-

The top five banks have combined construction loans of more than $72 billion.

March 20 -

For the second straight year, Goldman Sachs shareholders have filed a proposal calling for more details on racial and gender pay gaps. The request comes as the investment banking giant faces scrutiny over its lack of high-ranking women leaders.

March 19 -

Industry veterans are wary of prospective borrowers who can't pay for agents, and of compensation guidelines clashing with government mortgage lending programs.

March 19 -

It will take time for the banking industry to work through issues with CRE loans, Brian Moynihan says in discussing the aftermath of last year's banking crisis and New York Community Bancorp's recent warning about its exposure to troubled debt.

March 19 -

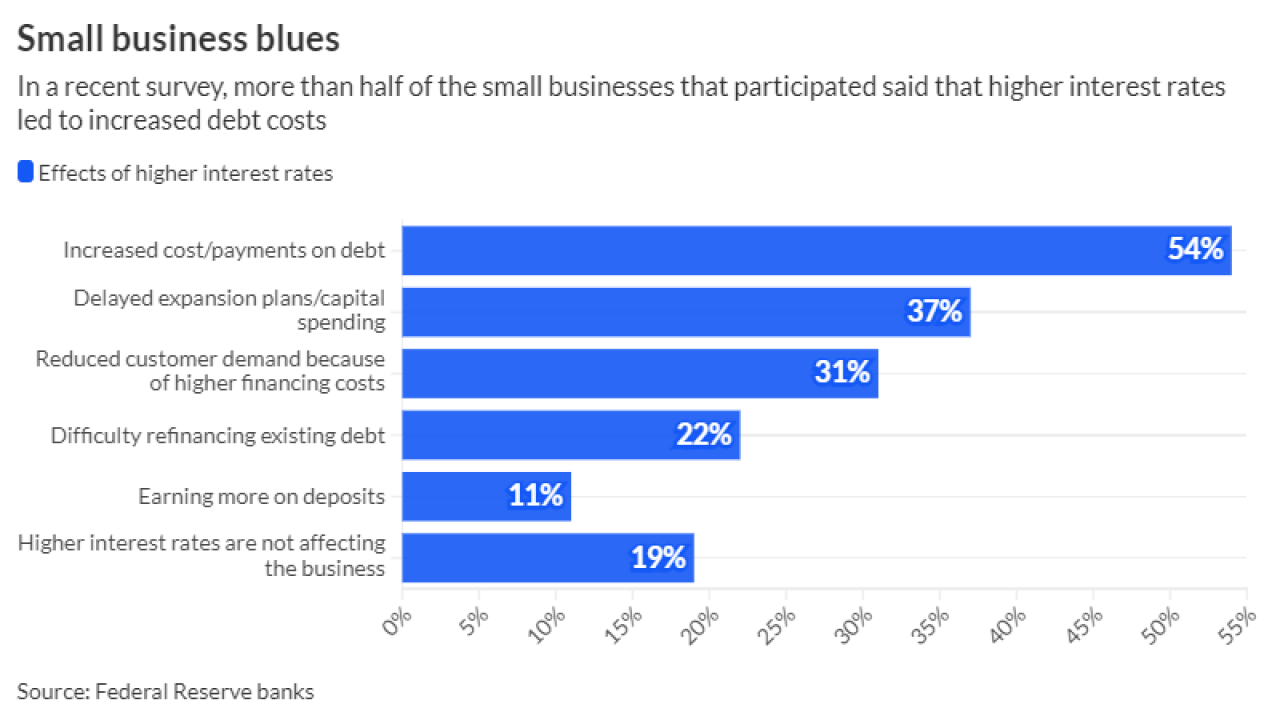

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

March 18 -

Increased federalization of the U.S. banking industry would be a disservice to consumers and the economy. The court must act to protect the vibrancy of the dual-banking system.

March 18

-

Goldman Sachs is unloading the home improvement lending platform GreenSky after a misadventure in consumer finance. However, the consortium buying GreenSky plans to invest heavily in its growth, and Synovus says it's eager to deepen its partnership with the online lender.

March 15 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

March 15 -

PNC announces a new head of corporate and institutional banking; Huntington hires JPMorgan exec to lead HR; former HSBC banker returns as the firm's new U.S. CEO; and more in the weekly banking news roundup.

March 15