(Image: Thinkstock)

On President Obama prodding regulators to speed up implementation of Dodd-Frank rules:

Related Article:

(Image: Bloomberg News)

On a call to ditch the word 'underbanked':

Related Article:

(Image: Thinkstock)

On a call to ditch the word 'underbanked':

Related Article:

(Image: Thinkstock)

On a call to ditch the word 'underbanked':

Related Article:

(Image: Thinkstock)

On the failures of blanket financial terminology:

Related Article:

(Image: Bloomberg News)

On tech companies' lax dress codes:

Related Article:

(Image: Thinkstock)

On a call for regulators to embrace Bitcoin:

Related Article:

(Image: Fotolia)

On an alternative to Dodd-Frank's mortgage rules:

Related Article:

(Image: Fotolia)

On the need for the risk-modeling required by regulators to be practical and logical:

Related Article:

(Image: Thinkstock)

On an assertion that banks should get a C+ in postcrisis risk management:

Related Article:

(Image: Fotolia)

On many banks still treating mobile banking as an afterthought:

Related Article:

(Image: Thinkstock

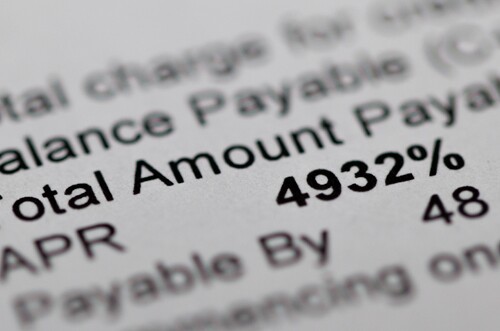

On using an annual percentage rate to describe the price of a short-term loan:

Related Article:

(Image: Thinkstock)