-

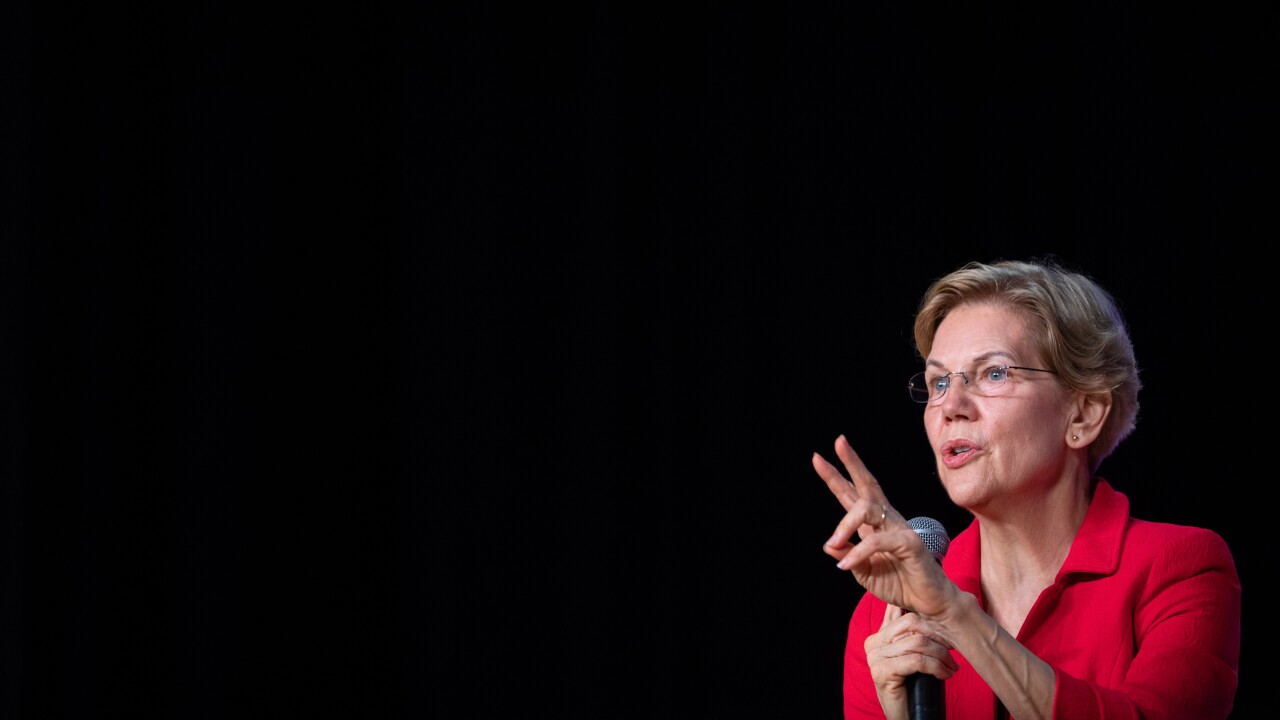

Sen. Elizabeth Warren stepped up her criticism of some of the largest U.S. corporations and singled out senior-level government officials who accepted jobs at Citibank, Wells Fargo, Facebook and Walmart after working for the federal government.

October 29 -

Congress should get behind the Fed's effort to launch a real-time payments service instead of getting in its way.

October 29 Oak View National Bank

Oak View National Bank -

The complaint alleges the lead plaintiff was charged two separate fees for the same transaction and she didn't have sufficient funds.

October 29 -

Nobody will be keen to go toe-to-toe with the Fed, which is the financial systems’ paramount regulator and central bank with virtually unlimited resources, says Intrepid Ventures' Eric Grover.

October 29

-

Beneficial-ownership legislation is within the banking industry’s reach, but the prospect of new regulatory burdens for small businesses is forcing lawmakers to choose sides.

October 28 -

Laurie Stewart says a string of bank sales to credit unions supports the case that the latter's tax-exempt status should be eliminated.

October 28 -

As the Federal Reserve prepares for its October meeting, many institutions are waiting to see how the board's actions might impact the ongoing war for deposits.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

Regulators globally are using "tech sprints" to test new anti-money-laundering solutions. More can be done, but it's a good start.

October 28 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Division is making progress, helped by a rise in branded credit cards; about 200 bankers in agriculture and energy lending let go in recent months.

October 28