-

Virtual reality and agetech devices were among the consumer electronics devices that caught the attention of U.S. Bank Chief Innovation Officer Don Relyea and Head of Research and Development, Innovation Todder Moning.

January 13 -

Coastal Financial in Washington State has acquired GreenFi, one of its fintech partners. The move is designed to buy time in order to figure out the best long-term strategy for the struggling neobank.

January 12 -

The 6-2 vote represents a win for the megabank, which has been fighting a nationwide push to organize its workers. Some 28 branches have voted in favor of unionization, while three have rejected unionization.

January 12 -

Despite attracting $2 billion in deposits, the cloud-native unit proved too expensive to maintain, prompting a strategic retreat by parent company SMBC.

January 12 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

Significant regulatory, legislative and business developments could shape the industry this year, putting pressure on banks to respond.

January 9 -

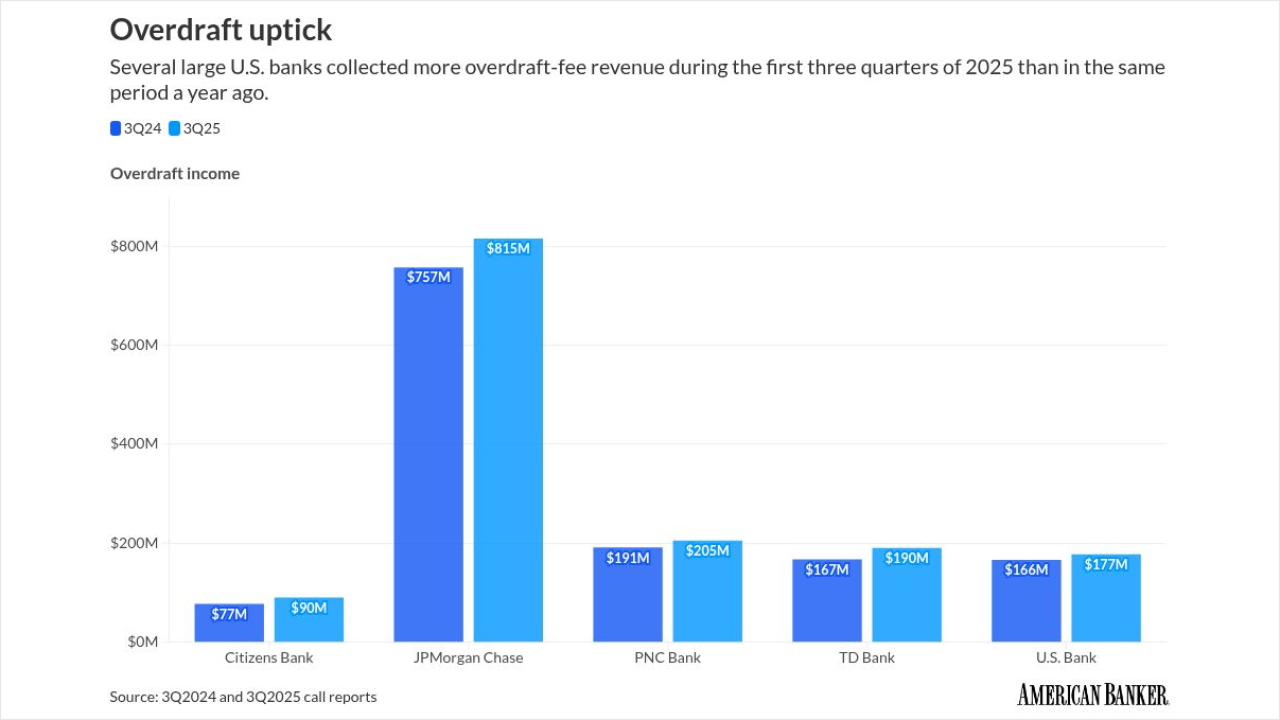

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The Federal Reserve will resume accepting pennies from banks and credit unions at all commercial coin distribution locations beginning Jan. 14. The central bank had ceased accepting pennies at some distribution centers late last year, but bankers praised Thursday's reversal.

January 8 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8