Rapidly Modernize Banking Processes

Sponsored by

How can the requirements of T+1 help your organization implement a more efficient trade settlement life cycle and make the necessary upgrades for success?

-

Stories about data breaches, fraud and one neobank were reader favorites this year.

-

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

-

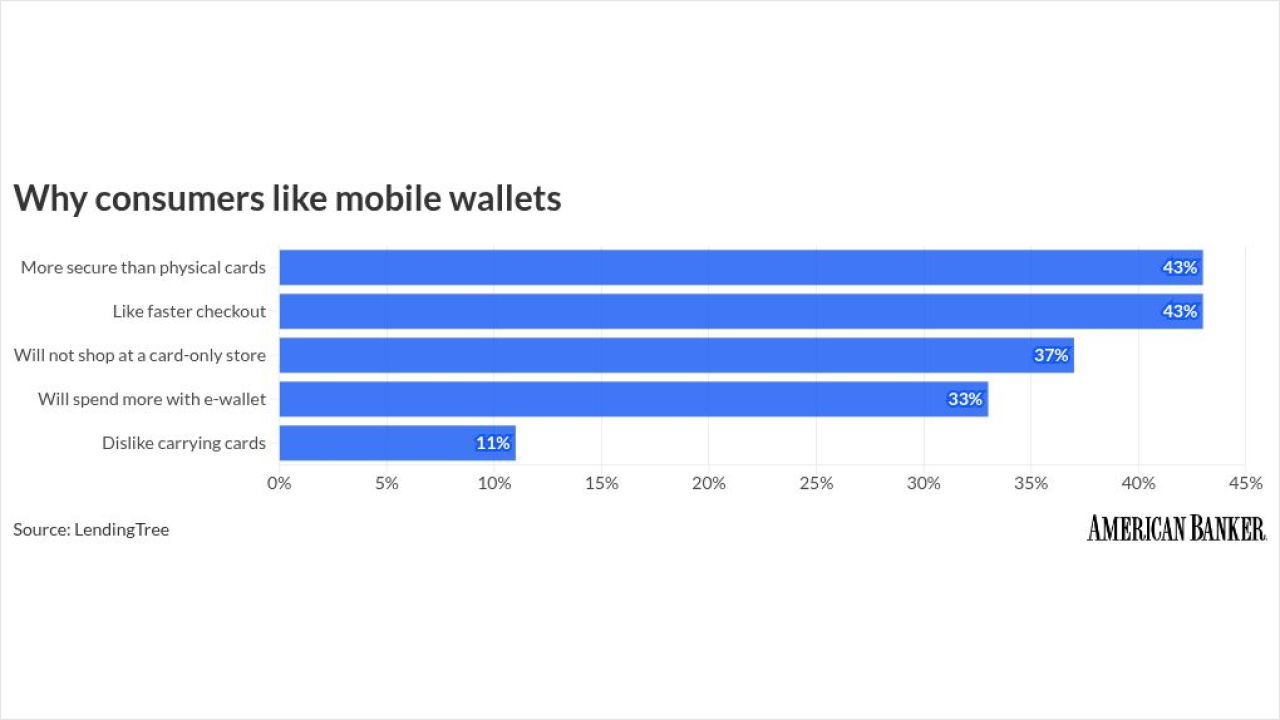

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

-

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

-

Bank merger and acquisition activity rebounded this year, led by Fifth Third's $10.9 billion proposed purchase of Comerica. Huntington, PNC and Columbia were involved in some of the other biggest deals announced in 2025.

-

Articles about stablecoins, scams, fintechs, premium credit cards and open banking were just some of the topics that struck a chord with American Banker subscribers in 2025.