-

Federal Reserve Chairman Jerome Powell said the fundamentals of the U.S. economic expansion look strong and support the case for continued gradual interest rate increases.

August 24 -

An OCC charter for fintechs requires firms to meet a “financial inclusion” standard instead of conventional Community Reinvestment Act requirements. That’s a problem.

August 24

-

The CFPB nominee wins approval from the Senate Banking Committee by a 13-12 vote; the country is looking to borrow $11 billion after Aramco IPO is delayed.

August 24 -

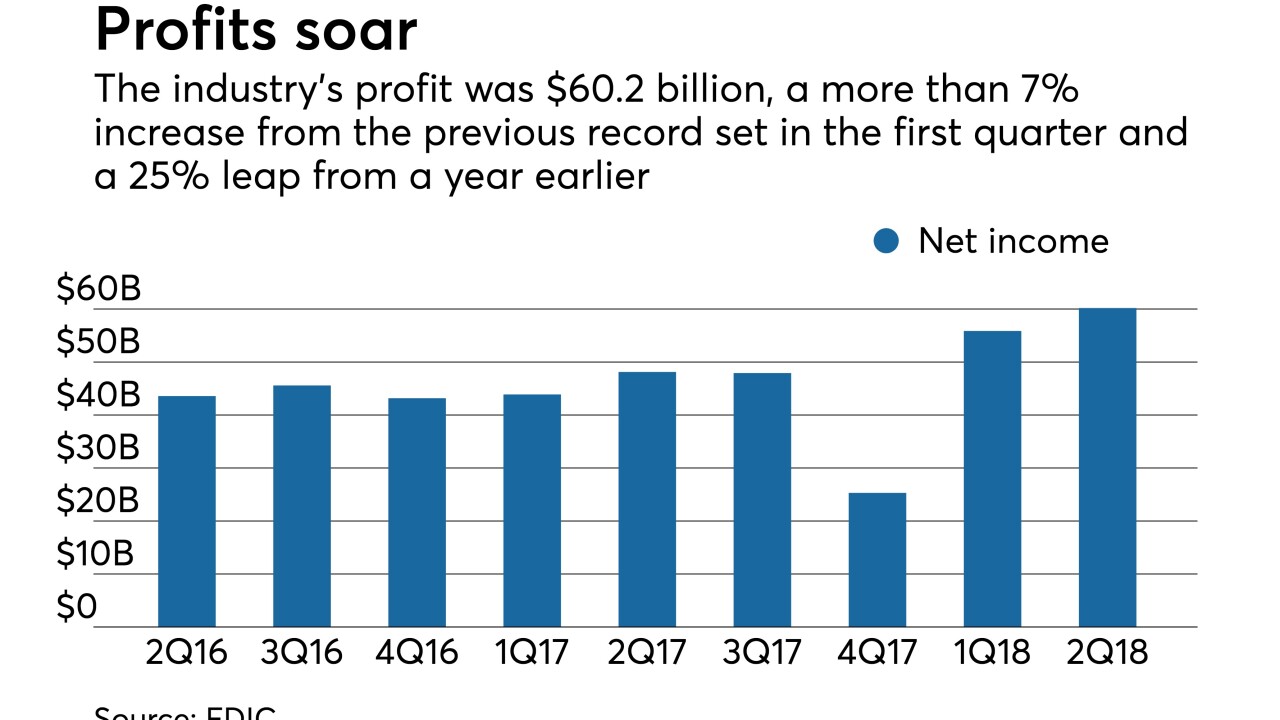

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

Before the passage of the recent regulatory relief law, only banks with assets of less than $1 billion were on an 18-month exam schedule.

August 23 -

Credit union groups are praising the committee's approval of Kathy Kraninger's nomination to head the Consumer Financial Protection Bureau in the face of strong Democratic opposition. Nominations for other positions also moved forward.

August 23 -

A top regulator has signaled that the banking agencies are receptive to extending the comment deadline, after banks raised concerns about a proposed revision to the ban on proprietary trading.

August 23 -

The committee approved the nomination of Kathy Kraninger to head the Consumer Financial Protection Bureau, despite strong Democratic opposition, as well as President Trump's picks for Ginnie Mae, the Export-Import Bank and several other positions.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23 -

The service can be useful for customers short on cash, but financial institutions need to clarify overdraft rules and develop alternative forms of credit.

August 23 The Pew Charitable Trusts

The Pew Charitable Trusts