-

Community bankers keep harping on the illusory issue of "too big to fail." If they're serious about strengthening the economy, they should make more of an effort to unite the industry, not divide it.

March 10

-

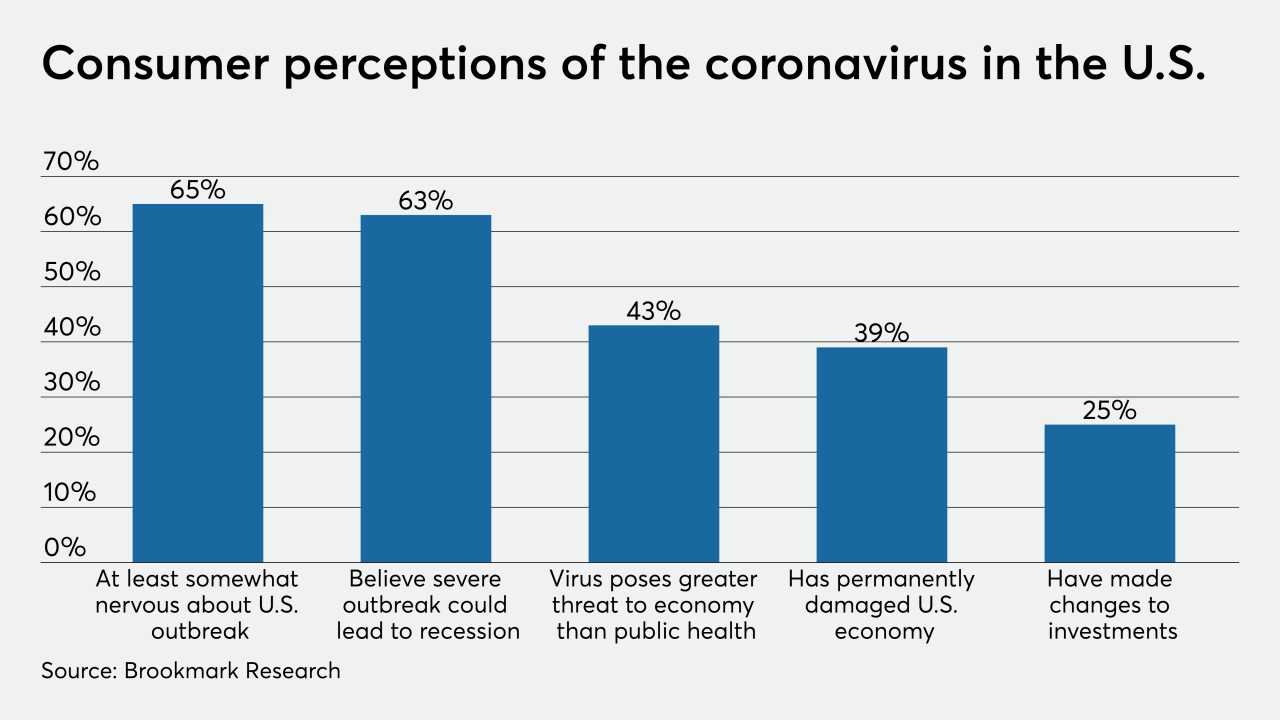

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

The Consumer Financial Protection Bureau says the Cincinnati bank engaged in aggressive sales practices and open bank and credit card accounts without consumers' authorization in order to meet sales targets.

March 9 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9 -

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

March 9 -

The company disclosed that an internal review of a now-discontinued loan program found that employees engaged in misconduct tied to income verification and requirements, among other things.

March 9 -

The Consumer Financial Protection Bureau will have a busy week starting with Director Kathy Kraninger testifying before lawmakers on Tuesday.

March 9 -

The Treasury secretary’s recent Senate testimony coming down on cryptocurrencies is misguided. Regulations should require building better blockchain technology at the banks.

March 9 Polyient Labs

Polyient Labs -

The network offering an array of vendor services to member banks named former trade group chiefs Camden Fine and Ed Yingling to its board and has hired former American Banker Editor-in-Chief Rob Blackwell as chief content officer and head of external affairs.

March 9 -

Maybe Congress shouldn’t be so quick to change laws without real-world input.

March 9 Community Financial Services Association of America

Community Financial Services Association of America