-

The Treasury Department is still struggling to understand whether some businesses are losing access to the banking system because of heightened enforcement of anti-money laundering requirements and concerns about high risk activities, a top official said Wednesday.

November 4 -

Nationstar will provide servicing-released option for fledging Chicago's MPF Government MPF program.

November 4 -

Deutsche Bank agreed to pay $258 million to the Federal Reserve and New Yorks Department of Financial Services, and to fire six employees, to resolve a probe into sanctions violations from 1999 to 2006 for allegedly handling transactions linked to Iran, Libya, Syria, Burma and Sudan.

November 4 -

WASHINGTON The House Financial Services Committee approved a series of bills Wednesday morning that would remove a key Dodd-Frank provision and amend the structure of the Financial Stability Oversight Council.

November 4 -

A lack of access to financial services, particularly the inability to transfer funds overseas, can prevent lifesaving work from being carried out and has touched the refugee crisis in Europe, where many aid groups are delivering assistance.

November 4

-

The number of startup companies opting out of the State of New York more than a dozen since the financial services department's BitLicense regulation was finalized is troublesome.

November 4

-

The Consumer Financial Protection Bureau announced Tuesday that it had revised the process by which companies can appeal a supervisory action.

November 3 -

The Federal Financial Institutions Examination Council issued a joint statement Tuesday advising financial institutions to take steps to defend against cyber-ransom attacks.

November 3 -

There is a time, a place and a customer base for pseudonymous cryptocurrency. For regulated financial institutions, other types of shared ledgers those whose validators are legally accountable for certain terms of service may provide unique utility.

November 3

-

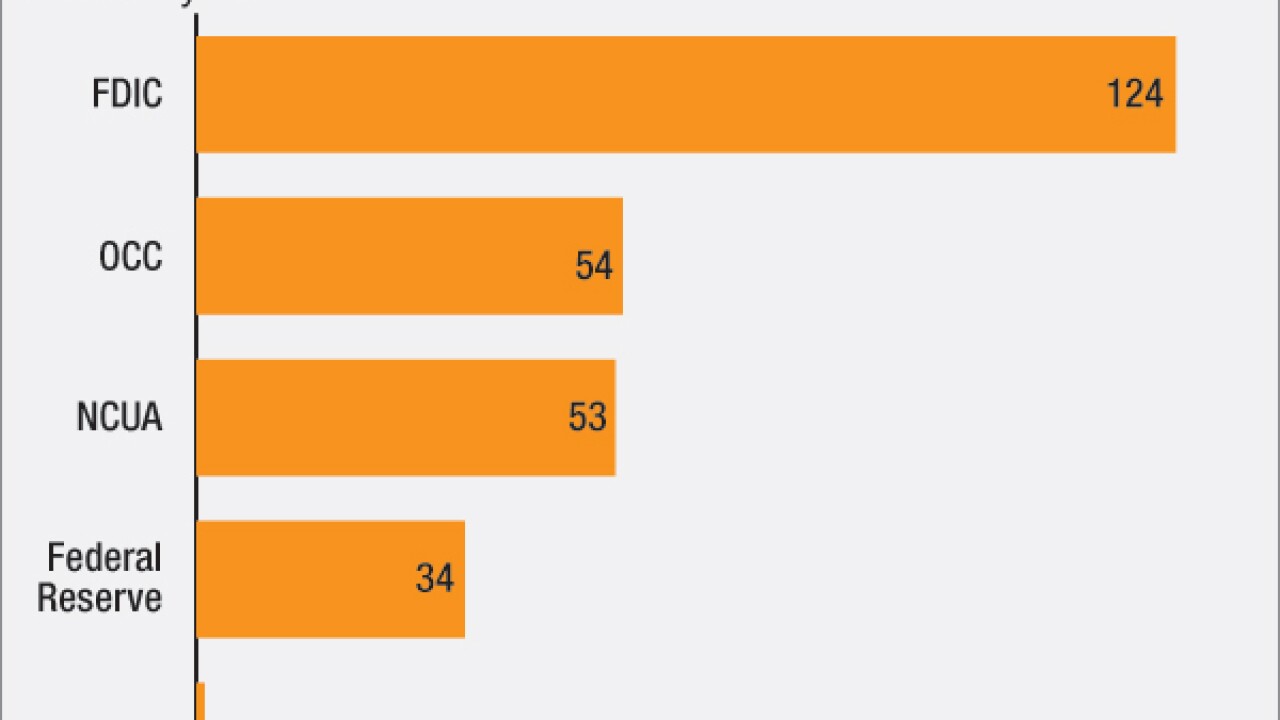

Banking regulators have been coy about whether they approve serving marijuana businesses, but lately one regional Fed bank has taken a strong position against the practice. But there are nearly three dozen Fed-supervised banks serving pot companies one of many seeming inconsistencies in an opaque and confusing regulatory policy.

November 3