-

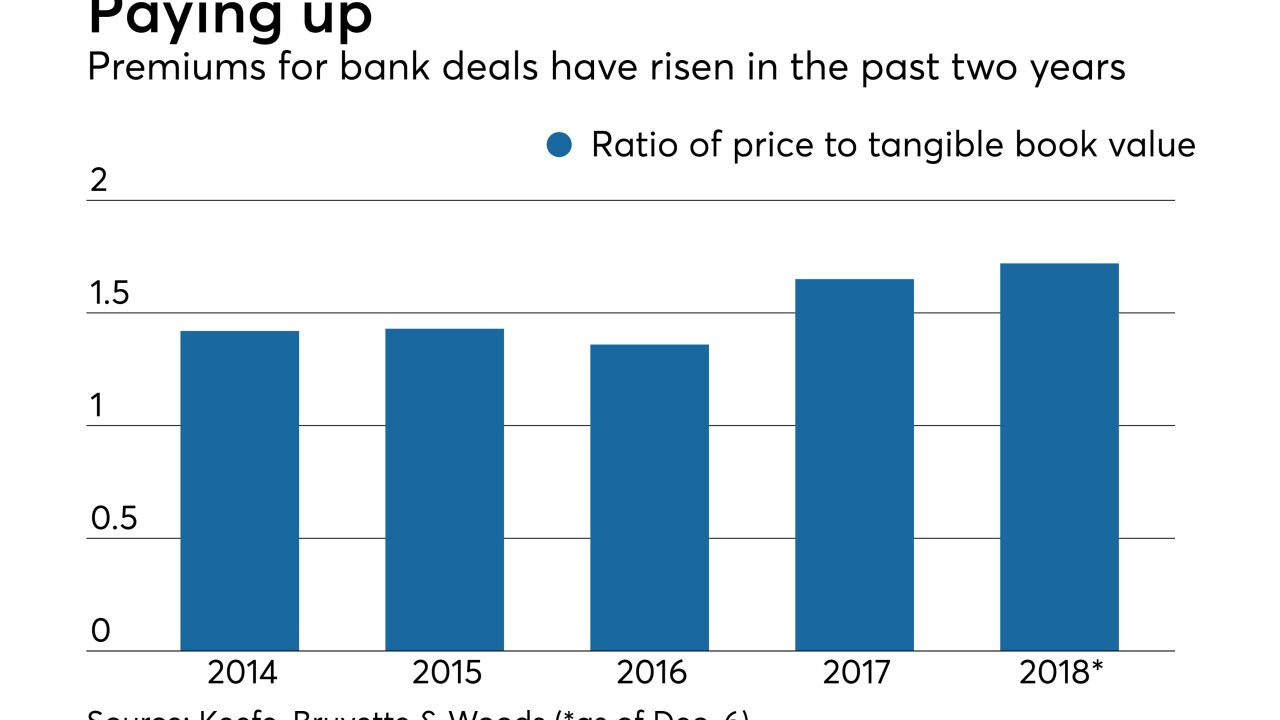

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

The Office of the Comptroller of the Currency announced Friday that it has lifted restrictions relating to U.S. Bank's flawed efforts to prevent money laundering and Citi's deceptive marketing and billing practices.

December 21 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

Prometheum may succeed whether others have failed because it has attempted to work closely with regulators.

December 21 -

The process to confirm Mark Calabria as FHFA director could be lengthy, forcing the White House to consider how it will proceed with housing finance reform under Joseph Otting as acting head of the agency.

December 21 -

The promotion of “insured” accounts by nonbanks and fintechs is a worrying trend, because it could leave customers falsely believing their accounts are just as safe as FDIC-insured ones.

December 21 Consumer Bankers Association

Consumer Bankers Association -

The Fed and FDIC found fault with resolution plans filed by four of the largest foreign lenders, though none of the shortcomings were severe enough to warrant rejecting the "living wills."

December 21 -

Regulators give OK, but find “shortcomings” that need to be addressed; Labor Department says the bank is laying off U.S. workers while hiring overseas.

December 21 -

Readers respond to one fintech startup's tough talk, debate failed plans to change the Consumer Financial Protection Bureau's name, weigh reforms to the Community Reinvestment Act and more.

December 20 -

The expected incoming chair of the House Financial Services Committee told the former acting CFPB chief that he will still be the target of a congressional inquiry despite no longer leading the agency.

December 20