-

The Senate Banking Committee is slated to hear testimony from acting Federal Deposit Insurance Corp. Chair Travis Hill Thursday morning as he seeks to be confirmed to the role permanently.

October 30 -

The agency's approval of the stablecoin-focused Erebor will be the first of many applications to open new banks, many focused on nontraditional elements of the business.

October 29

-

A district court has agreed to halt compliance with the Consumer Financial Protection Bureau's Biden-era open banking rule while the Trump administration pursues its own rule.

October 29 -

The Federal Open Market Committee is expected to announce guidance on the end of its quantitative tightening program later Wednesday. As that process draws to a close, experts are questioning when and how the central bank should use its balance sheet to smooth economic stress in the future.

October 29 -

The Consumer Financial Protection Bureau is rescinding two rules issued under former CFPB Director Rohit Chopra that required nonbanks to register court orders, plus terms and conditions of contracts.

October 28 -

A proposal from the Office of the Comptroller of the Currency would roll back Biden-era recovery planning rules for banks, leaving them with broad discretion to determine their own recovery protocols.

October 28 -

The New York-based bank, which works with many Democratic campaigns, faces investor concerns that it might be targeted by the Trump administration. CEO Priscilla Sims Brown says the bank's "strong profitability" is its best shield from political threats.

October 27 -

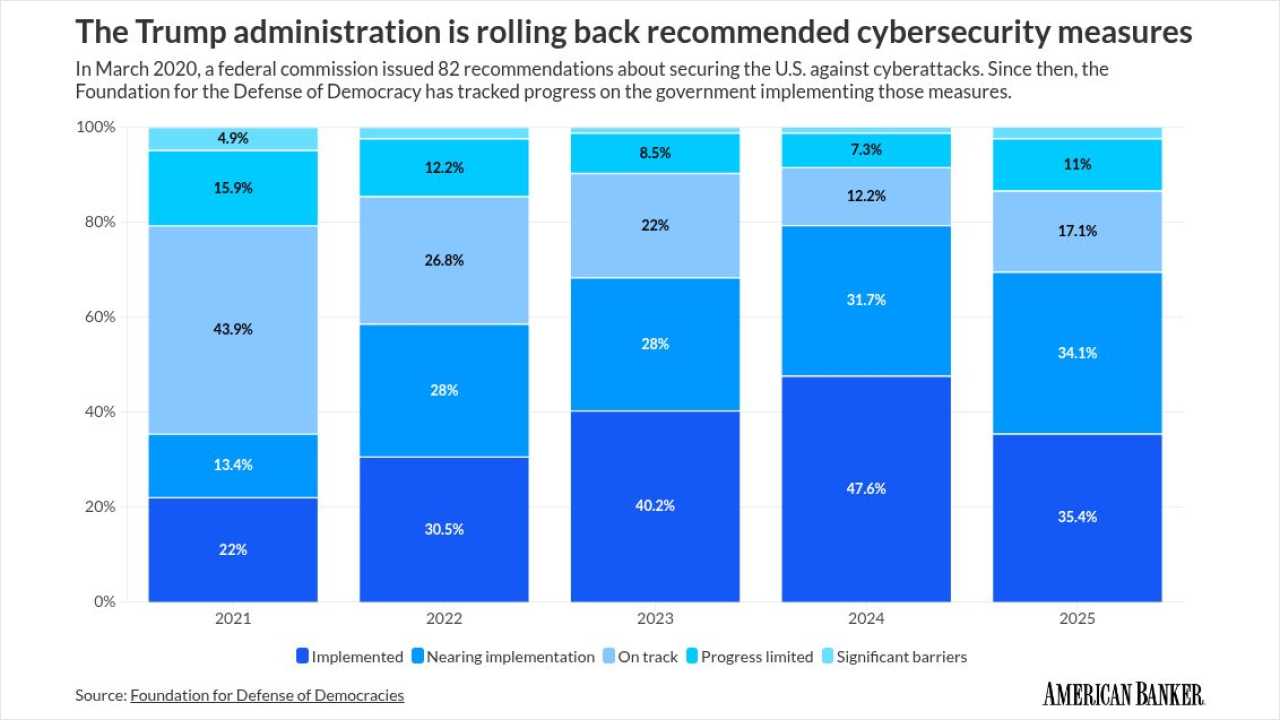

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

October 24 -

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

October 24 -

U.S. regulators have reached a rock-bottom settlement deal with a former Wells executive accused of wrongdoing in the phony-accounts scandal. The OCC had sought to recover $10 million from Claudia Russ Anderson, a onetime risk executive at the bank.

October 22