-

The Federal Deposit Insurance Corp. is soliciting feedback on banks' experiences with remote exams during the pandemic. Some welcome the review as a step toward a more modern examination system, while others contend the last year and a half exposed the drawbacks of long-distance oversight.

August 31 -

The agency asked bankers to reflect on their experience with virtual monitoring over the past year amid speculation that the pandemic could speed a full conversion to off-site supervision.

August 13 -

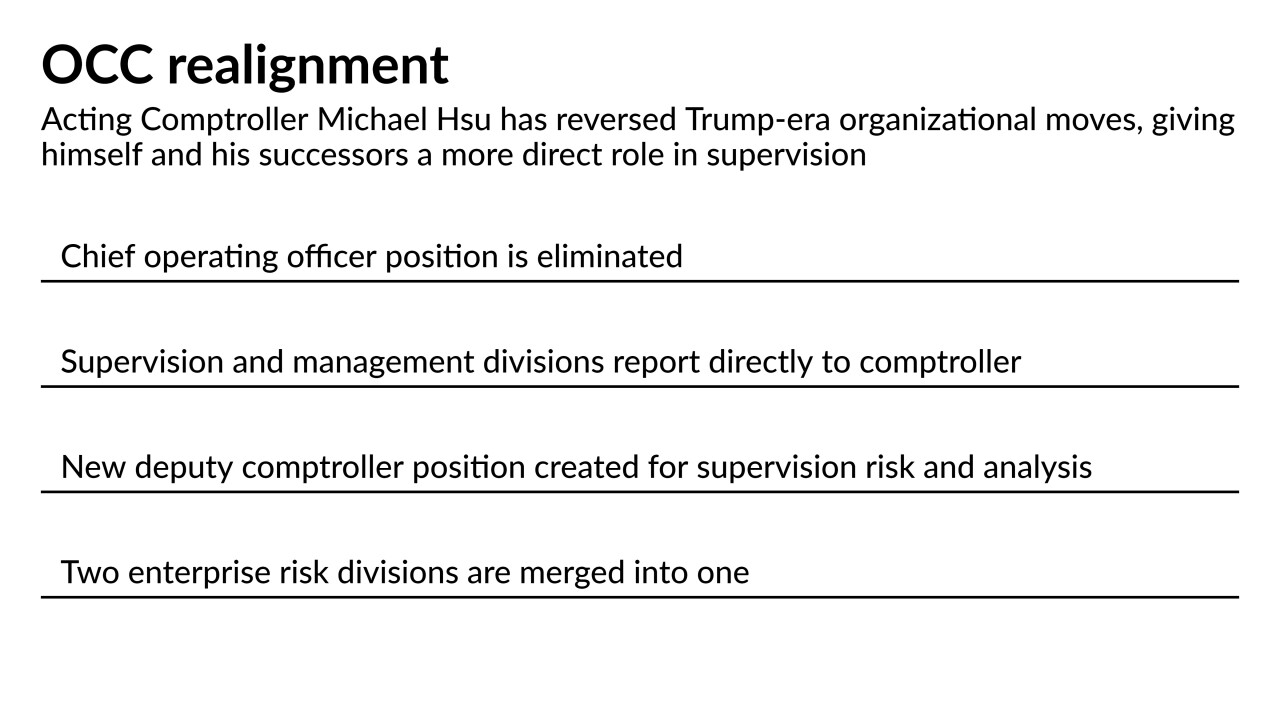

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

The agency used a notation vote to advance the final measure, the third time it has used that method in a month.

January 20 -

From dealing with a flood of deposits to working with examiners virtually, credit unions were forced to quickly adapt to a new normal after the pandemic hit. Here's a look at some of the biggest changes and challenges they faced.

December 31 -

Myra Toeppe, who had been serving as acting director since January, will take on that role permanently.

November 2 -

The credit union regulator has no immediate plans to bring staff and examiners back into the office, but Chairman Rodney Hood said staying remote would remain an option for all staff members during Phase 1 of any return.

October 21 -

With the Office of the Comptroller of the Currency considering a special charter for payments firms, a state regulator group said large money transmitters can opt for the “one company, one exam” program next year.

September 15 -

With the Office of the Comptroller of the Currency considering a special charter for payments firms, a state regulator group said large money transmitters can opt for the “one company, one exam” program next year.

September 15 -

With on-site supervision off the table indefinitely, various credit union trade associations have suggested how NCUA could improve remote exams, including issues related to exam timelines and cybersecurity.

September 3 -

Industry groups are also pushing the federal regulator to improve how off-site examinations are conducted.

August 31 -

The GOP is unlikely to discuss much policy that affects financial services this week during its national convention, though there could be remarks addressing controversial changes to the U.S. Postal Service.

August 24 -

The credit union regulator revised its summary of what examiners will focus on to reflect legal and regulatory changes that have taken place since the COVID-19 outbreak began.

July 15 -

Among other changes, the law allows state regulators to accept NCUA examination results in lieu of exams from local regulators.

July 9 -

Nearly 900 institutions are set to receive a payout related to the demise of Southwest Corporate FCU, but the agency could ultimately return as much as $2.5 billion tied to the corporate credit union failures of 2009 and 2010.

June 25 -

The pandemic will accelerate the drive toward a supervision process in which both regulators and banks will need the digital tools that enable sophisticated remote exams. Expect a heightened focus, too, on customers' financial health.

June 23 -

Though the agenda is unclear, the National Credit Union Administration's board meeting could include the long-awaited credit union version of the Community Bank Leverage Ratio.

June 22 -

The credit union regulator has outlined a multiple step plan to return employees to normal operations.

June 19 -

The acting comptroller of the currency signaled that his agency is planning to resume on-site supervision despite health risks tied to the pandemic. But some bankers and former examiners urged caution, saying remote monitoring has its advantages.

June 15 -

The agency flagged faulty risk management and other issues at the Federal Home Loan Bank of Des Moines and Federal Home Loan Bank of San Francisco in exams conducted last year.

June 15