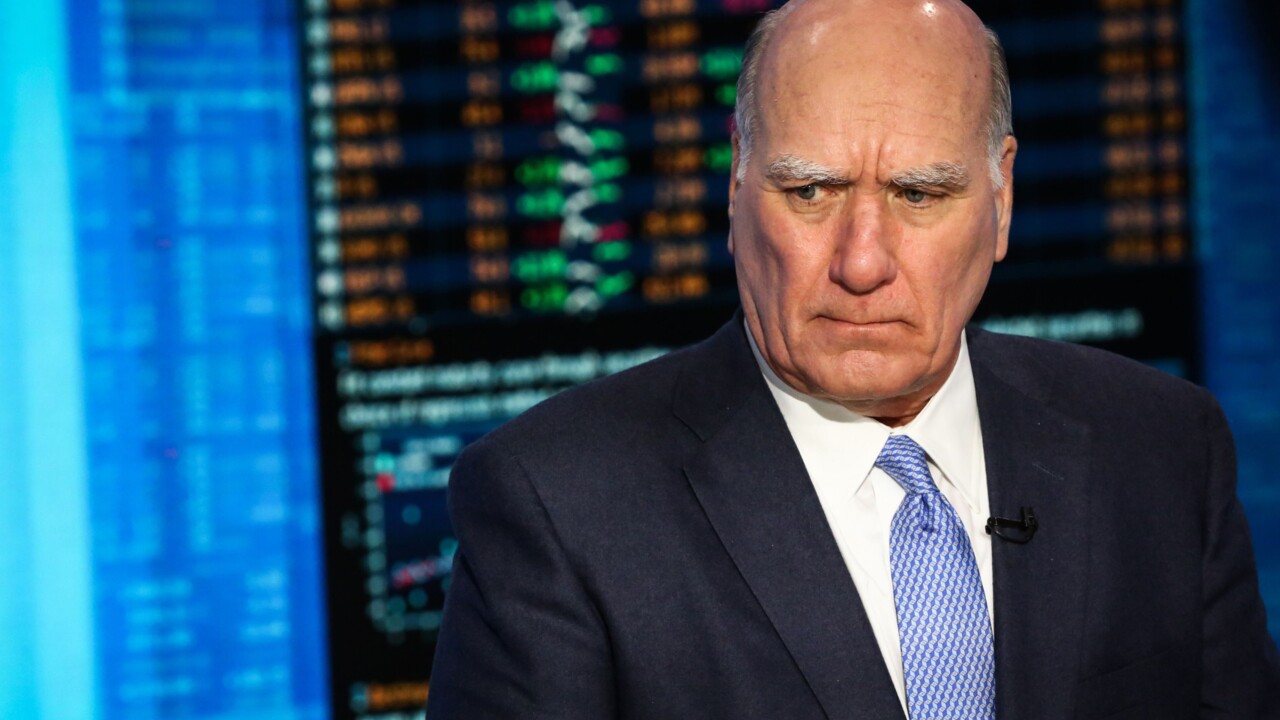

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

At a forum convened by the CFPB, several bank and fintech executives argued that long-delayed rules required under the Dodd-Frank Act can help fight discrimination and shine a light on unsavory practices in the market for small-business credit.

November 6 -

JPMorgan Chase Chief Executive Jamie Dimon said presidential hopeful Elizabeth Warren's rhetoric sounds like an attack on wealthier Americans.

November 6 -

Service would help with compliance; JPM CEO sees more short-term lending rate spikes if no long-term solution implemented.

November 6 -

Top officials at Bank of America and Wells Fargo said that commercial loan demand is weak, even as U.S. consumers show strength. Their comments echo recent findings by the Federal Reserve.

November 5 -

The CFPB, OCC and FDIC are signaling a renewed focus on the sector after regulation of it fell more to the states in recent years.

November 5 -

Financial regulators have been put on notice about the risk of an economically damaging cash crunch in the home mortgage market. Behind the concern: the rapid growth of shadow banks in the origination and servicing of home loans.

November 5 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

If elected president, Sen. Elizabeth Warren would charge large banks a fee to help pay for her Medicare-for-all plan.

November 4 American Banker

American Banker -

Regulators globally are using "tech sprints" to test new anti-money-laundering solutions. More can be done, but it's a good start.

November 4 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Senate leaders say they're ready to consider appointees to fill vacancies at the two regulatory agencies, if only the White House would send over their names.

November 3 -

A group of 64 House lawmakers is pushing congressional leadership to incorporate premium caps and address a new methodology for assessing risk in flood insurance reform legislation.

November 1 -

It's time to establish a fintech commission.

November 1

-

Readers react to Sen. Warren's plan to weed out Washington corruption, Facebook CEO Mark Zuckerberg's testimony before Congress, restricting the Federal Reserve's proposed real-time payments system and more.

October 31 -

Recent Fannie Mae and Freddie Mac activities are “not the kind of day-to-day behavior that you would expect from companies” under federal control, the head of the Federal Housing Finance Agency said.

October 31 -

A remark by Director Kathy Kraninger during a congressional hearing has renewed a fierce debate over how the agency uses academic studies to support rulemakings.

October 30 -

Federal Reserve Chairman Jerome Powell said Wednesday that he does not think revamping capital or liquidity requirements is necessary despite recent volatility in the repurchase markets.

October 30 -

Nearly two dozen Senate Democrats say the CFPB should "immediately" open up an enforcement investigation into the Pennsylvania Higher Education Assistance Agency’s loan forgiveness program for alleged mismanagement.

October 30 -

The restriction on how often a borrower’s account is debited was supposed to be relatively straightforward, but one lender is trying to fight that provision.

October 29