-

“We have actually discouraged banks from innovating,” FDIC Chairman Jelena McWilliams said in announcing a move that other agencies have made.

October 23 -

The agency’s biennial survey showed gradual improvement in access to mainstream banks, but over 14 million adults lack ties to a federally insured institution.

October 23 -

Many bankers say the agency needs to rethink its definition of brokered deposits and how it sets interest rate caps.

October 16 -

The heavy workload is not limited to implementing the financial regulatory reform bill enacted last spring, as the agencies also work to craft reforms of the Community Reinvestment Act and adjust key capital measures for the biggest banks.

October 8 -

A new agency Web page has information on nearly every aspect of the agency's operations, including de novo applications, bank exams and failures.

October 3 -

Applications this year are more than double the 2017 mark and the most since 2009. But with some fintechs withdrawing their bids, observers are urging caution.

October 3 -

Seven Republican senators urged regulators on Monday to consider additional changes to the Volcker Rule's "covered funds" definition.

October 1 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

The proposal, required by the regulatory relief package that Congress passed in May, would exempt the healthiest banks from having to count reciprocal deposits as brokered deposits.

September 13 -

The Senate Banking Committee said it is postponing a hearing on the implementation of regulatory relief for "logistical reasons."

September 11 -

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10 -

The appointments are on top of other recent personnel changes under Chairman Jelena McWilliams, who took the reins of the agency in June.

September 4 -

The agencies had proposed revisions designed to make compliance less complex, but banks have expressed concern that the plan could have the opposite effect.

September 4 -

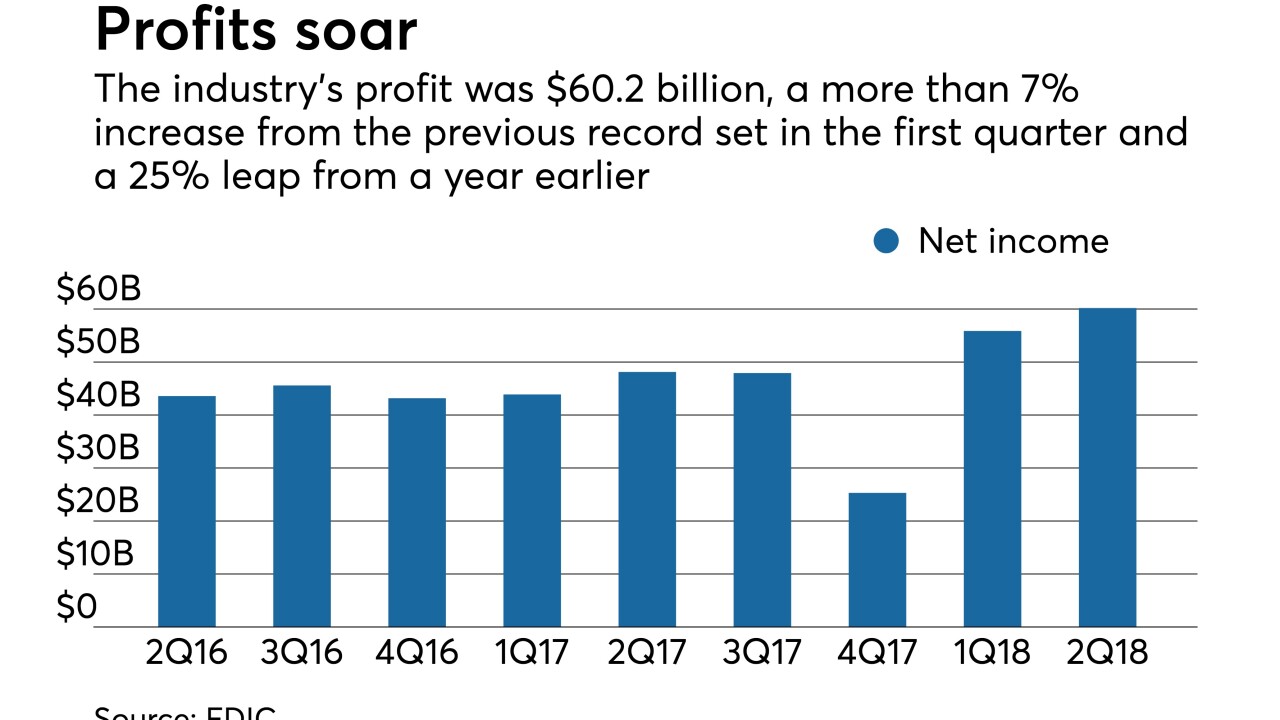

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

A top regulator has signaled that the banking agencies are receptive to extending the comment deadline, after banks raised concerns about a proposed revision to the ban on proprietary trading.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23 -

A new law exempts small lenders from expanded mortgage data reporting, but regulators are signaling that banks and credit unions no longer have to collect the data either.

August 3 -

A new law exempts small lenders from expanded mortgage data reporting, but regulators are signaling that banks no longer have to collect the data either.

August 2 -

Online lenders and other firms await news from OCC and Treasury on the future of their supervision, even as they absorb the news that Square had to temporarily pull its industry loan company application.

July 6 -

The payments processor has pulled its submission to the FDIC to become a depository bank but says it plans to make a second attempt soon.

July 5