-

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

Banks can capitalize on Amazon’s ambitions by teaming up to launch financial products and services aimed at coveted customer segments. But they should beware the legal and regulatory pitfalls.

August 24 CCG Catalyst

CCG Catalyst -

The GOP is unlikely to discuss much policy that affects financial services this week during its national convention, though there could be remarks addressing controversial changes to the U.S. Postal Service.

August 24 -

A federal judge in Florida ruled that lenders are not required to make payments to borrowers' attorneys and accountants unless they struck upfront agreements to do so. The decision has implications for a slew of related lawsuits.

August 20 -

The Dallas regional is placing deposits in several minority depository institutions, providing each with low-cost funds that can be redeployed in underserved communities.

August 19 -

The company has now filed three lawsuits in its bid to recoup nearly $900 million it inadvertently sent to the cosmetic company's creditors.

August 19 -

The Office of the Comptroller of the Currency is overstepping its authority in granting charters to fintechs and other companies that don’t take deposits.

August 19 Conference of State Bank Supervisors

Conference of State Bank Supervisors -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

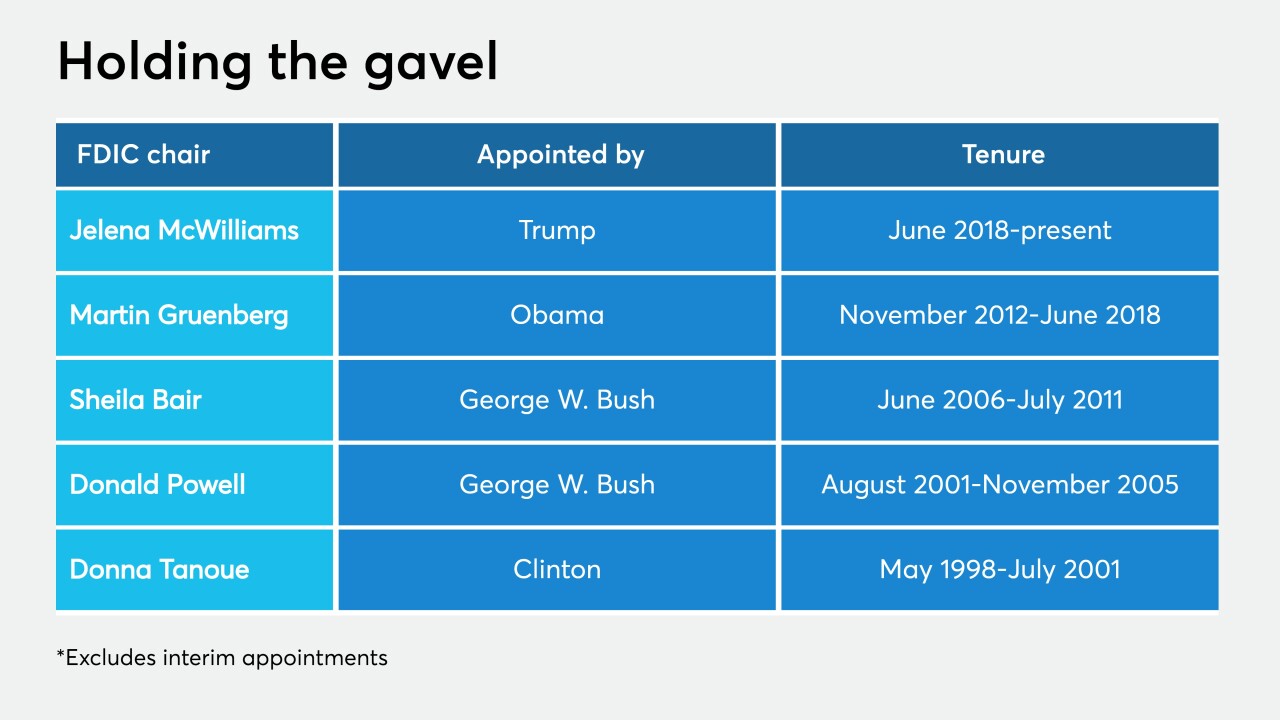

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

Two weeks of presidential nominating festivities kick off Monday as the controversy over funding for the U.S. Postal Service worsens.

August 17