-

Along with publishing the long-awaited beneficial ownership rule, the Treasury and Justice Departments urged Congress to pass legislation to put the U.S. on par with foreign partners in the fight to curb the flow of illicit funds.

May 5 -

One of the last surviving black-owned banks in Chicago was rescued from its loan-related woes by a Ghanaian-American family.

May 5 -

Cameron and Tyler Winklevoss's Gemini Trust Company LLC has gotten a New York State regulator's blessing to trade another kind of cryptocurrency on its bitcoin exchange.

May 5 -

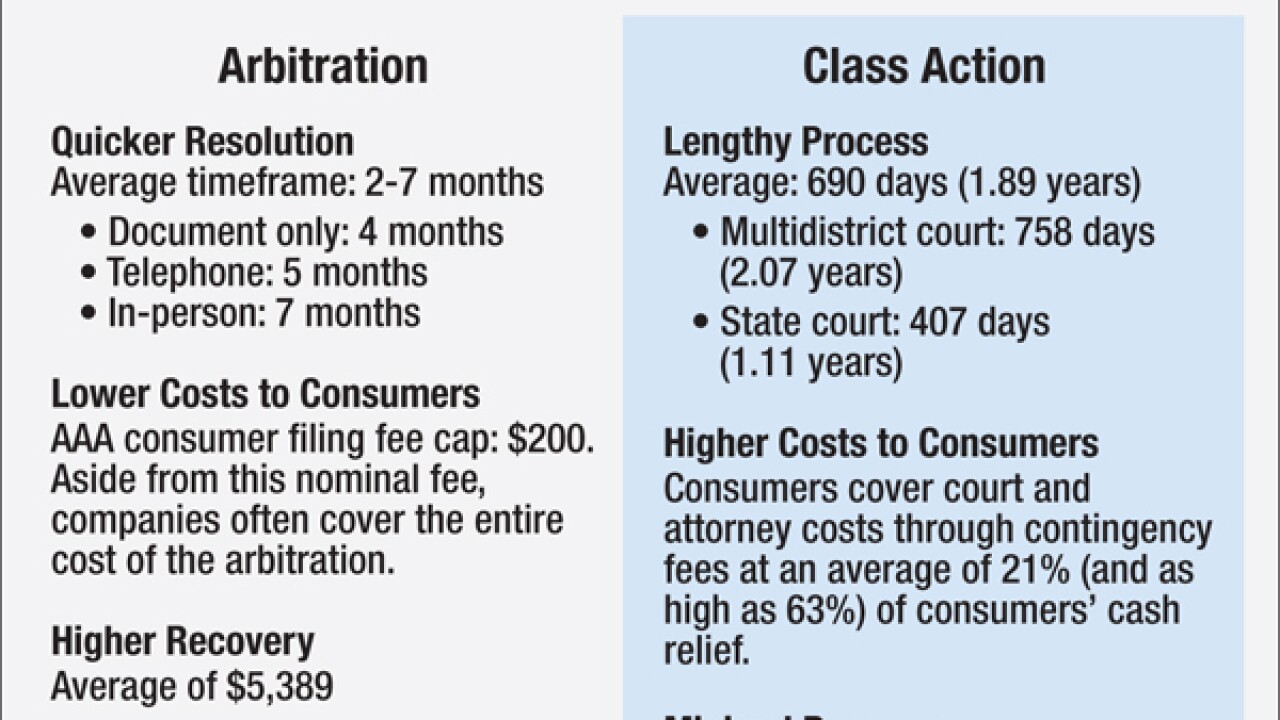

The finance industry pushed back against a proposal by the Consumer Financial Protection Bureau Thursday that would ban arbitration clauses in consumer contracts.

May 5 -

Going forward, Fannie Mae will be relying more on loan guarantee fee income from its single-family and multifamily businesses.

May 5 -

Presumptive GOP presidential candidate Donald Trump's pledge to replace Fed Chair Janet Yellen with a Republican is a break from recent presidential tradition and might further politicize the central bank, observers said.

May 5 -

Requirements that banks share anti-money-laundering information should extend to fraud and cyber risks, to connect the dots between bad actors and their transfer of money.

May 5

-

Fannie Mae will make a $919 million dividend payment to the U.S. Treasury Department after reporting a first-quarter profit driven by fees for guaranteeing loans against default and credit-related income.

May 5 -

Students with excess cash but no bank account have fallen victim to predatory financial vendors, but the government can take steps to bypass the middleman.

May 5

-

The Consumer Financial Protection Bureau is set on Thursday to issue a proposal that would ban the use of arbitration clauses that prevent consumers from bringing class action lawsuits. The proposal on arbitration is a major setback for the financial services industry, which will face potentially higher expenses to defend lawsuits.

May 5