-

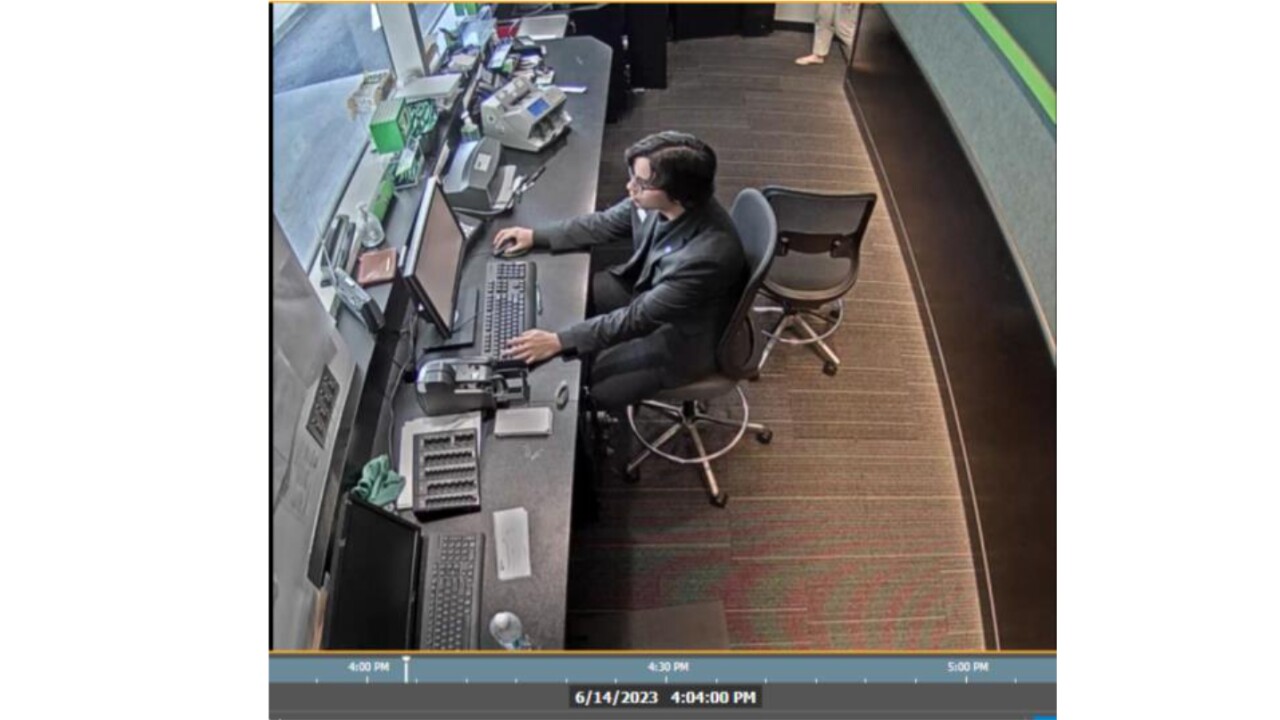

Renat Abramov, a former relationship manager in Brooklyn, bypassed know-your-customer protocols to open accounts for shell companies involved in a $14.6 billion scheme.

February 5 -

The latest directive, which takes effect in March, allows only U.S. citizens and nationals to seek government-guaranteed financing. It's drawing criticism from Democrats in Congress, small-business advocates and some lenders.

February 4 -

-

Prosecutors allege Curtis Weston and a bank insider used fraudulent loans to fund stock market trades, leaving the bank with $20 million in losses.

February 4 -

Treasury Secretary Scott Bessent is slated to testify in the House Financial Services Committee Wednesday morning as part of the committee's regular oversight of the Financial Stability Oversight Council.

February 4 -

The Chicago-based, $261 million-asset Metropolitan Capital Bank & Trust was placed in receivership and its assets sold to Detroit-based First Independence Bank, costing the Federal Deposit Insurance Corp.'s Deposit Insurance Fund an estimated $19.7 million.

January 30 -

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

January 30 -

A Government Accountability Office report warns the Office of the Comptroller of the Currency to clarify which records from the Basel Committee on Banking Supervision should be treated as federal records and thus retained according to the Federal Records Act.

January 29 -

Prosecutors argued the 23-year-old courier knew he was aiding criminals, citing texts about "gold rushing" and scammer videos on his phone.

January 27 -

As the Trump administration signals interest in reforming AML regulations, the industry must come together in support of new rules that promote efficiency and effectiveness in the fight against financial crime.

January 26