-

The Financial Accounting Standards Board is considering a plan to have banks break out charge-offs and recoveries on a year-by-year basis. Bankers fear new systems would be needed to comply.

November 9 -

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

The central bank's top regulator said public comments about the new tool, used to gauge capital strength during stress tests, will likely result in changes before it is adopted.

November 9 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

At the California and Nevada CU Leagues' annual REACH conference in Hollywood, credit union executives offered their take on how the 2018 election could impact the industry.

November 9 -

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9 -

As the FDIC considers reforms to its brokered deposit rules, the agency should recall the problems these funds caused in the lead-up to the S&L crisis, argues former Chairman William Isaac.

November 9 -

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

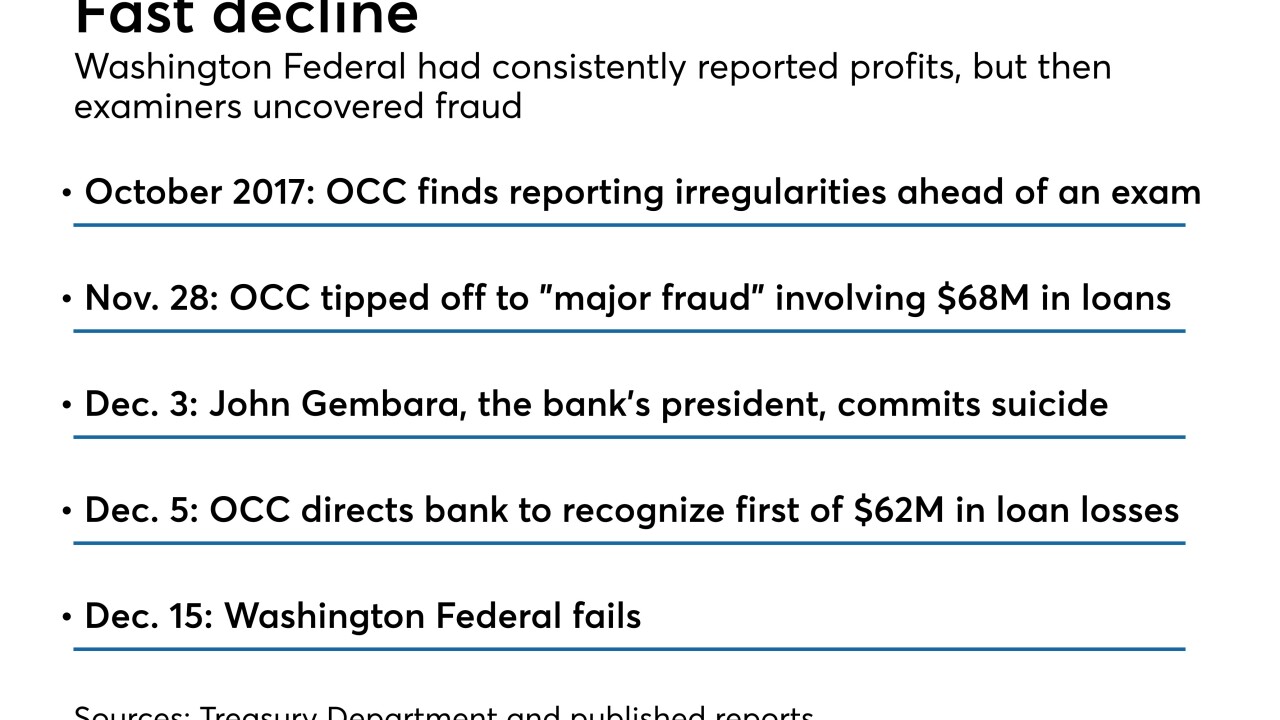

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

There was speculation the North Carolina congressman wanted a higher Republican leadership role, but on Thursday he expressed interest in the ranking member position.

November 8