- New York

A former M&T Bank executive was sentenced to 39 months prison time for leading a fraudulent scheme involving about $5.3 million in small-business loans.

December 31 -

The Dodd-Frank Act is a burden on community banks and credit unions but regulators are struggling to quantify the costs, according to a report released Wednesday by the Government Accountability Office.

December 31 -

Lawmakers are expected to debate a number of key banking provisions this year, even with the November elections on the horizon.

December 31 - California

East West Bancorp in Pasadena, Calif., paid $118.4 million to terminate single-family and commercial shared-loss agreements with the Federal Deposit Insurance Corp., tied to an acquisition of a failed bank.

December 31 -

A federal judge is urging the parties of a closely watched pot-banking case to settle their dispute.

December 31 -

Recent comments by Russell Golden, chairman of the Financial Accounting Standards Board, raise questions about the board's plans to change bank accounting standards.

December 31

-

A new digital currency backed by gold is billing itself as a more compliant, liquid and ultimately reliable store of value than decentralized systems such as bitcoin.

December 30 -

Regulators and institutions appear far apart when it comes to so-called "de-risking," in which banks drop businesses for fear of enhanced regulatory scrutiny, even while policymakers are stepping up their scrutiny of terrorist financing prevention in the wake of recent attacks.

December 30 -

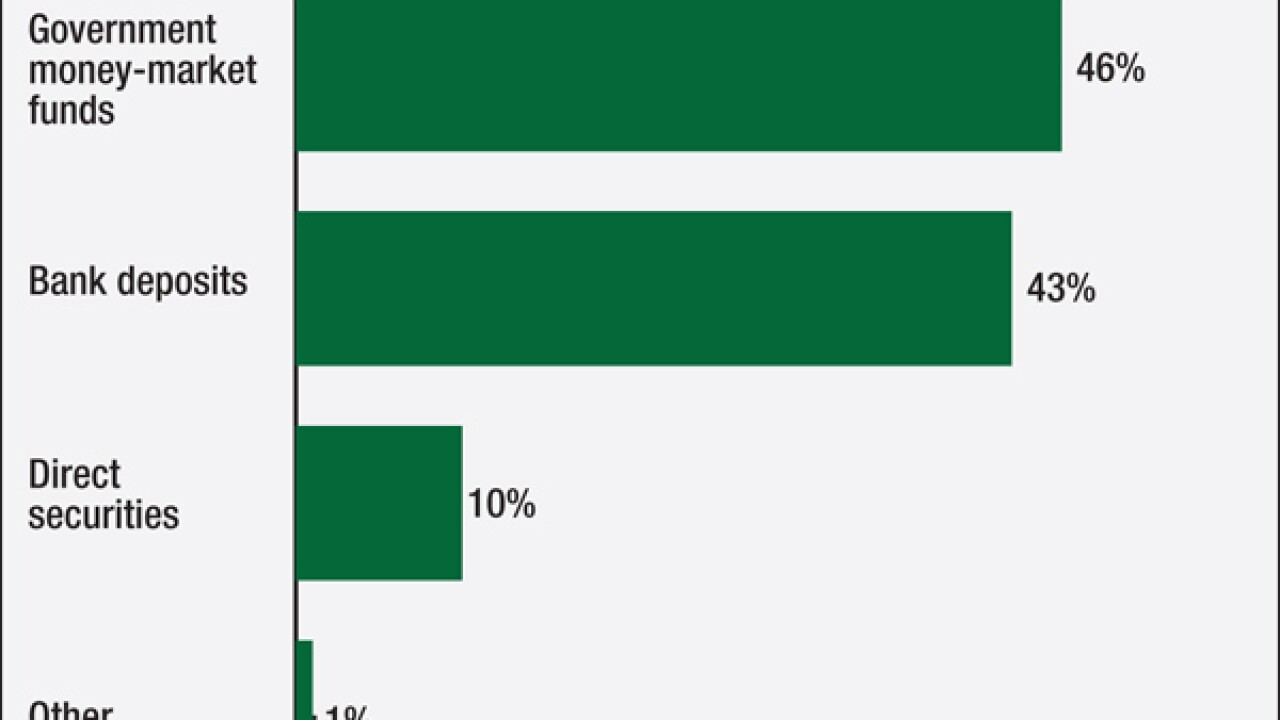

An overhaul of money-market funds, years in the making and fiercely opposed by the financial sector, will take effect in 2016. There's little debating that the new rules will be bad for some banks, but they could also create new opportunities for small and mid-sized banks in need of cheaper funding.

December 30 -

A federal judge is urging the parties of a closely watched pot-banking case to settle their dispute.

December 30