-

The House Financial Services Committee is examining sexual harassment charges against FHFA director Watt. American Banker reporter Hannah Lang offers her take.

October 2 -

Fed Vice Chairman of Supervision Randal Quarles said in written testimony that the central bank plans to move quickly to determine how to regulate banks between $100 billion and $250 billion of assets, and that it may provide also relief for banks over the $250 billion threshold.

October 1 -

Seven Republican senators urged regulators on Monday to consider additional changes to the Volcker Rule's "covered funds" definition.

October 1 -

Eric Blankenstein, a political appointee overseeing fair-lending policy at the agency, said in an email to staff that his blog posts from 14 years ago that used a racial epithet “reflected poor judgment.”

October 1 -

As NCUA Chairman Mark McWatters heads to Capitol Hill, credit unions are facing new threats at the ATM and CU trade groups are writing big checks in advance of midterm elections.

October 1 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

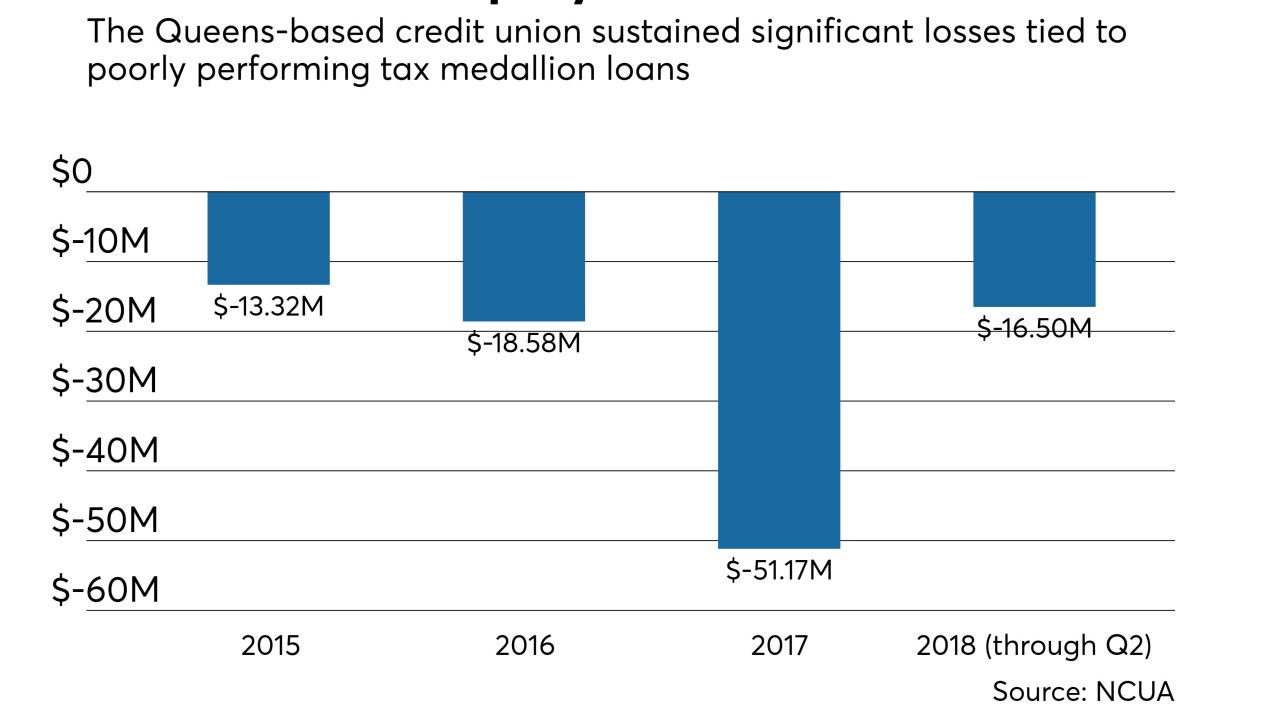

NCUA liquidated LOMTO Federal Credit Union following years of significant losses due to poorly performing taxi medallion loans.

October 1 -

Fintechs can get what they need from a traditional bank charter with the FDIC, as long as the agency is willing to play ball and step up its approach to innovation.

October 1

-

AmeriNational Community Services plans to form an industrial bank in Nevada.

October 1 -

What started as a single senior official at the CFPB voicing concerns about blog posts written 14 years ago by Eric Blankenstein, a top agency political appointee, is rapidly becoming a rising chorus of discontent.

September 30