-

The central bank's top regulator said public comments about the new tool, used to gauge capital strength during stress tests, will likely result in changes before it is adopted.

November 9 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

At the California and Nevada CU Leagues' annual REACH conference in Hollywood, credit union executives offered their take on how the 2018 election could impact the industry.

November 9 -

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9 -

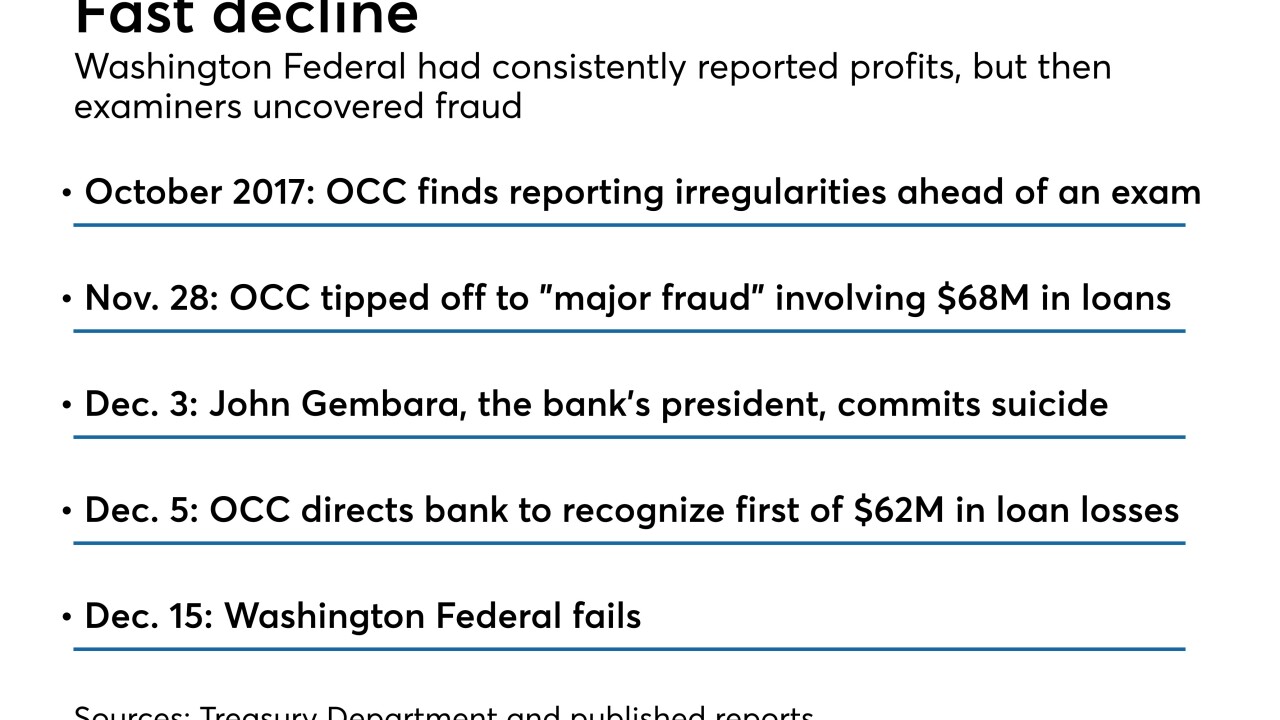

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

There was speculation the North Carolina congressman wanted a higher Republican leadership role, but on Thursday he expressed interest in the ranking member position.

November 8 -

The Swiss banking giant has been accused of helping wealthy French clients hide assets from tax authorities.

November 8 -

Despite deep political divisions across the country, the National Credit Union Administration board has shown Republicans and Democrats can still work together effectively.

November 8 National Credit Union Administration

National Credit Union Administration -

The presumptive chair of the Financial Services Committee resumed her tough criticism of the administration, but also committed to "hearing a range of views" if handed the gavel.

November 8 -

The head of the Consumer Bankers Association lays out four industry priorities for the regulatory push to overhaul the Community Reinvestment Act.

November 8