-

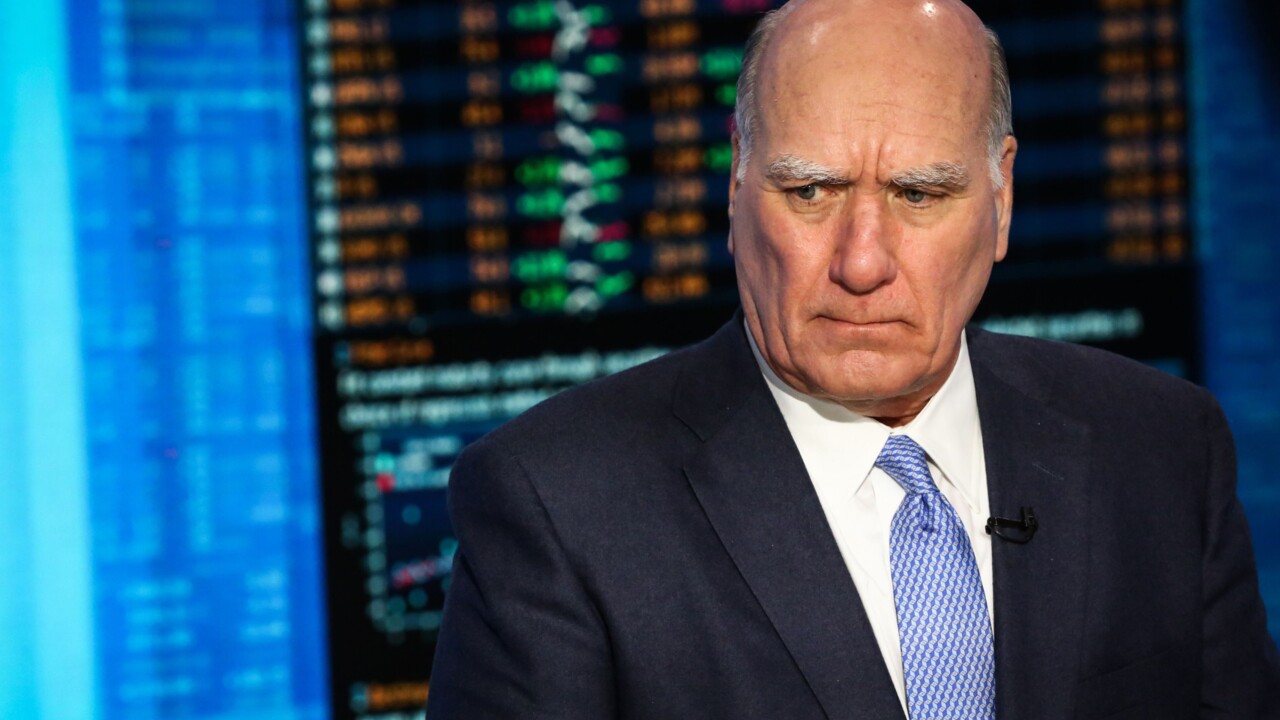

Intense scrutiny from poker-faced CEO Charlie Scharf is prompting executives at the bank to ponder their units’ strategies — as well as what’s in store for their own careers.

December 27 -

House Financial Services Committee Chairwoman Maxine Waters said oversight of the bank will be a focus for the panel next year.

December 19 -

Charles Peck, the head of public finance, is temporarily joining the leadership of the public affairs team.

December 18 -

Muneera Carr, who will become the San Francisco bank's controller on Jan. 6, is the newest addition to a team being assembled by CEO Charlie Scharf.

December 13 -

CEO Charlie Scharf said in a letter to Congress that a review is underway to determine how many customers were affected by confusion over monthly fees and that the bank will begin issuing refunds next year.

December 5 -

Scott Powell, who resolved numerous regulatory problems as the head of the Spanish bank's U.S. operations, will face similar challenges at scandal-plagued Wells. As the bank's chief operating officer, Powell will report to CEO Charlie Scharf, a former colleague at JPMorgan Chase.

December 2 -

Avid Modjtabai, who runs Wells Fargo's payments and technology innovation unit, is leaving the firm as new Chief Executive Officer Charlie Scharf continues to shake up top management.

November 21 -

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

The new CEO is the first outsider to head the scandal-ridden bank in decades; Facebook CEO faces the House Financial Services Committee on Wednesday to discuss Libra.

October 22 -

Perhaps the biggest test that Charles Scharf will face when he starts next week will be how to control expenses while still trying to make the necessary investments in risk management to satisfy regulators.

October 15 -

Investors got a reminder that the bank isn’t past its problems even as it seeks a fresh start under a new leader.

October 15 -

The ‘Unsinkable Cathy Bessant’; Thasunda Duckett’s rising star takes center stage; the challenges facing Wells Fargo chief Charles Scharf; Fannie, Freddie to retain $45B in capital; and more from this week’s most-read stories.

October 4 -

Incoming CEO Charles Scharf will remain in New York even though the bank's headquarters is in San Francisco. His hiring underscores the diminished importance of geographical proximity for executives at large banks.

October 1 -

Goldman’s consumer unit, Marcus, has so far lost $1.3 billion; big lenders like JPMorgan Chase and Amex are making loans for small-ticket items like clothes and cosmetics.

September 30 -

Bank of New York Mellon’s quick decision to elevate the longtime executive to succeed Charles Scharf on an interim basis was well received. Will the board keep him, or search for an outsider for the long term?

September 27 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27 -

In the payments world, Scharf is best known as the CEO of Visa Inc. from 2012 to 2016, where his strategies for faster payments, fintech partnerships and other key issues may shed light on what he has planned when he becomes CEO of Wells Fargo.

September 27 -

Bank of New York Mellon's clients shifted more of their deposits to higher-rate products. It was one of several trends that hurt the custody bank's bottom line.

April 17 -

Earnings were bolstered by lower taxes and higher asset-servicing fees, but revenue was flat and analysts raised concerns about a shrinking deposit base.

October 18 -

Assets under custody and administration surged to a record high of $33.6 trillion, the trust bank said in its second-quarter report.

July 19