-

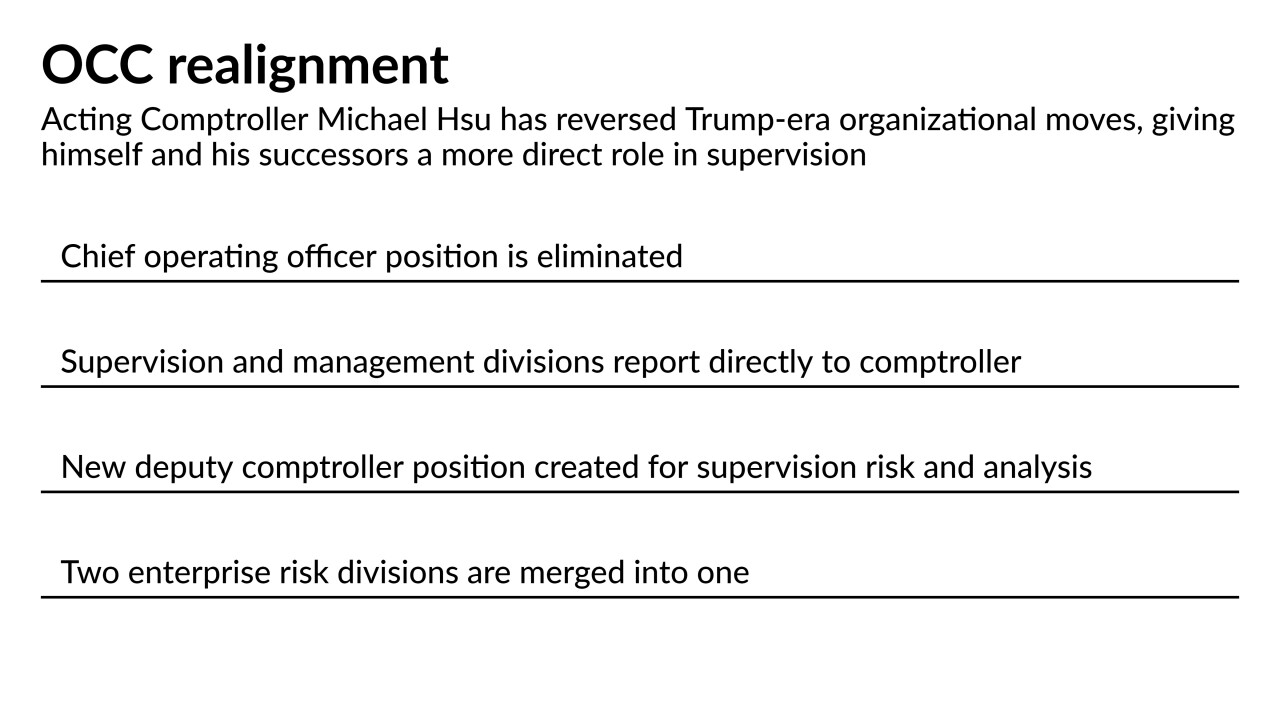

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

The Office of the Comptroller of the Currency confirmed it will rescind an unpopular rule overhauling the Community Reinvestment Act and joined other agencies in calling for a renewed interagency effort.

July 20 -

Graham Steele, a former Senate Banking Committee staffer who has supported strong regulation, was named as the administration's choice for assistant secretary of financial institutions.

July 20 -

The European Union’s planned Green Asset Ratio, intended to reveal how much a bank lends to climate-friendly companies and projects, will offer a distorted picture of reality, according to a Bloomberg survey of some 20 major European banks.

July 20 -

The Consumer Financial Protection Bureau's recent advisory on the products was mild, but some analysts say it's only a matter of time before the agency develops more prescriptive rules and targets providers for enforcement.

July 20 -

Widely perceived as the architect of the Consumer Financial Protection Bureau, Massachusetts Sen. Elizabeth Warren used the occasion of the agency's 10th anniversary to call for more robust oversight of cryptocurrency and banks' overdraft practices.

July 19 -

While money market funds are flocking to the Federal Reserve’s overnight reverse repurchase agreement facility for the yield, large U.S. banks are using the program to shed unwanted deposits.

July 16 -

Rohit Chopra, President Biden’s pick to head the Consumer Financial Protection Bureau, is expected to be the type of aggressive leader the agency had at its inception. Is that what consumers need?

July 16 -

Rep. Patrick McHenry, the ranking GOP member of the House Financial Services Committee, requested a hearing with Dave Uejio to address policy actions “traditionally ... reserved for a Senate-confirmed Director.”

July 16 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16

![“Even in the face of...opposition from politicians and from industry, the agency survived [the Trump administration] and stayed strong, in part because it is built right," Sen. Elizabeth Warren, D-Mass., said of the CFPB.](https://arizent.brightspotcdn.com/dims4/default/d94cc1d/2147483647/strip/true/crop/5795x3260+0+301/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F73%2F8b%2Ff7e050bd44529ac3c4914f3a9781%2Fwarren.jpg)